MetLife 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

In July 2001, the Company completed its sale of Conning Corporation (‘‘Conning’’), an affiliate acquired in the acquisition of GenAmerica Financial

Corporation (‘‘GenAmerica’’) in 2000. Conning specialized in asset management for insurance company investment portfolios and investment research.

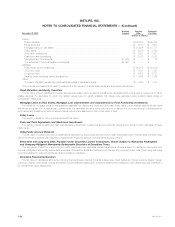

20. Discontinued Operations

The Company actively manages its real estate portfolio with the objective to maximize earnings through selective acquisitions and dispositions. In

accordance with SFAS 144, income related to real estate classified as held-for-sale on or after January 1, 2002 is presented as discontinued operations.

These assets are carried at the lower of cost or market.

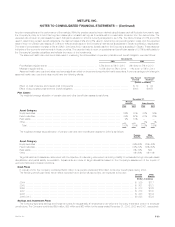

The following table presents the components of income from discontinued operations:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Investment income ***************************************************************************** $120 $ 458 $ 508

Investment expense **************************************************************************** (68) (298) (339)

Net investment gains (losses)********************************************************************* 421 582 —

Total revenues ************************************************************************* 473 742 169

Interest Expense ******************************************************************************* 11—

Provision for income taxes *********************************************************************** 172 270 62

Income from discontinued operations ****************************************************** $300 $ 471 $ 107

The carrying value of real estate related to discontinued operations was $89 million and $799 million at December 31, 2003 and 2002, respectively.

See Note 18 for discontinued operations by business segment.

Subsequent to December 31, 2003, MetLife entered into a marketing agreement to sell one of its real estate investments, the Sears Tower, and

reclassified the property from Real Estate — Held-for Investments to Real Estate — Held-for Sale. The carrying value of the property as of December 31,

2003 is approximately $700 million.

21. Fair Value Information

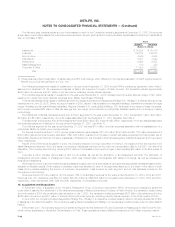

The estimated fair values of financial instruments have been determined by using available market information and the valuation methodologies

described below. Considerable judgment is often required in interpreting market data to develop estimates of fair value. Accordingly, the estimates

presented herein may not necessarily be indicative of amounts that could be realized in a current market exchange. The use of different assumptions or

valuation methodologies may have a material effect on the estimated fair value amounts.

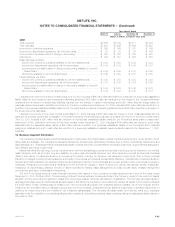

Amounts related to the Company’s financial instruments were as follows:

Notional Carrying Estimated

December 31, 2003 Amount Value Fair Value

(Dollars in millions)

Assets:

Fixed maturities********************************************************************** $167,752 $167,752

Equity securities ********************************************************************* $ 1,598 $ 1,598

Mortgage loans on real estate ********************************************************* $ 26,249 $ 28,259

Policy loans************************************************************************* $ 8,749 $ 8,749

Short-term investments *************************************************************** $ 1,826 $ 1,826

Cash and cash equivalents************************************************************ $ 3,733 $ 3,733

Mortgage loan commitments*********************************************************** $ 679 $ — $ (4)

Commitments to fund partnership investments ******************************************** $1,380 $ — $ —

Liabilities:

Policyholder account balances ********************************************************* $ 63,957 $ 64,861

Short-term debt ********************************************************************* $ 3,642 $ 3,642

Long-term debt********************************************************************** $ 5,703 $ 6,041

Shares subject to mandatory redemption ************************************************ $ 277 $ 336

Payable under securities loaned transactions ********************************************* $ 27,083 $ 27,083

MetLife, Inc. F-49