MetLife 2003 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

in the consolidated action and separate action have filed notices of appeal. Another purported class action in New York state court in Kings County has

been voluntarily held in abeyance by plaintiffs. The plaintiffs in the state court class actions seek injunctive, declaratory and compensatory relief, as well as

an accounting and, in some instances, punitive damages. Some of the plaintiffs in the above described actions also have brought a proceeding under

Article 78 of New York’s Civil Practice Law and Rules challenging the Opinion and Decision of the Superintendent who approved the plan. In this

proceeding, petitioners seek to vacate the Superintendent’s Opinion and Decision and enjoin him from granting final approval of the plan. This case also

is being held in abeyance by plaintiffs. Three purported class actions were filed in the United States District Court for the Eastern District of New York

claiming violation of the Securities Act of 1933. The plaintiffs in these actions, which have been consolidated, claim that the Policyholder Information

Booklets relating to the plan failed to disclose certain material facts and seek rescission and compensatory damages. Metropolitan Life’s motion to

dismiss these three cases was denied in 2001. On February 4, 2003, plaintiffs filed a consolidated amended complaint adding a fraud claim under the

Securities Exchange Act of 1934. Metropolitan Life has served a motion to dismiss the consolidated amended complaint and a motion for summary

judgment in this action. Metropolitan Life, the Holding Company and the individual defendants believe they have meritorious defenses to the plaintiffs’

claims and are contesting vigorously all of the plaintiffs’ claims in these actions.

In 2001, a lawsuit was filed in the Superior Court of Justice, Ontario, Canada on behalf of a proposed class of certain former Canadian policyholders

against the Holding Company, Metropolitan Life, and Metropolitan Life Insurance Company of Canada. Plaintiffs’ allegations concern the way that their

policies were treated in connection with the demutualization of Metropolitan Life; they seek damages, declarations, and other non-pecuniary relief. The

defendants believe they have meritorious defenses to the plaintiffs’ claims and will contest vigorously all of plaintiffs’ claims in this matter.

In July 2002, a lawsuit was filed in the United States District Court for the Eastern District of Texas on behalf of a proposed class comprised of the

settlement class in the Metropolitan Life sales practices class action settlement approved in December 1999 by the United States District Court for the

Western District of Pennsylvania. After the defendants’ motion to transfer the lawsuit to the Western District of Pennsylvania was granted, plaintiffs filed an

amended complaint alleging that the treatment of the cost of the sales practices settlement in connection with the demutualization of Metropolitan Life

breached the terms of the settlement. Plaintiffs sought compensatory and punitive damages, as well as attorneys’ fees and costs. In October 2003, the

court granted defendants’ motion to dismiss the action. Plaintiffs filed a notice of appeal to the United States Court of Appeals for the Third Circuit. In

January 2004, the appeal was dismissed.

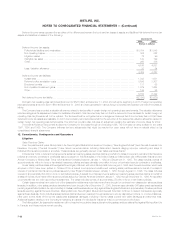

Race-Conscious Underwriting Claims

Insurance departments in a number of states initiated inquiries in 2000 about possible race-conscious underwriting of life insurance. These inquiries

generally have been directed to all life insurers licensed in their respective states, including Metropolitan Life and certain of its affiliates. The New York

Insurance Department has concluded its examination of Metropolitan Life concerning possible past race-conscious underwriting practices. Four

purported class action lawsuits filed against Metropolitan Life in 2000 and 2001 alleging racial discrimination in the marketing, sale, and administration of

life insurance policies have been consolidated in the United States District Court for the Southern District of New York. On April 28, 2003, the United

States District Court approved a class-action settlement of the consolidated actions. Several persons filed notices of appeal from the order approving the

settlement, but subsequently the appeals were dismissed. Metropolitan Life also has entered into settlement agreements to resolve the regulatory

examination. Metropolitan Life recorded a charge in the fourth quarter of 2001 in connection with the anticipated resolution of these matters. The

Company believes the remaining portion of the previously recorded charge is adequate to cover the costs associated with the resolution of these

matters.

Sixteen lawsuits involving approximately 130 plaintiffs have been filed in federal and state court in Alabama, Mississippi and Tennessee alleging

federal and/or state law claims of racial discrimination in connection with the sale, formation, administration or servicing of life insurance policies.

Metropolitan Life is contesting vigorously plaintiffs’ claims in these actions.

Other

In 2001, a putative class action was filed against Metropolitan Life in the United States District Court for the Southern District of New York alleging

gender discrimination and retaliation in the MetLife Financial Services unit of the Individual segment. The plaintiffs were seeking unspecified compensatory

damages, punitive damages, a declaration that the alleged practices were discriminatory and illegal, injunctive relief requiring Metropolitan Life to

discontinue the alleged discriminatory practices, an order restoring class members to their rightful positions (or appropriate compensation in lieu thereof),

and other relief. Plaintiffs filed a motion for class certification. Opposition papers were filed by Metropolitan Life. In August 2003, the court granted

preliminary approval to a settlement of the lawsuit. At the fairness hearing held on November 6, 2003, the court approved the settlement of the lawsuit.

Implementation of the settlement has commenced in 2004.

A putative class action lawsuit is pending in the United States District Court for the District of Columbia, in which plaintiffs allege that they were

denied certain ad hoc pension increases awarded to retirees under the Metropolitan Life retirement plan. The ad hoc pension increases were awarded

only to retirees (i.e., individuals who were entitled to an immediate retirement benefit upon their termination of employment) and not available to individuals

like these plaintiffs whose employment, or whose spouses’ employment, had terminated before they became eligible for an immediate retirement benefit.

The plaintiffs seek to represent a class consisting of former Metropolitan Life employees, or their surviving spouses, who are receiving deferred vested

annuity payments under the retirement plan and who were allegedly eligible to receive the ad hoc pension increases awarded in 1977, 1980, 1989,

1992, 1996 and 2001, as well as increases awarded in earlier years. Metropolitan Life is vigorously defending itself against these allegations.

A lawsuit was filed against Metropolitan Life in Ontario, Canada by Clarica Life Insurance Company regarding the sale of the majority of Metropolitan

Life’s Canadian operation to Clarica in 1998. Clarica alleged that Metropolitan Life breached certain representations and warranties contained in the sale

agreement, that Metropolitan Life made misrepresentations upon which Clarica relied during the negotiations and that Metropolitan Life was negligent in

the performance of certain of its obligations and duties under the sale agreement. The parties settled the matter in January 2004. The settlement will have

no material impact on the Company’s consolidated financial results in 2004.

A reinsurer of universal life policy liabilities of Metropolitan Life and certain of its affiliates commenced an arbitration proceeding and sought

rescission, claiming that, during underwriting, material misrepresentations or omissions were made to the reinsurer. The reinsurer also sent a notice

purporting to increase reinsurance premium rates. In December 2003, the arbitration panel denied the reinsurer’s attempt to rescind the contract and

granted the reinsurer’s request to raise rates. As a result of the panel’s rulings, liabilities ceded to the reinsurer were recaptured effective May 5, 2003.

The recapture had no material impact on the Company’s consolidated financial results in 2003.

MetLife, Inc. F-35