MetLife 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

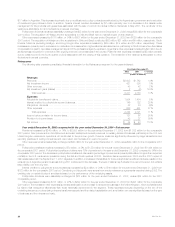

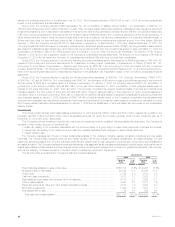

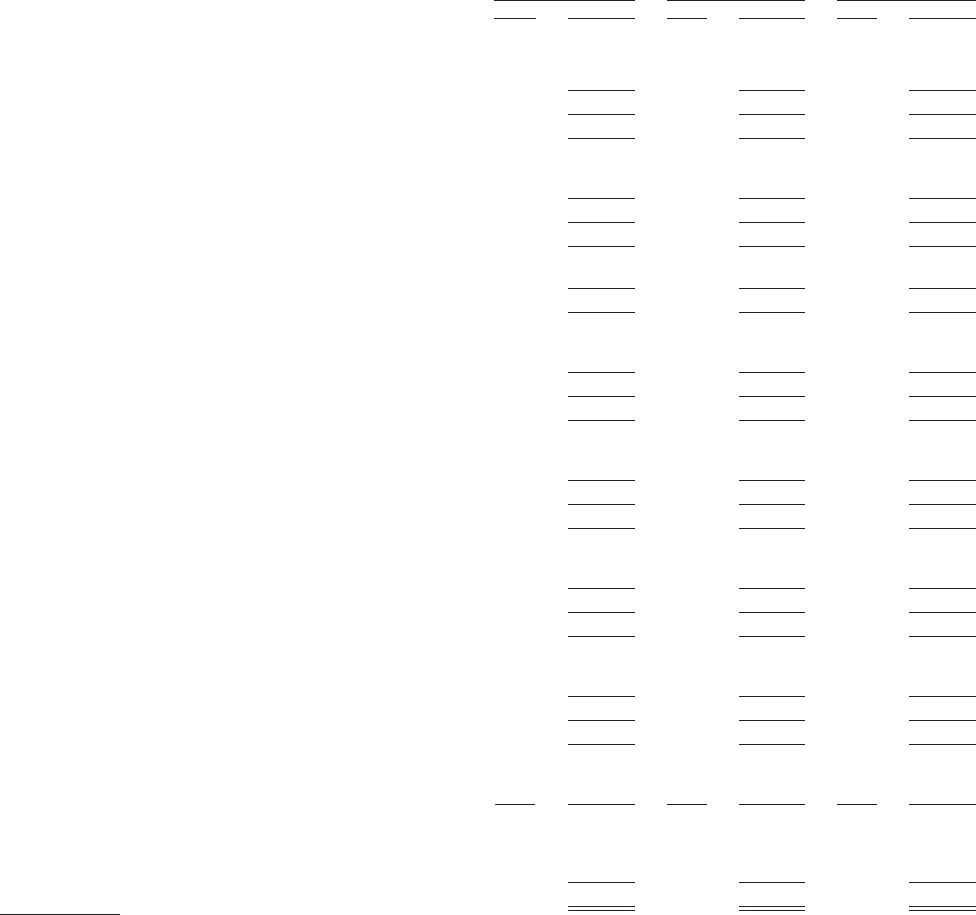

Investment Results

Net investment income, including net investment income from discontinued operations and scheduled periodic settlement payments on derivative

instruments that do not qualify for hedge accounting under SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended

(‘‘SFAS 133’’), on general account cash and invested assets totaled $11,772 million, $11,453 million and $11,380 million for the years ended

December 31, 2003, 2002 and 2001, respectively. The annualized yields on general account cash and invested assets, including net investment

income from discontinued operations and scheduled periodic settlement payments on derivative instruments that do not qualify for hedge accounting

under SFAS No. 133, and excluding all net investment gains and losses, were 6.67%, 7.20% and 7.56% for the years ended December 31, 2003, 2002

and 2001, respectively. The decline in annualized yields is due primarily to the decline in interest rates during these years.

The following table illustrates the net investment income and annualized yields on average assets for each of the components of the Company’s

investment portfolio for the years ended December 31, 2003, 2002 and 2001:

2003 2002 2001

Yield(1) Amount Yield(1) Amount Yield(1) Amount

(Dollars in millions)

Fixed Maturities:(2)

Investment income **************************************** 6.89% $ 8,502 7.46% $ 8,076 7.89% $ 8,018

Net investment gains (losses)******************************** (398) (917) (645)

Total ************************************************** $ 8,104 $ 7,159 $ 7,373

Ending assets ******************************************** $167,752 $140,288 $115,150

Mortgage Loans on Real Estate:(3)

Investment income **************************************** 7.48% $ 1,903 7.84% $ 1,883 8.17% $ 1,848

Net investment gains (losses)******************************** (56) (22) (91)

Total ************************************************** $ 1,847 $ 1,861 $ 1,757

Ending assets ******************************************** $ 26,249 $ 25,086 $ 23,621

Policy Loans:

Investment income **************************************** 6.40% $ 554 6.49% $ 543 6.56% $ 536

Ending assets ******************************************** $ 8,749 $ 8,580 $ 8,272

Cash, Cash Equivalents and Short-term Investments:

Investment income **************************************** 2.73% $ 165 4.17% $ 232 5.54% $ 279

Net investment gains (losses)******************************** 1 — (5)

Total ************************************************** $ 166 $ 232 $ 274

Ending assets ******************************************** $ 5,559 $ 4,244 $ 8,676

Real Estate and Real Estate Joint Ventures:(4)

Investment income, net of expenses************************** 10.78% $ 518 11.41% $ 637 10.58% $ 584

Net investment gains (losses)******************************** 440 576 (4)

Total ************************************************** $ 958 $ 1,213 $ 580

Ending assets ******************************************** $ 4,803 $ 4,725 $ 5,730

Equity Securities and Other Limited Partnership Interests:

Investment income **************************************** 2.66% $ 106 2.47% $ 99 2.56% $ 110

Net investment gains (losses)******************************** (43) 222 (96)

Total ************************************************** $63 $321 $14

Ending assets ******************************************** $ 4,075 $ 4,008 $ 4,948

Other Invested Assets:(5)

Investment income **************************************** 6.84% $ 290 6.42% $ 218 7.60% $ 249

Net investment gains (losses)******************************** (180) (206) 79

Total ************************************************** $ 110 $ 12 $ 328

Ending assets ******************************************** $ 4,645 $ 3,727 $ 3,298

Total Investments:

Investment income before expenses and fees****************** 6.82 % $ 12,038 7.35 % $ 11,688 7.72 % $ 11,624

Investment expenses and fees ****************************** (0.15)% (266) (0.15)% (235) (0.16)% (244)

Net investment income ************************************* 6.67 % $ 11,772 7.20 % $ 11,453 7.56 % $ 11,380

Net investment gains (losses)******************************** (236) (347) (762)

Adjustments to investment gains (losses)(6) ******************** 215 145 134

Gains from sales of subsidiaries ***************************** ——25

Total ************************************************** $ 11,751 $ 11,251 $ 10,777

(1) Yields are based on quarterly average asset carrying values, excluding recognized and unrealized gains and losses, and for yield calculation

purposes, average assets exclude collateral associated with the Company’s securities lending program.

(2) Included in fixed maturities are equity-linked notes of $880 million, $834 million, and $1,004 million at December 31, 2003, 2002 and 2001, respectively,

which include an equity-like component as part of the notes’ return. Investment income for fixed maturities includes prepayment fees and income from the

securities lending program. Fixed maturity investment income has been reduced by rebates paid under the securities lending program.

(3) Investment income from mortgage loans on real estate includes prepayment fees.

(4) Real estate and real estate joint venture income is shown net of depreciation of $183 million, $227 million and $220 million for the years ended

December 31, 2003, 2002 and 2001, respectively. Real estate and real estate joint venture income includes amounts classified as discontinued

operations of $52 million, $160 million and $169 million for the years ended December 31, 2003, 2002 and 2001, respectively. These amounts are

net of depreciation of $15 million, $66 million and $93 million for the years ended December 31, 2003, 2002 and 2001, respectively. Net investment

MetLife, Inc. 29