MetLife 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

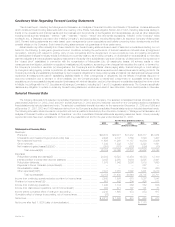

Cautionary Note Regarding Forward-Looking Statements

This Annual Report, including the Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains statements

which constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to

trends in the operations and financial results and the business and the products of the Registrant and its subsidiaries, as well as other statements

including words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘plan,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘intend’’ and other similar expressions. ‘‘MetLife’’ or the ‘‘Company’’ refers

to MetLife, Inc., a Delaware corporation (the ‘‘Holding Company’’), and its subsidiaries, including Metropolitan Life Insurance Company (‘‘Metropolitan

Life’’). Forward-looking statements are made based upon management’s current expectations and beliefs concerning future developments and their

potential effects on the Company. Such forward-looking statements are not guarantees of future performance.

Actual results may differ materially from those included in the forward-looking statements as a result of risks and uncertainties including, but not

limited to, the following: (i) changes in general economic conditions, including the performance of financial markets and interest rates; (ii) heightened

competition, including with respect to pricing, entry of new competitors and the development of new products by new and existing competitors;

(iii) unanticipated changes in industry trends; (iv) MetLife, Inc.’s primary reliance, as a holding company, on dividends from its subsidiaries to meet debt

payment obligations and the applicable regulatory restrictions on the ability of the subsidiaries to pay such dividends; (v) deterioration in the experience of

the ‘‘closed block’’ established in connection with the reorganization of Metropolitan Life; (vi) catastrophe losses; (vii) adverse results or other

consequences from litigation, arbitration or regulatory investigations; (viii) regulatory, accounting or tax changes that may affect the cost of, or demand for,

the Company’s products or services; (ix) downgrades in the Company’s and its affiliates’ claims paying ability, financial strength or credit ratings;

(x) changes in rating agency policies or practices; (xi) discrepancies between actual claims experience and assumptions used in setting prices for the

Company’s products and establishing the liabilities for the Company’s obligations for future policy benefits and claims; (xii) discrepancies between actual

experience and assumptions used in establishing liabilities related to other contingencies or obligations; (xiii) the effects of business disruption or

economic contraction due to terrorism or other hostilities; (xiv) the Company’s ability to identify and consummate on successful terms any future

acquisitions, and to successfully integrate acquired businesses with minimal disruption; and (xv) other risks and uncertainties described from time to time

in MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission, including its S-1 and S-3 registration statements. The Company specifically

disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

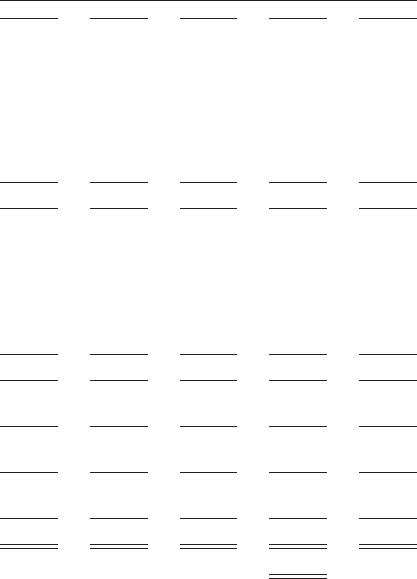

Selected Financial Data

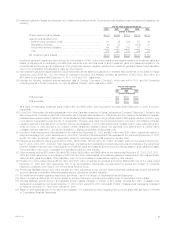

The following table sets forth selected consolidated financial information for the Company. The selected consolidated financial information for the

years ended December 31, 2003, 2002, and 2001 and at December 31, 2003 and 2002 has been derived from the Company’s audited consolidated

financial statements included elsewhere herein. The selected consolidated financial information for the years ended December 31, 2000 and 1999 and

at December 31, 2001, 2000 and 1999 has been derived from the Company’s audited consolidated financial statements not included elsewhere herein.

The following information should be read in conjunction with and is qualified in its entirety by the information contained in ‘‘Management’s Discussion and

Analysis of Financial Condition and Results of Operations,’’ and the consolidated financial statements appearing elsewhere herein. Some previously

reported amounts have been reclassified to conform with the presentation at and for the year ended December 31, 2003.

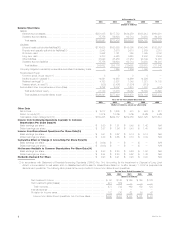

For the Years Ended December 31,

2003 2002 2001 2000 1999

(Dollars in millions)

Statements of Income Data

Revenues:

Premiums ************************************************************* $20,673 $19,077 $17,212 $16,317 $12,084

Universal life and investment-type product policy fees ************************ 2,496 2,147 1,889 1,820 1,437

Net investment income(1) ************************************************ 11,636 11,261 11,187 10,986 9,436

Other revenues ******************************************************** 1,342 1,332 1,507 2,229 1,861

Net investment gains (losses)(1)(2)(3)(7) ************************************ (358) (751) (579) (390) (70)

Total revenues(4)(6) *********************************************** 35,789 33,066 31,216 30,962 24,748

Expenses:

Policyholder benefits and claims(2)(7) ************************************** 20,848 19,523 18,454 16,893 13,100

Interest credited to policyholder account balances *************************** 3,035 2,950 3,084 2,935 2,441

Policyholder dividends*************************************************** 1,975 1,942 2,086 1,919 1,690

Payments to former Canadian policyholders(5)******************************* — — — 327 —

Demutualization costs *************************************************** — — — 230 260

Other expenses(1)(2)(8)************************************************** 7,301 7,015 7,022 7,401 6,210

Total expenses(4)(6)*********************************************** 33,159 31,430 30,646 29,705 23,701

Income from continuing operations before provision for income taxes ************* 2,630 1,636 570 1,257 1,047

Provision for income taxes(1)(9) ********************************************* 687 502 204 405 511

Income from continuing operations ****************************************** 1,943 1,134 366 852 536

Income from discontinued operations, net of income taxes(1) ******************** 300 471 107 101 81

Income before cumulative effect of change in accounting *********************** 2,243 1,605 473 953 617

Cumulative effect of change in accounting, net of income taxes****************** (26)————

Net income************************************************************** $ 2,217 $ 1,605 $ 473 $ 953 $ 617

Net income after April 7, 2000 (date of demutualization)************************* $ 1,173

MetLife, Inc. 1