MetLife 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

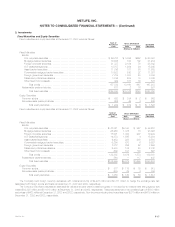

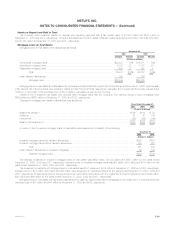

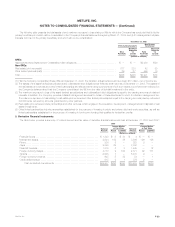

Real Estate and Real Estate Joint Ventures

Real estate and real estate joint ventures consisted of the following:

December 31,

2003 2002

(Dollars in millions)

Real estate and real estate joint ventures held-for-investment **************************************** $4,997 $4,197

Impairments ********************************************************************************* (283) (271)

Total *********************************************************************************** 4,714 3,926

Real estate held-for-sale *********************************************************************** 101 815

Impairments ********************************************************************************* —(5)

Valuation allowance *************************************************************************** (12) (11)

Total *********************************************************************************** 89 799

Real estate and real estate joint ventures ************************************************* $4,803 $4,725

Accumulated depreciation on real estate was $1,955 million and $1,951 million at December 31, 2003 and 2002, respectively. The related

depreciation expense was $183 million, $227 million and $220 million for the years ended December 31, 2003, 2002 and 2001, respectively. These

amounts include $15 million, $66 million and $93 million of depreciation expense related to discontinued operations for the years ended December 31,

2003, 2002 and 2001, respectively.

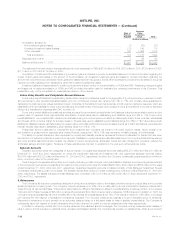

Real estate and real estate joint ventures were categorized as follows:

December 31,

2003 2002

Amount Percent Amount Percent

(Dollars in millions)

Office *************************************************************************** $2,775 58% $2,733 58%

Retail**************************************************************************** 667 14 699 15

Apartments*********************************************************************** 861 18 835 18

Land **************************************************************************** 81 2 87 2

Agriculture *********************************************************************** 1— 7—

Other**************************************************************************** 418 8 364 7

Total ******************************************************************** $4,803 100% $4,725 100%

The Company’s real estate holdings are primarily located throughout the United States. At December 31, 2003, approximately 28%, 17% and 16%

of the Company’s real estate holdings were located in New York, California and Illinois, respectively.

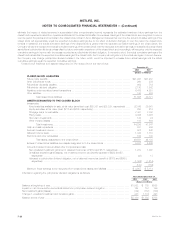

Changes in real estate and real estate joint ventures held-for-sale valuation allowance were as follows:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Balance at January 1 **************************************************************************** $11 $35 $39

Additions charged to investment income ************************************************************ 17 21 16

Deductions for writedowns and dispositions ********************************************************* (16) (45) (20)

Balance at December 31 ************************************************************************* $12 $11 $35

Investment income related to impaired real estate and real estate joint ventures held-for-investment was $35 million, $48 million and $34 million for

the years ended December 31, 2003, 2002 and 2001, respectively. There was no investment income related to impaired real estate and real estate joint

ventures held-for-sale for the year ended December 31, 2003. Investment income related to impaired real estate and real estate joint ventures held-for-

sale was $3 million and $19 million for the years ended December 31, 2002 and 2001, respectively. The carrying value of non-income producing real

estate and real estate joint ventures was $77 million and $63 million at December 31, 2003 and 2002, respectively.

The Company owned real estate acquired in satisfaction of debt of $3 million and $10 million at December 31, 2003 and 2002, respectively.

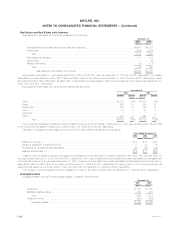

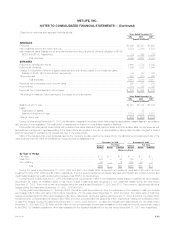

Leveraged Leases

Leveraged leases, included in other invested assets, consisted of the following:

December 31,

2003 2002

(Dollars in millions)

Investment ********************************************************************************** $ 974 $ 985

Estimated residual values ********************************************************************** 386 428

Total *********************************************************************************** 1,360 1,413

Unearned income **************************************************************************** (380) (368)

Leveraged leases ************************************************************************ $ 980 $1,045

MetLife, Inc.

F-20