MetLife 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

estate investments, the Sears Tower, and reclassified the property from Real Estate — Held-for Investments to Real Estate — Held-for Sale. The carrying

value of the property as of December 31, 2003 is approximately $700 million.

Equity Securities and Other Limited Partnership Interests

The Company’s carrying value of equity securities, which primarily consist of investments in common and preferred stocks and mutual fund

interests, was $1,598 million and $1,613 million at December 31, 2003 and 2002, respectively. Substantially all of the common stock is publicly traded

on major securities exchanges. The carrying value of the other limited partnership interests (which primarily represent ownership interests in pooled

investment funds that make private equity investments in companies in the U.S. and overseas) was $2,477 million and $2,395 million at December 31,

2003 and 2002, respectively. The Company classifies its investments in common stocks as available-for-sale and marks them to market, except for non-

marketable private equities, which are generally carried at cost. The Company uses the equity method of accounting for investments in limited partnership

interests in which it has more than a minor interest, has influence over the partnership’s operating and financial policies and does not have a controlling

interest. The Company uses the cost method for minor interest investments and when it has virtually no influence over the partnership’s operating and

financial policies. The Company’s investments in equity securities excluding partnerships represented 0.7% and 0.8% of cash and invested assets at

December 31, 2003 and 2002, respectively.

Equity securities include private equity securities with an estimated fair value of $432 million and $443 million at December 31, 2003 and 2002,

respectively. The Company may not freely trade its private equity securities because of restrictions imposed by federal and state securities laws and

illiquid markets.

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded commit-

ments were $1,380 million and $1,667 million at December 31, 2003 and 2002, respectively. The Company anticipates that these amounts could be

invested in these partnerships any time over the next five years.

Some of the Company’s investments in other limited partnership interests meet the definition of a VIE under FIN 46(r). See ‘‘ — Variable Interest

Entities.’’

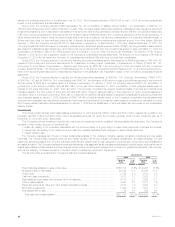

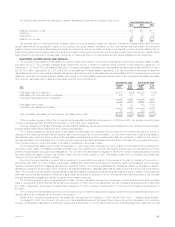

The following tables set forth the cost, gross unrealized gain or loss and estimated fair value of the Company’s equity securities, as well as the

percentage of the total equity securities at:

December 31, 2003

Gross

Unrealized Estimated % of

Cost Gain Loss Fair Value Total

(Dollars in millions)

Equity Securities:

Common stocks ************************************************************* $ 620 $334 $2 $ 952 59.6%

Nonredeemable preferred stocks************************************************ 602 48 4 646 40.4

Total equity securities *************************************************** $1,222 $382 $6 $1,598 100.0%

December 31, 2002

Gross

Unrealized Estimated % of

Cost Gain Loss Fair Value Total

(Dollars in millions)

Equity Securities:

Common stocks ************************************************************* $ 877 $115 $79 $ 913 56.6%

Nonredeemable preferred stocks************************************************ 679 25 4 700 43.4

Total equity securities *************************************************** $1,556 $140 $83 $1,613 100.0%

Potential Problem and Problem Equity Securities and Other Limited Partnership Interests. The Company monitors its equity securities and other

limited partnership interests on a continual basis. Through this monitoring process, the Company identifies investments that management considers to be

problems or potential problems.

Potential problem equity securities and other limited partnership interests are defined as securities issued by a company that is experiencing

significant operating problems or difficult industry conditions. Criteria generally indicative of these problems or conditions are (i) cash flows falling below

varying thresholds established for the industry and other relevant factors; (ii) significant declines in revenues and/or margins; (iii) public securities trading at

a substantial discount compared to original cost as a result of specific credit concerns; and (iv) other information that becomes available.

Problem equity securities and other limited partnership interests are defined as securities (i) in which significant declines in revenues and/or margins

threaten the ability of the issuer to continue operating; or (ii) where the issuer has entered into bankruptcy.

Equity Security Impairment. The Company classifies all of its equity securities as available-for-sale and marks them to market through other

comprehensive income. All securities with gross unrealized losses at the consolidated balance sheet date are subjected to the Company’s process for

identifying other-than-temporary impairments. The Company writes down to fair value securities that it deems to be other-than-temporarily impaired in the

period the securities are deemed to be so impaired. The assessment of whether such impairment has occurred is based on management’s case-by-

case evaluation of the underlying reasons for the decline in fair value. Management considers a wide range of factors, as described below, about the

security issuer and uses its best judgment in evaluating the cause of the decline in the estimated fair value of the security and in assessing the prospects

for near-term recovery. Inherent in management’s evaluation of the security are assumptions and estimates about the operations of the issuer and its

future earnings potential.

Considerations used by the Company in the impairment evaluation process include, but are not limited to, the following:

)length of time and the extent to which the market value has been below cost;

)potential for impairments of securities when the issuer is experiencing significant financial difficulties, including a review of all securities of the

issuer, including its known subsidiaries and affiliates, regardless of the form of the Company’s ownership;

)potential for impairments in an entire industry sector or sub-sector;

)potential for impairments in certain economically depressed geographic locations;

MetLife, Inc.

38