MetLife 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

eliminate the impact of related amounts in accumulated other comprehensive income) represents the estimated maximum future earnings from the

closed block expected to result from operations attributed to the closed block after income taxes. Earnings of the closed block are recognized in income

over the period the policies and contracts in the closed block remain in-force. Management believes that over time the actual cumulative earnings of the

closed block will approximately equal the expected cumulative earnings due to the effect of dividend changes. If, over the period the closed block

remains in existence, the actual cumulative earnings of the closed block is greater than the expected cumulative earnings of the closed block, the

Company will pay the excess of the actual cumulative earnings of the closed block over the expected cumulative earnings to closed block policyholders

as additional policyholder dividends unless offset by future unfavorable experience of the closed block and, accordingly, will recognize only the expected

cumulative earnings in income with the excess recorded as a policyholder dividend obligation. If over such period, the actual cumulative earnings of the

closed block is less than the expected cumulative earnings of the closed block, the Company will recognize only the actual earnings in income. However,

the Company may change policyholder dividend scales in the future, which would be intended to increase future actual earnings until the actual

cumulative earnings equal the expected cumulative earnings.

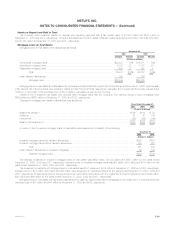

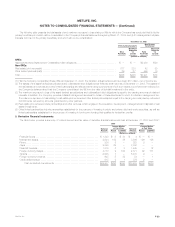

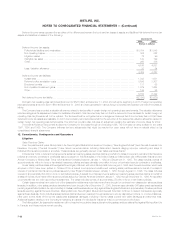

Closed block liabilities and assets designated to the closed block are as follows:

December 31,

2003 2002

(Dollars in millions)

CLOSED BLOCK LIABILITIES

Future policy benefits ************************************************************************ $41,928 $41,207

Other policyholder funds ********************************************************************* 260 279

Policyholder dividends payable **************************************************************** 682 719

Policyholder dividend obligation **************************************************************** 2,130 1,882

Payables under securities loaned transactions *************************************************** 6,418 4,851

Other liabilities ****************************************************************************** 180 433

Total closed block liabilities *********************************************************** 51,598 49,371

ASSETS DESIGNATED TO THE CLOSED BLOCK

Investments:

Fixed maturities available-for-sale, at fair value (amortized cost: $30,381 and $28,339, respectively) **** 32,348 29,981

Equity securities, at fair value (cost: $217 and $236, respectively)********************************* 250 218

Mortgage loans on real estate *************************************************************** 7,431 7,032

Policy loans ****************************************************************************** 4,036 3,988

Short-term investments********************************************************************* 123 24

Other invested assets********************************************************************** 108 604

Total investments******************************************************************** 44,296 41,847

Cash and cash equivalents ******************************************************************* 531 435

Accrued investment income******************************************************************* 527 540

Deferred income taxes *********************************************************************** 1,043 1,151

Premiums and other receivables *************************************************************** 164 130

Total assets designated to the closed block ********************************************* 46,561 44,103

Excess of closed block liabilities over assets designated to to the closed block *********************** 5,037 5,268

Amounts included in accumulated other comprehensive loss:

Net unrealized investment gains net of deferred income tax of $730 and $577, respectively *********** 1,270 1,047

Unrealized derivative gains (losses), net of deferred income tax (benefit) expense of $(28) and $7,

respectively **************************************************************************** (48) 13

Allocated to policyholder dividend obligation, net of deferred income tax benefit of ($778) and ($668),

respectively **************************************************************************** (1,352) (1,214)

(130) (154)

Maximum future earnings to be recognized from closed block assets and liabilities********************* $ 4,907 $ 5,114

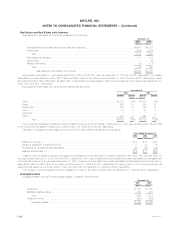

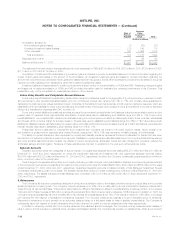

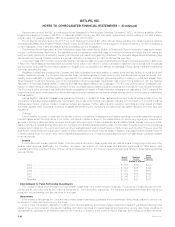

Information regarding the policyholder dividend obligation is as follows:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Balance at beginning of year********************************************************************* $1,882 $ 708 $385

Impact on net income before amounts allocated from policyholder dividend obligation ********************* 144 157 159

Net investment gains (losses) ******************************************************************** (144) (157) (159)

Change in unrealized investment and derivative gains ************************************************ 248 1,174 323

Balance at end of year************************************************************************** $2,130 $1,882 $708

MetLife, Inc.

F-28