MetLife 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

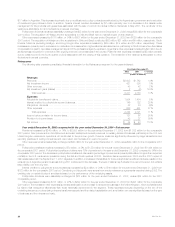

$17 million in Argentina. This decrease is primarily due to modifications to policy contracts as authorized by the Argentinean government and a reduction

of investment-type policies in-force. In addition, Spain’s interest credited decreased by $7 million primarily due to a decrease in the assets under

management for life products with guarantees associated with the sale of a block of policies to Banco Santander in May 2001. The remainder of the

variance is attributable to minor fluctuations in several countries.

Policyholder dividends remained essentially unchanged at $35 million for the year ended December 31, 2002 versus $36 million for the comparable

2001 period. The acquisition of Hidalgo and the acquisitions in Chile and Brazil had no material impact on this variance.

Other expenses increased by $178 million, or 54%, to $507 million for the year ended December 31, 2002 from $329 million for the comparable

2001 period. The acquisition of Hidalgo and the acquisitions in Chile and Brazil contributed $82 million, $21 million and $5 million, respectively. South

Korea’s, Mexico’s (excluding Hidalgo), and Hong Kong’s other expenses increased by $29 million, $19 million and $7 million, respectively. These

increases are primarily due to increased non-deferrable commissions from higher sales as discussed above, particularly in South Korea where fixed sales

compensation is paid to new sales management as part of the professional agency expansion. Argentina’s other expenses increased by $9 million due to

additional loss recognition in connection with ongoing economic circumstances in the country. Poland’s other expenses increased by $5 million primarily

due to costs incurred in the fourth quarter of 2002 associated with the closing of this operation. The remainder of the variance is attributable to minor

fluctuations in several countries.

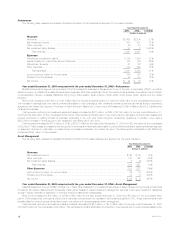

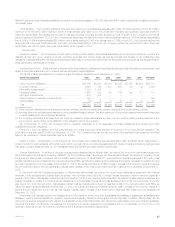

Reinsurance

The following table presents consolidated financial information for the Reinsurance segment for the years indicated:

Year Ended December 31,

2002 2001 % Change

(Dollars in millions)

Revenues

Premiums ************************************************************************* $2,005 $1,762 14 %

Net investment income ************************************************************** 421 390 8 %

Other revenues ********************************************************************* 43 42 2 %

Net investment gains (losses) ********************************************************* 2 (6) 133 %

Total revenues****************************************************************** 2,471 2,188 13 %

Expenses

Policyholder benefits and claims******************************************************* 1,554 1,484 5 %

Interest credited to policyholder account balances**************************************** 146 122 20 %

Policyholder dividends *************************************************************** 22 24 (8)%

Other expenses ******************************************************************** 622 491 27 %

Total expenses ***************************************************************** 2,344 2,121 11 %

Income before provision for income taxes *********************************************** 127 67 90 %

Provision for income taxes************************************************************ 43 27 59 %

Net income ************************************************************************ $ 84 $ 40 110 %

Year ended December 31, 2002 compared with the year ended December 31, 2001—Reinsurance

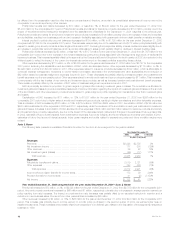

Premiums increased by $243 million, or 14%, to $2,005 million for the year ended December 31, 2002 from $1,762 million for the comparable

2001 period. New premiums from facultative and automatic treaties and renewal premiums on existing blocks of business, particularly in the U.S. and

United Kingdom reinsurance operations, all contributed to the premium growth. Premium levels are significantly influenced by large transactions and

reporting practices of ceding companies and, as a result, can fluctuate from period to period.

Other revenues remained essentially unchanged at $43 million for the year ended December 31, 2002 versus $42 million for the comparable 2001

period.

Policyholder benefits and claims increased by $70 million, or 5%, to $1,554 million for the year ended December 31, 2002 from $1,484 million for

the comparable 2001 period. Policyholder benefits and claims were 78% of premiums for the year ended December 31, 2002 compared to 84% in the

comparable 2001 period. The decrease in policyholder benefits and claims as a percentage of premiums is primarily attributable to higher than expected

mortality in the U.S. reinsurance operations during the first and fourth quarters of 2001, favorable claims experience in 2002 and the 2001 impact of

claims associated with the September 11, 2001 tragedies. In addition, increases in the liabilities for future policyholder benefits and adverse results on the

reinsurance of Argentine pension business during 2001 contributed to the decrease. The level of claims may fluctuate from period to period, but exhibits

less volatility over the long term.

Interest credited to policyholder account balances increased by $24 million, or 20%, to $146 million for the year ended December 31, 2002 from

$122 million for the comparable 2001 period. Contributing to this growth were several new annuity reinsurance agreements executed during 2002. The

crediting rate on certain blocks of annuities is based on the performance of the underlying assets.

Policyholder dividends were essentially unchanged at $22 million for the year ended December 31, 2002, versus $24 million for the 2001

comparable period.

Other expenses increased by $131 million, or 27%, to $622 million for the year ended December 31, 2002 from $491 million for the comparable

2001 period. The increase in other expenses is primarily attributable to an increase in reinsurance business in the United Kingdom, which is characterized

by higher initial reinsurance allowances than those historically experienced in the segment. These expenses fluctuate depending on the mix of the

underlying insurance products being reinsured as allowances paid and the related capitalization and amortization can vary significantly based on the type

of business and the reinsurance treaty.

MetLife, Inc.

20