MetLife 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

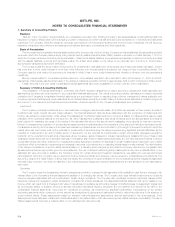

2. Investments

Fixed Maturities and Equity Securities

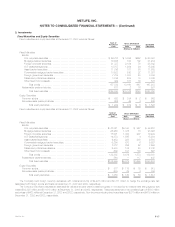

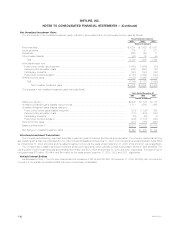

Fixed maturities and equity securities at December 31, 2003 were as follows:

Cost or Gross Unrealized

Amortized Estimated

Cost Gain Loss Fair Value

(Dollars in millions)

Fixed Maturities:

Bonds:

U.S. corporate securities ************************************************** $ 56,757 $ 3,886 $252 $ 60,391

Mortgage-backed securities ************************************************ 30,836 720 102 31,454

Foreign corporate securities ************************************************ 21,727 2,194 79 23,842

U.S treasuries/agencies *************************************************** 14,707 1,264 26 15,945

Asset-backed securities *************************************************** 11,736 187 60 11,863

Commercial mortgage-backed securities ************************************* 10,523 530 22 11,031

Foreign government securities ********************************************** 7,789 1,003 28 8,764

States and political subdivisions ******************************************** 3,155 209 15 3,349

Other fixed income assets ************************************************* 492 167 83 576

Total bonds ********************************************************* 157,722 10,160 667 167,215

Redeemable preferred stocks ************************************************ 611 2 76 537

Total fixed maturities ************************************************** $158,333 $10,162 $743 $167,752

Equity Securities:

Common stocks *********************************************************** $ 620 $ 334 $ 2 $ 952

Nonredeemable preferred stocks ********************************************* 602 48 4 646

Total equity securities ************************************************* $ 1,222 $ 382 $ 6 $ 1,598

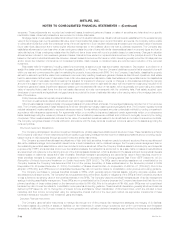

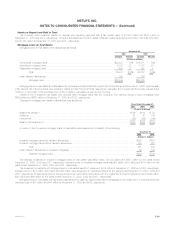

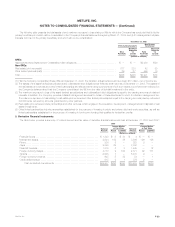

Fixed maturities and equity securities at December 31, 2002 were as follows:

Cost or Gross Unrealized

Amortized Estimated

Cost Gain Loss Fair Value

(Dollars in millions)

Fixed Maturities:

Bonds:

U.S. corporate securities************************************************** $ 47,021 $3,193 $ 957 $ 49,257

Mortgage-backed securities *********************************************** 26,966 1,076 16 28,026

Foreign corporate securities *********************************************** 18,001 1,435 207 19,229

U.S treasuries/agencies ************************************************** 14,373 1,565 4 15,934

Asset-backed securities ************************************************** 9,483 228 208 9,503

Commercial mortgage-backed securities************************************* 6,290 573 6 6,857

Foreign government securities ********************************************* 7,012 636 52 7,596

States and political subdivisions ******************************************** 2,580 182 20 2,742

Other fixed income assets ************************************************ 609 191 103 697

Total bonds ********************************************************* 132,335 9,079 1,573 139,841

Redeemable preferred stocks************************************************ 564 — 117 447

Total fixed maturities************************************************** $132,899 $9,079 $1,690 $140,288

Equity Securities:

Common stocks*********************************************************** $ 877 $ 115 $ 79 $ 913

Nonredeemable preferred stocks ********************************************* 679 25 4 700

Total equity securities************************************************* $ 1,556 $ 140 $ 83 $ 1,613

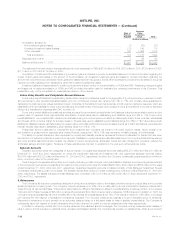

The Company held foreign currency derivatives with notional amounts of $4,273 million and $2,371 million to hedge the exchange rate risk

associated with foreign bonds and loans at December 31, 2003 and 2002, respectively.

The Company held fixed maturities at estimated fair values that were below investment grade or not rated by an independent rating agency that

totaled $12,825 million and $11,619 million at December 31, 2003 and 2002, respectively. These securities had a net unrealized gain of $888 million

and a loss of $422 million at December 31, 2003 and 2002, respectively. Non-income producing fixed maturities were $371 million and $479 million at

December 31, 2003 and 2002, respectively.

MetLife, Inc. F-17