MetLife 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

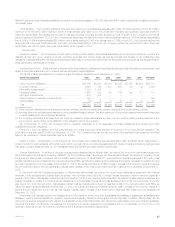

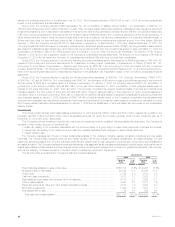

$1 billion of common stock. Under these authorizations, the Holding Company may purchase its common stock from the MetLife Policyholder Trust, in

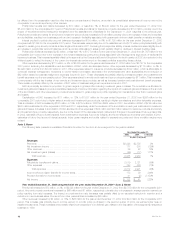

the open market and in privately negotiated transactions. The following table summarizes the 2003, 2002 and 2001 repurchase activity:

December 31,

2003 2002 2001

(Dollars in millions)

Shares Repurchased*************************************************** 2,997,200 15,244,492 45,242,966

Cost **************************************************************** $ 97 $ 471 $ 1,321

At December 31, 2003, the Holding Company had approximately $709 million remaining on its existing share repurchase program.

In the fourth quarter of 2003, RGA offered to the public 12,075,000 shares of its common stock at $36.65 per share. MetLife and its affiliates

purchased 3,000,000 shares of the common stock being offered by RGA. As a result of this offering, MetLife’s ownership percentage of outstanding

shares of RGA common stock was reduced from approximately 59% at December 31, 2002 to approximately 52% at December 31, 2003.

Support Agreements. In 2002, the Holding Company entered into a net worth maintenance agreement with three of its insurance subsidiaries,

MetLife Investors Insurance Company, First MetLife Investors Insurance Company and MetLife Investors Insurance Company of California. Under the

agreements, the Holding Company agreed, without limitation as to the amount, to cause each of these subsidiaries to have a minimum capital and

surplus of $10 million (or, with respect to MetLife Investors Insurance Company of California, $5 million), total adjusted capital at a level not less than

150% of the company action level RBC, as defined by state insurance statutes, and liquidity necessary to enable it to meet its current obligations on a

timely basis. At December 31, 2003, the capital and surplus of each of these subsidiaries was in excess of the minimum capital and surplus amounts

referenced above, and their total adjusted capital was in excess of the most recent referenced RBC-based amount calculated at December 31, 2003.

Based on management’s analysis and comparison of its current and future cash inflows from the dividends it receives from subsidiaries, including

Metropolitan Life, that are permitted to be paid without prior insurance regulatory approval and its portfolio of liquid assets and other anticipated cash

flows, management believes there will be sufficient liquidity to enable the Holding Company to make payments on debt, make cash dividend payments

on its common stock, contribute capital to its subsidiaries, pay all operating expenses and meet its other obligations.

The Company

Capital

RBC. Section 1322 of the New York Insurance Law requires that New York domestic life insurers report their RBC based on a formula calculated

by applying factors to various asset, premium and statutory reserve items; similar rules apply to each of the Company’s domestic insurance subsidiaries.

The formula takes into account the risk characteristics of the insurer, including asset risk, insurance risk, interest rate risk and business risk. Section 1322

gives the Superintendent explicit regulatory authority to require various actions by, or to take various actions against, insurers whose total adjusted capital

does not exceed certain RBC levels. At December 31, 2003, Metropolitan Life’s and each of the Holding Company’s domestic insurance subsidiaries’

total adjusted capital was in excess of each of the RBC levels required by each state of domicile.

The National Association of Insurance Commissioners (‘‘NAIC’’) adopted Codification of Statutory Accounting Principles (‘‘Codification’’), which is

intended to standardize regulatory accounting and reporting to state insurance departments and became effective January 1, 2001. However, statutory

accounting principles continue to be established by individual state laws and permitted practices. The Department required adoption of Codification with

certain modifications for the preparation of statutory financial statements of insurance companies domiciled in New York effective January 1, 2001.

Effective December 31, 2002, the Department adopted a modification to its regulations to be consistent with Codification with respect to the admissibility

of deferred income taxes by New York insurers, subject to certain limitations. The adoption of Codification, as modified by the Department, did not

adversely affect Metropolitan Life’s statutory capital and surplus. Further modifications by state insurance departments may impact the effect of

Codification on the statutory capital and surplus of Metropolitan Life and the Holding Company’s other insurance subsidiaries.

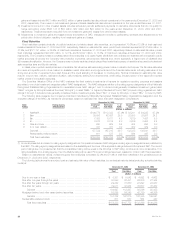

Liquidity Sources

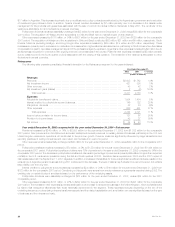

Cash Flow from Operations. The Company’s principal cash inflows from its insurance activities come from insurance premiums, annuity considera-

tions and deposit funds. A primary liquidity concern with respect to these cash inflows is the risk of early contractholder and policyholder withdrawal. The

Company seeks to include provisions limiting withdrawal rights on many of its products, including general account institutional pension products

(generally group annuities, including guaranteed interest contracts and certain deposit fund liabilities) sold to employee benefit plan sponsors.

The Company’s principal cash inflows from its investment activities come from repayments of principal, proceeds from maturities and sales of

invested assets and investment income. The primary liquidity concerns with respect to these cash inflows are the risk of default by debtors and market

volatilities. The Company closely monitors and manages these risks through its credit risk management process.

Liquid Assets. An integral part of the Company’s liquidity management is the amount of liquid assets it holds. Liquid assets include cash, cash

equivalents, short-term investments and marketable fixed maturity and equity securities. Liquid assets exclude assets relating to securities lending and

dollar roll activities. At December 31, 2003 and 2002, the Company had $125 billion and $108 billion in liquid assets, respectively.

Global Funding Sources. Liquidity is also provided by a variety of both short and long-term instruments, including repurchase agreements,

commercial paper, medium and long-term debt, capital securities and stockholders’ equity. The diversification of the Company’s funding sources

enhances funding flexibility, limits dependence on any one source of funds and generally lowers the cost of funds.

At December 31, 2003 and 2002, the Company had $3,642 million and $1,161 million in short-term debt outstanding, and $5,703 million and

$4,425 million in long-term debt outstanding, respectively. On November 1, 2003, the Company redeemed the $300 million of 7.45% Surplus Notes

outstanding scheduled to mature on November 1, 2023 at a redemption price of $311 million. See ‘‘— The Holding Company — Global Funding

Sources.’’

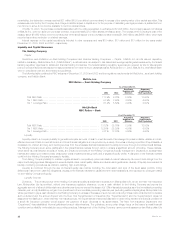

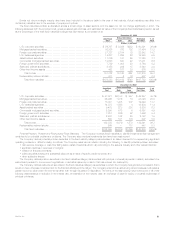

MetLife Funding serves as a centralized finance unit for Metropolitan Life. Pursuant to a support agreement, Metropolitan Life has agreed to cause

MetLife Funding to have a tangible net worth of at least one dollar. At December 31, 2003 and 2002, MetLife Funding had a tangible net worth of

$10.8 million and $10.7 million, respectively. MetLife Funding raises funds from various funding sources and uses the proceeds to extend loans, through

MetLife Credit Corp., a subsidiary of Metropolitan Life, to the Holding Company, Metropolitan Life and other affiliates. MetLife Funding manages its

funding sources to enhance the financial flexibility and liquidity of Metropolitan Life and other affiliated companies. At December 31, 2003 and 2002,

MetLife, Inc.

24