MetLife 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

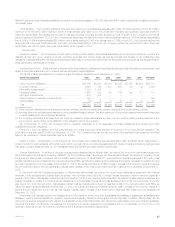

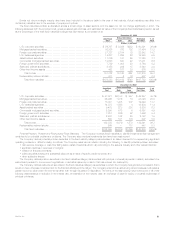

Mortgage-Backed Securities. The following table shows the types of mortgage-backed securities the Company held at:

December 31, 2003 December 31, 2002

Estimated % of Estimated % of

Fair Value Total Fair Value Total

(Dollars in millions)

Pass-through securities ************************************************************** $15,427 36.3% $12,515 35.9%

Collateralized mortgage obligations ***************************************************** 16,027 37.7 15,511 44.5

Total mortgage-backed securities ********************************************** 31,454 74.0 28,026 80.4

Commercial mortgage-backed securities ************************************************ 11,031 26.0 6,857 19.6

Total ********************************************************************** $42,485 100.0% $34,883 100.0%

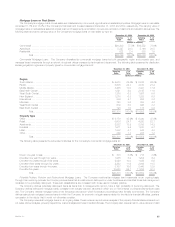

At December 31, 2003 and 2002, pass-through and collateralized mortgage obligations totaled $31,454 million and $28,026 million, respectively,

or 74.0% and 80.4%, respectively, of total mortgage-backed securities, and a majority of these amounts represented agency-issued pass-through and

collateralized mortgage obligations guaranteed or otherwise supported by the Federal National Mortgage Association, the Federal Home Loan Mortgage

Corporation or the Government National Mortgage Association. At December 31, 2003 and 2002, approximately $6,992 million and $3,598 million,

respectively, or 63.4% and 52.5%, respectively, of the commercial mortgage-backed securities, and $31,210 million and $27,590 million, respectively,

or 99.2% and 98.4%, respectively, of the pass-through securities and collateralized mortgage obligations, were rated Aaa/AAA by Moody’s or S&P.

The principal risks inherent in holding residential mortgage-backed securities are prepayment and extension risks, which will affect the timing of when

cash will be received and are dependent on the level of mortgage interest rates. Prepayment risk is the unexpected increase in principal payments

primarily as a result of homeowner refinancing. Extension risk relates to the unexpected slowdown in principal payments. The Company’s active

monitoring of its residential mortgage-backed securities mitigates exposure to the cash flow uncertainties associated with these risks.

The principal risks in owning commercial mortgage-backed securities are related to structural, credit and capital market risks. Structural risks include

the security’s priority in the issuer’s capital structure and the adequacy of and ability to realize proceeds from the underlying real estate collateral. Credit

risk results from potential defaults on the underlying commercial mortgages. Capital market risks include the general level of interest rates and the liquidity

for these securities in the marketplace.

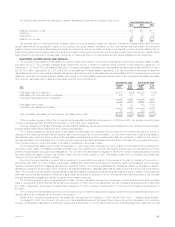

Asset-Backed Securities. Asset-backed securities, which include home equity loans, credit card receivables, collateralized debt obligations and

automobile receivables, are purchased both to diversify the overall risks of the Company’s fixed maturity assets and to provide income. The Company’s

asset-backed securities are diversified both by sector and by issuer. Credit card and home equity loan securitizations, each accounting for about 29% of

the total holdings, constitute the largest exposures in the Company’s asset-backed securities portfolio. Asset-backed securities generally have limited

sensitivity to changes in interest rates. Approximately $7,528 million and $4,912 million, or 63.5% and 51.7%, of total asset-backed securities were rated

Aaa/AAA by Moody’s or S&P at December 31, 2003 and 2002, respectively.

The principal risks in holding asset-backed securities are related to structural, credit and capital market risks. Structural risks include the security’s

priority in the issuer’s capital structure, the adequacy of and ability to realize proceeds from the collateral and the potential for prepayments. Credit risks

include consumer or corporate credits, such as credit card holders, equipment lessees, and corporate obligors. Capital market risks include the general

level of interest rates and the liquidity for these securities in the marketplace.

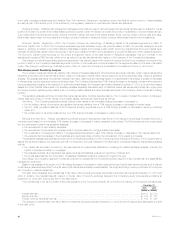

Structured Investment Transactions. The Company participates in structured investment transactions, primarily asset securitizations and structured

notes. These transactions enhance the Company’s total return of the investment portfolio principally by generating management fee income on asset

securitizations and by providing equity-based returns on debt securities through structured notes and similar instruments.

The Company sponsors financial asset securitizations of high yield debt securities, investment grade bonds and structured finance securities and

also is the collateral manager and a beneficial interest holder in such transactions. As the collateral manager, the Company earns management fees on

the outstanding securitized asset balance, which are recorded in income as earned. When the Company transfers assets to a bankruptcy-remote SPE

and surrenders control over the transferred assets, the transaction is accounted for as a sale. Gains or losses on securitizations are determined with

reference to the carrying amount of the financial assets transferred, which is allocated to the assets sold and the beneficial interests retained based on

relative fair values at the date of transfer. Beneficial interests in securitizations are carried at fair value in fixed maturities. Income on these beneficial

interests is recognized using the prospective method in accordance with EITF Issue No. 99-20, Recognition of Interest Income and Impairment on Certain

Investments (‘‘EITF 99-20’’). The SPEs used to securitize assets are not consolidated by the Company because the Company has determined that it is

not the primary beneficiary of these entities based on the framework provided in FASB Interpretation No. 46 (revised December 31, 2003), Consolidation

of Variable Interest Entities, An Interpretation of ARB No. 51 (‘‘FIN 46(r)’’). Prior to the adoption of FIN 46(r), such SPEs were not consolidated because

they did not meet the criteria for consolidation under previous accounting guidance.

The Company purchases or receives beneficial interests in SPEs, which generally acquire financial assets, including corporate equities, debt

securities and purchased options. The Company has not guaranteed the performance, liquidity or obligations of the SPEs and the Company’s exposure

to loss is limited to its carrying value of the beneficial interests in the SPEs. The Company uses the beneficial interests as part of its risk management

strategy, including asset-liability management. These SPEs are not consolidated by the Company because the Company has determined that it is not the

primary beneficiary of these entities based on the framework provided in FIN 46(r). Prior to the adoption of FIN 46(r), such SPEs were not consolidated

because they did not meet the criteria for consolidation under previous accounting guidance. These beneficial interests are generally structured notes, as

defined by EITF Issue No. 96-12, Recognition of Interest Income and Balance Sheet Classification of Structured Notes, which are included in fixed

maturities, and their income is recognized using the retrospective interest method or the level yield method, as appropriate. Impairments of these

beneficial interests are included in net investment gains and losses.

MetLife, Inc.

34