MetLife 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

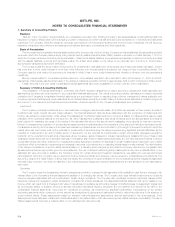

Foreign Currency

Balance sheet accounts of foreign operations are translated at the exchange rates in effect at each year-end and income and expense accounts are

translated at the average rates of exchange prevailing during the year. The local currencies of foreign operations are the functional currencies unless the

local economy is highly inflationary. Translation adjustments are charged or credited directly to other comprehensive income or loss. Gains and losses

from foreign currency transactions are reported in earnings.

Discontinued Operations

The results of operations of a component of the Company that either has been disposed of or is classified as held-for-sale on or after January 1,

2002 are reported in discontinued operations if the operations and cash flows of the component have been or will be eliminated from the ongoing

operations of the Company as a result of the disposal transaction and the Company will not have any significant continuing involvement in the operations

of the component after the disposal transaction.

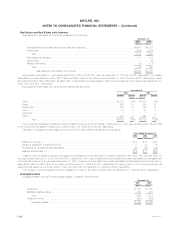

Earnings Per Share

Basic earnings per share is computed based on the weighted average number of shares outstanding during the period. Diluted earnings per share

includes the dilutive effect of the assumed: (i) conversion of forward purchase contracts; (ii) exercise of stock options, and (iii) issuance under deferred

stock compensation using the treasury stock method. Under the treasury stock method, forward purchase contracts, exercise of the stock options and

issuance under deferred stock compensation is assumed with the proceeds used to purchase common stock at the average market price for the period.

The difference between the number of shares assumed issued and number of shares assumed purchased represents the dilutive shares.

Demutualization and Initial Public Offering

On April 7, 2000 (the ‘‘date of demutualization’’), Metropolitan Life Insurance Company (‘‘Metropolitan Life’’) converted from a mutual life insurance

company to a stock life insurance company and became a wholly-owned subsidiary of MetLife, Inc. The conversion was pursuant to an order by the New

York Superintendent of Insurance (the ‘‘Superintendent’’) approving Metropolitan Life’s plan of reorganization, as amended (the ‘‘plan’’).

On the date of demutualization, policyholders’ membership interests in Metropolitan Life were extinguished and eligible policyholders received, in

exchange for their interests, trust interests representing 494,466,664 shares of common stock of MetLife, Inc. to be held in a trust, cash payments

aggregating $2,550 million and adjustments to their policy values in the form of policy credits aggregating $408 million, as provided in the plan. In

addition, Metropolitan Life’s Canadian branch made cash payments of $327 million in the second quarter of 2000 to holders of certain policies

transferred to Clarica Life Insurance Company in connection with the sale of a substantial portion of Metropolitan Life’s Canadian operations in 1998, as a

result of a commitment made in connection with obtaining Canadian regulatory approval of that sale.

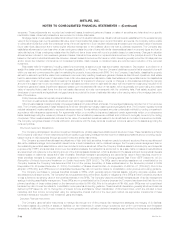

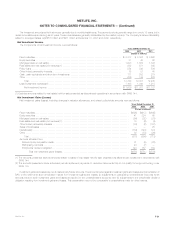

Application of Recent Accounting Pronouncements

Effective December 31, 2003, the Company adopted EITF Issue No. 03-1, The Meaning of Other-Than-Temporary Impairment and Its Application to

Certain Investments (‘‘EITF 03-1’’). EITF 03-1 provides guidance on the disclosure requirements for other-than-temporary impairments of debt and

marketable equity investments that are accounted for under Statement of Financial Accounting Standards (‘‘SFAS’’) No. 115, Accounting for Certain

Investments in Debt and Equity Securities. The adoption of EITF 03-1 requires the Company to include certain quantitative and qualitative disclosures for

debt and marketable equity securities classified as available-for-sale or held-to-maturity under SFAS 115 that are impaired at the balance sheet date but

for which an other-than-temporary impairment has not been recognized. (See Note 2). The initial adoption of EITF 03-1, which only required additional

disclosures, did not have a material impact on the Company’s consolidated financial statements.

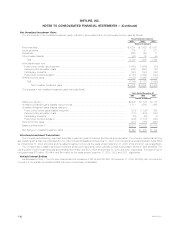

In December 2003, the Financial Accounting Standards Board (‘‘FASB’’) revised SFAS No. 132, Employers’ Disclosures about Pensions and Other

Postretirement Benefits — an Amendment of FASB Statements No. 87, 88 and 106 (‘‘SFAS 132(r)’’). SFAS 132(r) retains most of the disclosure

requirements of SFAS 132 and requires additional disclosure about assets, obligations, cash flows and net periodic benefit cost of defined benefit

pension plans and other defined postretirement plans. SFAS 132(r) is primarily effective for fiscal years ending after December 15, 2003; however, certain

disclosures about foreign plans and estimated future benefit payments are effective for fiscal years ending after June 15, 2004. The Company’s adoption

of SFAS 132(r) on December 31, 2003 did not have a significant impact on its consolidated financial statements since it only revises disclosure

requirements. In January 2004, the FASB issued FASB Staff Position (‘‘FSP’’) No. 106-1, Accounting and Disclosure Requirements Related to the

Medicare Prescription Drug, Improvement and Modernization Act of 2003 (‘‘FSP 106-1’’), which permits a sponsor of a postretirement health care plan

that provides a prescription drug benefit to make a one-time election to defer accounting for the effects of the new legislation. The Company has elected

to defer the accounting until further guidance is issued by the FASB. The measurements of the Company’s postretirement accumulated benefit plan

obligation and net periodic benefit cost disclosed in Note 13 do not reflect the effects of the new legislation. The guidance, when issued, could require

the Company to change previously reported information.

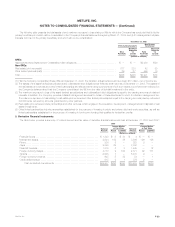

In July 2003, the Accounting Standards Executive Committee of the American Institute of Certified Public Accountants issued Statement of

Position 03-1, Accounting and Reporting by Insurance Enterprises for Certain Nontraditional Long-Duration Contracts and for Separate Accounts

(‘‘SOP 03-1’’). SOP 03-1 provides guidance on (i) the classification and valuation of long-duration contract liabilities, (ii) the accounting for sales

inducements, and (iii) separate account presentation and valuation. SOP 03-1 is effective for fiscal years beginning after December 15, 2003. As of

January 1, 2004, the Company increased future policyholder benefits for various guaranteed minimum death and income benefits net of DAC and

unearned revenue liability offsets under certain variable annuity and universal life contracts of approximately $40 million, net of income tax, which will be

reported as a cumulative effect of a change in accounting. Industry standards and practices continue to evolve relating to the valuation of liabilities relating

to these types of benefits, which may result in further adjustments to the Company’s measurement of liabilities associated with such benefits in

subsequent accounting periods. Effective with the adoption of SOP 03-1, costs associated with enhanced or bonus crediting rates to contractholders

will be deferred and amortized over the life of the related contract using assumptions consistent with the amortization of DAC. Prior to adoption of

SOP 03-1, the costs associated with these sales inducements have been deferred and amortized over the contingent sales inducement period. This

provision of SOP 03-1 will be applied prospectively to contracts. Effective January 1, 2004, the Company reclassified $115 million of ownership in its

own separate accounts from other assets to fixed maturities available-for-sale and equity securities. This reclassification will have no effect on net income

or other comprehensive income. In accordance with SOP 03-1’s revised definition of a separate account, effective January 1, 2004, the Company also

MetLife, Inc.

F-14