MetLife 2003 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

chairman’s letter

To MetLife’s Shareholders:

The attributes that define the MetLife brand and reputation—trustworthy, financially strong and opti-

mistic, to name a few—were clearly reinforced in 2003 by the positive results we generated across the

entire organization. As a fellow shareholder, I am pleased to report that MetLife made strong progress in

2003 as we continued to implement our business strategy, grow our diverse businesses and, ultimately,

position our company for continued, long-term growth.

The marketplace for financial services is extremely competitive, and MetLife continues to be a leader.

In addition to being the largest life insurer in the United States, we are ranked number one in most group

product areas, including life insurance, automobile and homeowners insurance and long-term care. But

more than anything, as a leader, we undoubtedly play a significant role in millions of people’s lives. We also know that MetLife does

much more than help its clients grow or protect their financial future. We are helping millions of individuals live a life of significance,

enjoying the things that matter most because we have helped them build financial freedom.

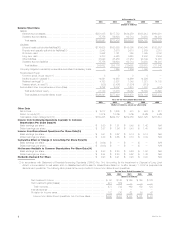

HDelivering Strong, Positive Results

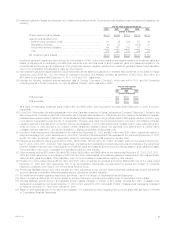

After three years of a broad, economic slowdown, in 2003 we witnessed improvements in both the credit and equity markets. At the

same time, while interest rates remained at historic lows, the S&P 500 Index was up 26% for the year. Against this backdrop, MetLife

delivered $2.22 billion in net income during the year—a 38% increase over 2002’s results. Also in 2003, assets under management grew

by 17% to $350.2 billion; Individual annuity deposits grew 42% to $11.2 billion; and total premiums and fees increased 9% to

$23.2 billion.

These positive results clearly demonstrate both our commitment and ability to deliver value and growth to MetLife’s shareholders. In

addition to top line growth across the enterprise, our diverse businesses increased sales, improved operating efficiencies and continued

to leverage resources, improving our ability to perform—today and many years into the future.

MetLife’s financial strength continues to be augmented by business segments that have established leadership positions and a

strong track record in the marketplace.

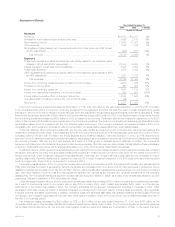

With 88 of the FORTUNE 100 as clients and a 13% return on equity, MetLife’s Institutional Business segment has sustained strong

growth. In 2003, we further expanded and enhanced our institutional market position with the acquisition of John Hancock’s group life

insurance business and the pending acquisition of the long-term care business of TIAA-CREF. At the same time, our existing group life

insurance business continued to outpace the market as premiums and fees reached $5.4 billion in 2003.

On the retail side, our Individual Business segment not only sharpened its business focus, but also experienced significant growth in

key areas. In 2003, MetLife Investors Group, which distributes MetLife products through banks and national and regional independent

broker/dealers, achieved annuity deposits of $6.4 billion in 2003—$2.9 billion more than in 2002. Including annuity deposits from

MetLife Financial Services and New England Financial, total annuity deposits were $11.2 billion for the year. At the same time, our

MetLife Financial Services and New England Financial distribution channels continued to focus on expense management, future sales

growth and improving profitability.

During the year, MetLife Bank, which was formed in 2001, surpassed $1 billion in deposits. Moving forward, the bank will play an

important role in the MetLife enterprise. In the first quarter of 2004, we launched a promotional campaign to bring more new business to

the bank and we continue to leverage the bank’s offerings among our Individual and Institutional distribution channels.

At MetLife Auto & Home, the 13th largest provider of personal lines property and casualty insurance in the U.S. by written premium,

record net income of $157 million was achieved in 2003 and Auto & Home’s combined ratio was 99.7% at year end.

MetLife International played an important role in our progress in 2003. We continued to focus on growing our business in significant

emerging markets. Like other areas of MetLife, we also created a common platform of support for International to enhance customer

service, create efficiencies and build a global MetLife brand. We successfully integrated our Mexican companies and launched MetLife

Mexico, the largest life insurance company in that country. We formed a joint venture company with Capital Airports Holding Company to

begin business in Beijing, China, where sales are expected to begin in the first quarter of 2004. After performing disciplined analysis, we

decided to exit the insurance markets in Spain, Portugal and Poland—countries that were not part of our strategic focus.

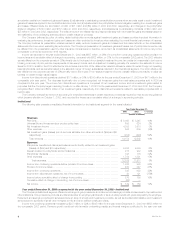

HEffective Capital Management

In addition to maintaining strong, top line growth in our business segments, we have continued to effectively manage our capital. This

effort, which has been ongoing since the initial public offering, has enabled us to preserve MetLife’s financial strength and has resulted in

increases in MetLife’s book value, risk-based capital ratio and operating return on equity.

In November, we leveraged our strong credit ratings as we completed a $200 million retail offering of 5.875% 30-year senior notes

and a $500 million institutional offering of 5.00% 10-year senior notes. The retail offering was different from our prior debt offerings in that

it was targeted directly to retail investors, which will enable MetLife to attract a broader and more diverse base of investors. At the same

time, we resumed our common stock repurchase program and, in the fourth quarter of 2003, repurchased an additional three million

shares. We also declared an annual stock dividend of $0.23 per common share—a 10% increase from the 2002 annual dividend.

In 2003, we generated nearly $12 billion in net investment income while adhering to our investment principles of rigorous asset-

liability management, through risk management and portfolio diversification in managing MetLife’s $222 billion investment portfolio. We