MetLife 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

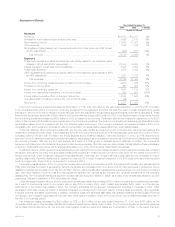

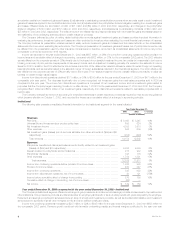

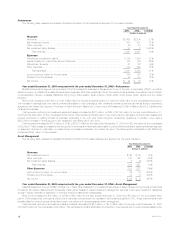

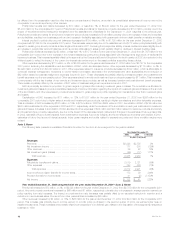

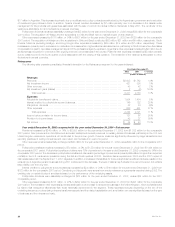

International

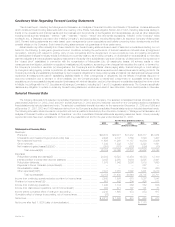

The following table presents consolidated financial information for the International segment for the years indicated:

Year Ended December 31,

2003 2002 % Change

(Dollars in millions)

Revenues

Premiums ************************************************************************ $1,678 $1,511 11 %

Universal life and investment-type product policy fees************************************ 272 144 89 %

Net investment income ************************************************************* 502 461 9 %

Other revenues ******************************************************************** 80 14 471 %

Net investment gains (losses) (net of amounts allocable from other accounts of $3 and $0,

respectively) ******************************************************************** 4 (9) 144 %

Total revenues***************************************************************** 2,536 2,121 20 %

Expenses

Policyholder benefits and claims (excludes amounts directly related to net investment gains

(losses) of $3 and $0, respectively) ************************************************* 1,454 1,388 5 %

Interest credited to policyholder account balances*************************************** 143 79 81 %

Policyholder dividends ************************************************************** 55 35 57 %

Other expenses ******************************************************************* 659 507 30 %

Total expenses **************************************************************** 2,311 2,009 15 %

Income from continuing operations before provision for income taxes *********************** 225 112 101 %

Provision for income taxes*********************************************************** 17 28 (39)%

Net income *********************************************************************** $ 208 $ 84 148 %

Year ended December 31, 2003 compared with the year ended December 31, 2002—International

International provides life insurance, accident and health insurance, annuities and savings and retirement products to both individuals and groups,

and auto and homeowners coverage to individuals. The Company focuses on emerging markets in the Latin America and Asia/Pacific regions.

Net income increased by $124 million, or 148%, to $208 million for the year ended December 31, 2003 from $84 million for the comparable 2002

period. The acquisition of Hidalgo accounted for $48 million of this increase. Also contributing to the increase in earnings during 2003 is a $62 million

after-tax benefit from the merger of the Mexican operations and a reduction in policyholder liabilities resulting from a change in reserve methodology, a

$12 million tax benefit in Chile and an $8 million after-tax benefit related to reinsurance treaties. These increases are partially offset by a $19 million after-

tax charge in Taiwan related to an increased loss recognition reserve due to low interest rates relative to product guarantees.

Total revenues, excluding net investment gains and losses, increased by $402 million, or 19%, to $2,532 million for the year ended December 31,

2003 from $2,130 million for the comparable 2002 period. This increase is primarily due to the acquisition of Hidalgo, which accounted for $469 million of

the variance, partially offset by decreases in Canada of $106 million attributable to a non-recurring sale of an annuity contract and $28 million relating to

the restructuring of a pension contract from an investment-type product to a long-term annuity, both of which occurred in 2002. In addition, South

Korea’s, Chile’s and Taiwan’s revenues increased by $102 million, $60 million and $36 million, respectively, primarily due to business growth. These

increases are partially offset by a $161 million decrease in Mexico, excluding Hidalgo. Anticipated actions taken by the Mexican government adversely

impacted the insurance and annuities market and resulted in a decline in premiums in Mexico’s group and individual life businesses. In addition, the

cancellation of a large broker-sponsored case at the end of 2002 and the weakening of the peso also contributed to the 2003 decline in Mexico.

Total expenses increased by $302 million, or 15%, to $2,311 million for the year ended December 31, 2003 from $2,009 million for the comparable

2002 period. The acquisition of Hidalgo contributed $394 million to this increase. Partially offsetting this is a decrease of $106 million for the

aforementioned non-recurring sale of an annuity contract and a decrease of $28 million for the restructuring of a pension contract, both of which

occurred in 2002. In addition, South Korea’s, Chile’s and Taiwan’s expenses increased by $95 million, $65 million and $64 million, respectively,

commensurate with the revenue increases in each country. Additionally, Taiwan’s expenses include a $30 million pre-tax charge due to an increased loss

recognition reserve as a result of low interest rates relative to product guarantees. These increases are partially offset by a $251 million decrease in

Mexico, other than Hidalgo, primarily as a result of the impact on expenses from the aforementioned revenue decline in Mexico and a reduction in

policyholder liabilities related to a change in reserve methodology.

MetLife, Inc. 11