MetLife 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

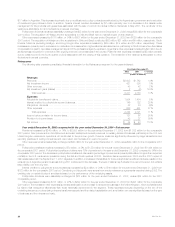

Policyholder benefits and claims decreased by $102 million, or 5%, to $2,019 million for the year ended December 31, 2002 from $2,121 million for

the comparable 2001 period. Property policyholder benefits and claims decreased by $120 million due to improved claim frequency, underwriting and

agency management actions, and a $41 million reduction in catastrophe losses. Property catastrophes represented 7.4% of the property loss ratio in

2002 compared to 13.5% in 2001. Other policyholder benefits and claims decreased by $10 million due to fewer personal umbrella claims. Fluctuations

in these policyholder benefits and claims may not be commensurate with the change in premiums for a given period due to low premium volume and high

liability limits. Auto policyholder benefits and claims increased by $28 million largely due to an increase in current year bodily injury and no-fault severities.

Costs associated with the processing of the New York assigned risk business also contributed to this increase. These increases were partially offset by

improved claim frequency resulting from milder winter weather, underwriting and agency management actions, as well as lower catastrophe losses.

Other expenses decreased by $7 million, or 1%, to $793 million for the year ended December 31, 2002 from $800 million for the comparable 2001

period. This decrease is primarily due to reduced employee head-count and reduced expenses associated with the consolidation of The St. Paul

business acquired in 1999. These declines are partially offset by an increase in expenses related to the outsourced New York assigned risk business.

The effective income tax rates for the year ended December 31, 2002 and 2001 differ from the federal corporate tax rate of 35% due to the impact

of non-taxable investment income.

International

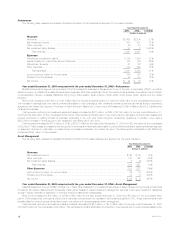

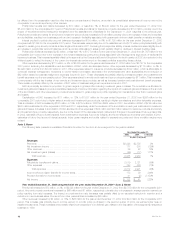

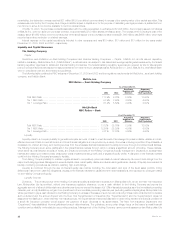

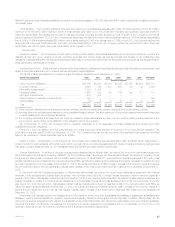

The following table presents consolidated financial information for the International segment for the years indicated:

Year Ended December 31,

2002 2001 % Change

(Dollars in millions)

Revenues

Premiums ************************************************************************ $1,511 $ 846 79%

Universal life and investment-type product policy fees************************************ 144 38 279%

Net investment income ************************************************************* 461 267 73%

Other revenues ******************************************************************** 14 16 (13)%

Net investment gains (losses) ******************************************************** (9) (16) (44)%

Total revenues***************************************************************** 2,121 1,151 84%

Expenses

Policyholder benefits and claims****************************************************** 1,388 689 101%

Interest credited to policyholder account balances*************************************** 79 51 55%

Policyholder dividends ************************************************************** 35 36 (3)%

Other expenses ******************************************************************* 507 329 54%

Total expenses **************************************************************** 2,009 1,105 82%

Income from continuing operations before provision for income taxes *********************** 112 46 143%

Provision for income taxes*********************************************************** 28 32 (13)%

Net income *********************************************************************** $ 84 $ 14 500%

Year ended December 31, 2002 compared with the year ended December 31, 2001—International

Premiums increased by $665 million, or 79%, to $1,511 million for the year ended December 31, 2002 from $846 million for the comparable 2001

period. The June 2002 acquisition of Hidalgo and the 2001 acquisitions in Chile and Brazil increased premiums by $228 million, $102 million and

$8 million, respectively. In addition, a portion of the increase in premiums is attributable to a $108 million increase due to the sale of an annuity contract in

the first quarter of 2002 to a Canadian trust company. South Korea’s premiums increased by $91 million primarily due to a larger professional sales force

and improved agent productivity. Mexico’s premiums (excluding Hidalgo), increased by $66 million, primarily due to increases in its group life, major

medical and individual life businesses. Excluding the aforementioned sale of an annuity contract, Canada’s premiums increased by $26 million due to the

restructuring of a pension contract from an investment-type product to a long-term annuity. Taiwan’s premiums increased by $13 million due primarily to

continued growth in the individual life insurance business. Hong Kong’s premiums increased $5 million primarily due to continued growth in the group life

and traditional life businesses. These increases are partially offset by a decrease in Argentina’s premiums of $9 million due to the reduction in business

caused by the Argentine economic environment. The remainder of the variance is attributable to minor fluctuations in other countries.

Universal life and investment type-product policy fees increased by $106 million, or 279%, to $144 million for the year ended December 31, 2002

from $38 million for the comparable 2001 period. The acquisition of Hidalgo and the acquisitions in Chile resulted in increases of $102 million and

$5 million, respectively. These increases were partially offset by a $9 million decrease in Spain due to a reduction in fees caused by a decline in assets

under management, as a result of the cessation of product lines offered through a joint venture with Banco Santander in 2001. The remainder of the

variance is attributable to minor fluctuations in several countries.

Other revenues decreased by $2 million, or 13%, to $14 million for the year ended December 31, 2002 from $16 million for the comparable 2001

period. Canada’s other revenues in 2001 included $1 million due primarily to the settlement of two legal cases in 2001. The remainder of the variance is

attributable to minor fluctuations in several countries. The acquisition of Hidalgo and the acquisitions in Chile and Brazil had no material impact on this

variance.

Policyholder benefits and claims increased by $699 million, or 101%, to $1,388 million for the year ended December 31, 2002 from $689 million for

the comparable 2001 period. The acquisition of Hidalgo and the acquisitions in Chile increased policyholder benefits and claims by $224 million and

$169 million, respectively. In addition, $108 million of this increase in policyholder benefits and claims is attributable to the aforementioned sale of an

annuity contract in Canada. South Korea’s, Mexico’s (excluding Hidalgo), Taiwan’s and Spain’s policyholder benefits and claims increased by $69 million,

$67 million, $18 million and $15 million, respectively, commensurate with the overall premium increases discussed above. Excluding the aforementioned

sale of an annuity contract, Canada’s policyholder benefits and claims increased by $32 million primarily due to the restructuring of a pension contract

from an investment-type product to a long-term annuity. The remainder of the variance is attributable to minor fluctuations in several countries.

Interest credited to policyholder account balances increased by $28 million, or 55%, to $79 million for the year ended December 31, 2002 from

$51 million for the comparable 2001 period. The acquisition of Hidalgo contributed $51 million. This increase was partially offset by a decrease of

MetLife, Inc. 19