MetLife 2003 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

risk of the property and casualty business and could contribute to significant fluctuations in the Company’s results of operations. The Company uses

excess of loss and quota share reinsurance arrangements to limit its maximum loss, provide greater diversification of risk and minimize exposure to larger

risks.

The Company has also protected itself through the purchase of combination risk coverage. This reinsurance coverage pools risks from several lines

of business and includes individual and group life claims in excess of $2 million per policy, as well as excess property and casualty losses, among others.

See Note 12 for information regarding certain excess of loss reinsurance agreements providing coverage for risks associated primarily with sales

practices claims.

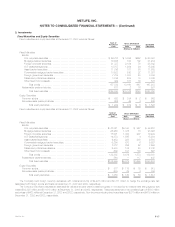

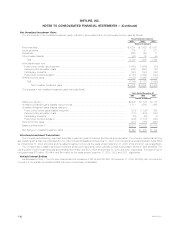

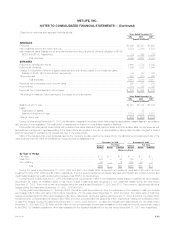

The amounts in the consolidated statements of income are presented net of reinsurance ceded. The effects of reinsurance were as follows:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Direct premiums ************************************************************************ $19,396 $18,439 $16,332

Reinsurance assumed ******************************************************************* 3,706 2,993 2,907

Reinsurance ceded ********************************************************************* (2,429) (2,355) (2,027)

Net premiums ************************************************************************** $20,673 $19,077 $17,212

Reinsurance recoveries netted against policyholder benefits ************************************ $ 2,417 $ 2,886 $ 2,255

Reinsurance recoverables, included in premiums and other receivables, were $4,014 million and $3,918 million at December 31, 2003 and 2002,

respectively, including $1,341 million and $1,348 million, respectively, relating to reinsurance of long-term guaranteed interest contracts and structured

settlement lump sum contracts accounted for as a financing transaction. Reinsurance and ceded commissions payables, included in other liabilities,

were $106 million and $79 million at December 31, 2003 and 2002, respectively.

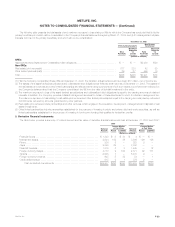

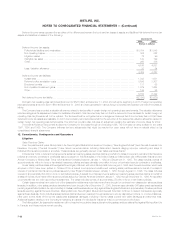

The following table provides an analysis of the activity in the liability for benefits relating to property and casualty, group accident and non-medical

health policies and contracts:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Balance at January 1 ************************************************************* $ 4,885 $ 4,597 $ 4,226

Reinsurance recoverables ******************************************************* (498) (457) (410)

Net balance at January 1 ********************************************************* 4,387 4,140 3,816

Incurred related to:

Current year ****************************************************************** 4,483 4,219 4,182

Prior years ******************************************************************** 45 (81) (84)

4,528 4,138 4,098

Paid related to:

Current year ****************************************************************** (2,676) (2,559) (2,538)

Prior years ******************************************************************** (1,352) (1,332) (1,236)

(4,028) (3,891) (3,774)

Net Balance at December 31 ****************************************************** 4,887 4,387 4,140

Add: Reinsurance recoverables ************************************************** 525 498 457

Balance at December 31********************************************************** $ 5,412 $ 4,885 $ 4,597

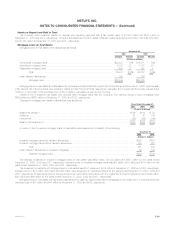

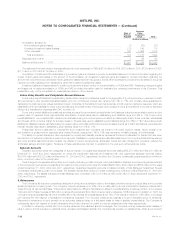

6. Closed Block

On the date of demutualization, Metropolitan Life established a closed block for the benefit of holders of certain individual life insurance policies of

Metropolitan Life. Assets have been allocated to the closed block in an amount that has been determined to produce cash flows which, together with

anticipated revenues from the policies included in the closed block, are reasonably expected to be sufficient to support obligations and liabilities relating

to these policies, including, but not limited to, provisions for the payment of claims and certain expenses and taxes, and to provide for the continuation of

policyholder dividend scales in effect for 1999, if the experience underlying such dividend scales continues, and for appropriate adjustments in such

scales if the experience changes. At least annually, the Company compares actual and projected experience against the experience assumed in the

then-current dividend scales. Dividend scales are adjusted periodically to give effect to changes in experience.

The closed block assets, the cash flows generated by the closed block assets and the anticipated revenues from the policies in the closed block will

benefit only the holders of the policies in the closed block. To the extent that, over time, cash flows from the assets allocated to the closed block and

claims and other experience related to the closed block are, in the aggregate, more or less favorable than what was assumed when the closed block was

established, total dividends paid to closed block policyholders in the future may be greater than or less than the total dividends that would have been paid

to these policyholders if the policyholder dividend scales in effect for 1999 had been continued. Any cash flows in excess of amounts assumed will be

available for distribution over time to closed block policyholders and will not be available to stockholders. If the closed block has insufficient funds to make

guaranteed policy benefit payments, such payments will be made from assets outside of the closed block. The closed block will continue in effect as

long as any policy in the closed block remains in-force. The expected life of the closed block is over 100 years.

The Company uses the same accounting principles to account for the participating policies included in the closed block as it used prior to the date

of demutualization. However, the Company establishes a policyholder dividend obligation for earnings that will be paid to policyholders as additional

dividends as described below. The excess of closed block liabilities over closed block assets at the effective date of the demutualization (adjusted to

MetLife, Inc. F-27