MetLife 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

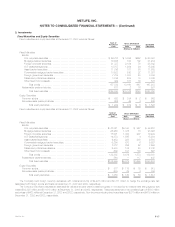

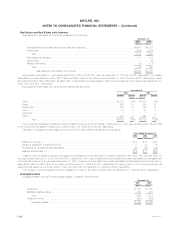

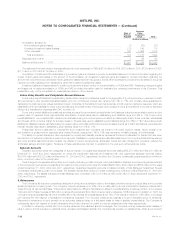

Net Unrealized Investment Gains

The components of net unrealized investment gains, included in accumulated other comprehensive income, were as follows:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Fixed maturities***************************************************************************** $ 9,204 $ 7,360 $ 3,097

Equity securities **************************************************************************** 376 57 617

Derivatives ********************************************************************************* (427) (24) 71

Other invested assets *********************************************************************** (33) 16 59

Total ********************************************************************************** 9,120 7,409 3,844

Amounts allocated from:

Future policy benefit loss recognition ********************************************************* (1,482) (1,269) (30)

Deferred policy acquisition costs ************************************************************ (674) (559) (21)

Participating contracts ********************************************************************* (183) (153) (127)

Policyholder dividend obligation ************************************************************* (2,130) (1,882) (708)

Deferred income taxes*********************************************************************** (1,679) (1,264) (1,079)

Total ********************************************************************************** (6,148) (5,127) (1,965)

Net unrealized investment gains ******************************************************* $ 2,972 $ 2,282 $ 1,879

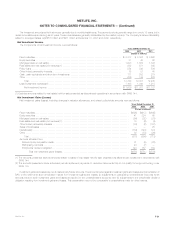

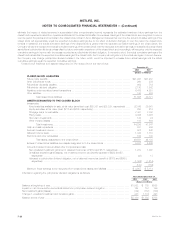

The changes in net unrealized investment gains were as follows:

Years Ended December 31,

2003 2002 2001

(Dollars in millions)

Balance at January 1 ************************************************************************* $2,282 $ 1,879 $1,175

Unrealized investment gains (losses) during the year *********************************************** 1,711 3,565 1,365

Unrealized investment gains (losses) relating to:

Future policy benefit gains (losses) recognition ************************************************** (213) (1,239) 254

Deferred policy acquisition costs ************************************************************* (115) (538) (140)

Participating contracts ********************************************************************** (30) (26) 6

Policyholder dividend obligation ************************************************************** (248) (1,174) (323)

Deferred income taxes************************************************************************ (415) (185) (458)

Balance at December 31 ********************************************************************* $2,972 $ 2,282 $1,879

Net change in unrealized investment gains ******************************************************* $ 690 $ 403 $ 704

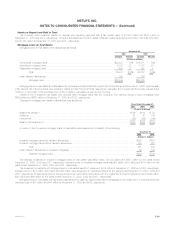

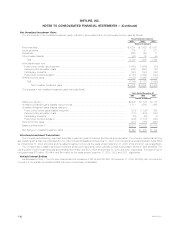

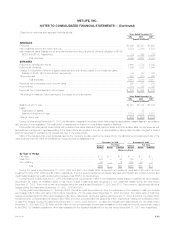

Structured Investment Transactions

The Company securitizes high yield debt securities, investment grade bonds and structured finance securities. The Company has sponsored four

securitizations with a total of approximately $1,431 million in financial assets as of December 31, 2003. The Company’s beneficial interests in these SPEs

as of December 31, 2003 and 2002 and the related investment income for the years ended December 31, 2003, 2002 and 2001 were insignificant.

The Company also invests in structured notes and similar type instruments, which generally provide equity-based returns on debt securities. The

carrying value of such investments was approximately $880 million and $870 million at December 31, 2003 and 2002, respectively. The related income

recognized was $78 million, $1 million and $44 million for the years ended December 31, 2003, 2002 and 2001, respectively.

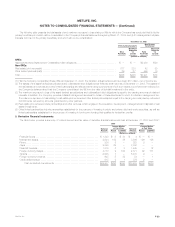

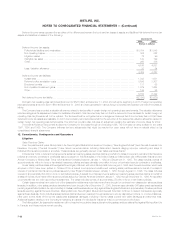

Variable Interest Entities

As discussed in Note 1, the Company has adopted the provisions of FIN 46 and FIN 46(r). At December 31, 2003, FIN 46(r) did not require the

Company to consolidate any additional VIEs that were not previously consolidated.

MetLife, Inc.

F-22