MetLife 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

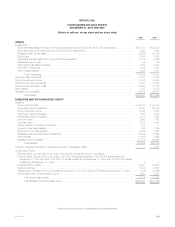

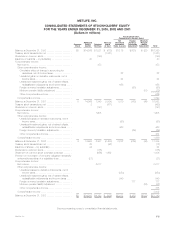

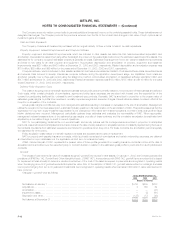

METLIFE, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

(Dollars in millions)

Accumulated Other

Comprehensive Income (Loss)

Net Foreign Minimum

Additional Treasury Unrealized Currency Pension

Common Paid-in Retained Stock Investment Translation Liability

Stock Capital Earnings at Cost Gains (Losses) Adjustment Adjustment Total

Balance at December 31, 2000 ********************** $8 $14,926 $1,021 $ (613) $1,175 $(100) $ (28) $16,389

Treasury stock transactions, net ********************** (1,321) (1,321)

Dividends on common stock************************* (145) (145)

Issuance of warrants — by subsidiary ***************** 40 40

Comprehensive income:

Net income ************************************* 473 473

Other comprehensive income:

Cumulative effect of change in accounting for

derivatives, net of income taxes **************** 22 22

Unrealized gains on derivative instruments, net of

income taxes******************************** 24 24

Unrealized investment gains, net of related offsets,

reclassification adjustments and income taxes **** 658 658

Foreign currency translation adjustments *********** (60) (60)

Minimum pension liability adjustment ************** (18) (18)

Other comprehensive income ******************** 626

Comprehensive income *************************** 1,099

Balance at December 31, 2001 ********************** 8 14,966 1,349 (1,934) 1,879 (160) (46) 16,062

Treasury stock transactions, net ********************** 2 (471) (469)

Dividends on common stock************************* (147) (147)

Comprehensive income:

Net income ************************************* 1,605 1,605

Other comprehensive income:

Unrealized losses on derivative instruments, net of

income taxes******************************** (60) (60)

Unrealized investment gains, net of related offsets,

reclassification adjustments and income taxes **** 463 463

Foreign currency translation adjustments *********** (69) (69)

Other comprehensive income ******************** 334

Comprehensive income *************************** 1,939

Balance at December 31, 2002 ********************** 8 14,968 2,807 (2,405) 2,282 (229) (46) 17,385

Treasury stock transactions, net ********************** 20 (92) (72)

Issuance of shares — by subsidiary ******************* 24 24

Dividends on common stock************************* (175) (175)

Settlement of common stock purchase contracts ******* (656) 1,662 1,006

Premium on conversion of company-obligated mandatorily

redeemable securities of a subsidiary trust *********** (21) (21)

Comprehensive income:

Net income ************************************* 2,217 2,217

Other comprehensive income:

Unrealized losses on derivative instruments, net of

income taxes******************************** (250) (250)

Unrealized investment gains, net of related offsets,

reclassification adjustments and income taxes **** 940 940

Foreign currency translation adjustments *********** 177 177

Minimum pension liability adjustment ************** (82) (82)

Other comprehensive income ******************** 785

Comprehensive income *************************** 3,002

Balance at December 31, 2003 ********************** $8 $14,991 $4,193 $ (835) $2,972 $ (52) $(128) $21,149

See accompanying notes to consolidated financial statements.

MetLife, Inc. F-5