MetLife 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

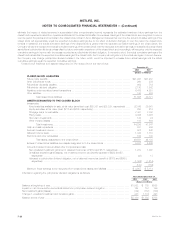

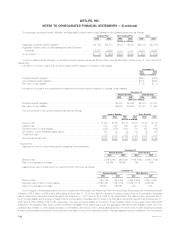

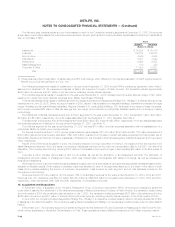

The aggregate projected benefit obligation and aggregate contract value of plan assets for the pension plans were as follows:

Qualified Plan Non-Qualified Plan Total

2003 2002 2003 2002 2003 2002

(Dollars in millions)

Aggregate projected benefit obligation *************************** $(4,735) $(4,311) $(537) $(474) $(5,272) $(4,785)

Aggregate contract value of plan assets (principally Company

contracts) ************************************************* 4,731 4,053 — — 4,731 4,053

Under funded************************************************ $ (4) $ (258) $(537) $(474) $ (541) $ (732)

The accumulated benefit obligation for all defined benefit pension plans was $4,902 million and $4,259 million at December 31, 2003 and 2002,

respectively.

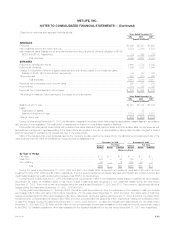

Information for pension plans with an accumulated benefit obligation in excess of plan assets:

December 31,

2003 2002

(Dollars in millions)

Projected benefit obligation ***************************************************************************** $560 $489

Accumulated benefit obligation ************************************************************************** $472 $359

Fair value of plan assets ******************************************************************************* $16 $ 9

Information for pension and postretirement plans with a projected benefit obligation in excess of plan assets:

December 31,

Pension Benefits Other Benefits

2003 2002 2003 2002

(Dollars in millions)

Projected benefit obligation ******************************************************** $5,232 $4,746 $2,078 $1,878

Fair value of plan assets*********************************************************** $4,675 $3,995 $1,001 $ 965

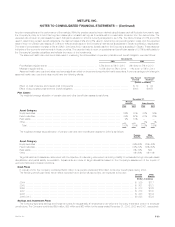

The components of net periodic benefit cost were as follows:

Pension Benefits Other Benefits

2003 2002 2001 2003 2002 2001

(Dollars in millions)

Service cost ******************************************************** $ 123 $ 105 $ 104 $ 38 $ 36 $ 34

Interest cost********************************************************* 314 308 308 122 123 115

Expected return on plan assets **************************************** (335) (356) (402) (71) (93) (108)

Amortization of prior actuarial losses (gains)******************************* 103 33 (2) (12) (9) (27)

Curtailment cost ***************************************************** 10 11 21 3 4 6

Net periodic benefit cost ********************************************** $ 215 $ 101 $ 29 $ 80 $ 61 $ 20

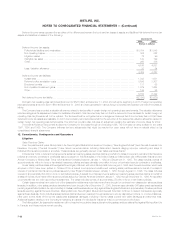

Assumptions

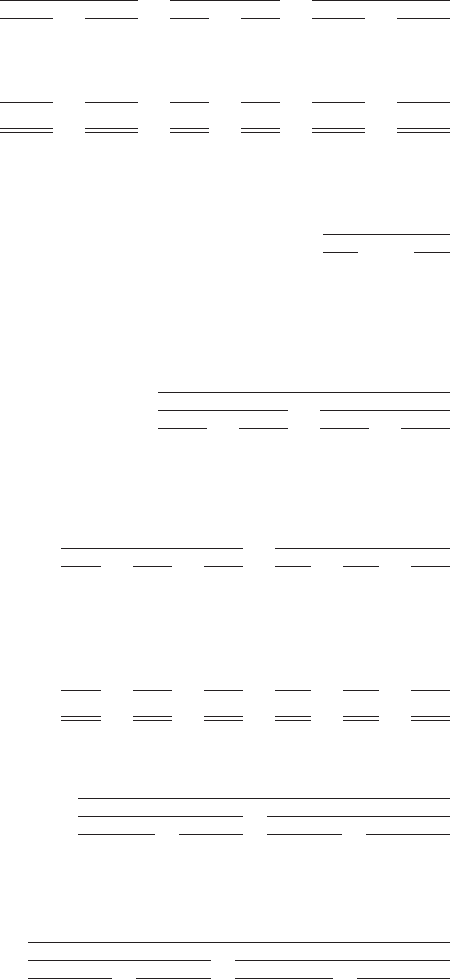

Assumptions used in determining benefit obligations were as follows:

December 31,

Pension Benefits Other Benefits

2003 2002 2003 2002

Discount rate ********************************************************** 3.5%-9.5% 4%-9.5% 6.1%-6.5% 6.5%-7.25%

Rate of compensation increase******************************************* 3%-8% 2%-8% N/A N/A

Assumptions used in determining net periodic benefit cost were as follows:

December 31,

Pension Benefits Other Benefits

2003 2002 2003 2002

Discount rate**************************************************** 4%-9.5% 4%-9.5% 6.5%-6.75% 6.5%-7.40%

Expected rate of return on plan assets ****************************** 3.5%-10% 4%-10 % 3.79%-8.5 % 5.2%-9%

Rate of compensation increase ************************************ 3%-8% 2%-8% N/A N/A

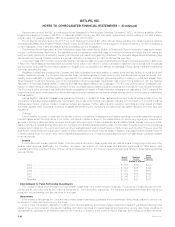

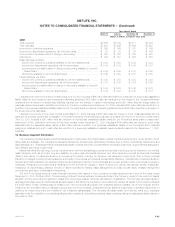

For the largest of the plans sponsored by the Company (the Metropolitan Life Retirement Plan for United States Employees, with a projected benefit

obligation of $5.2 billion or 98% of all qualified plans at December 31, 2003), the discount rate and the range of rates of future compensation increases

used in determining that plan’s benefit obligation at December 31, 2003 were 6.1% and 4% to 8%, respectively. The discount rate, expected rate of

return on plan assets, and the range of rates of future compensation increases used in determining that plan’s net periodic benefit cost at December 31,

2003 were 6.75%, 8.5% and 4% to 8%, respectively. The discount rate is based on the yield of a hypothetical portfolio of high-quality debt instruments

available on the valuation date, which would provide the necessary future cash flows to pay the aggregate projected benefit obligation when due. The

expected rate of return on plan assets is based on anticipated performance of the various asset sectors in which the plan invests, weighted by target

allocation percentages. Anticipated future performance is based on long-term historical returns of the plan assets by sector, adjusted for the Company’s

MetLife, Inc.

F-38