MetLife 2003 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

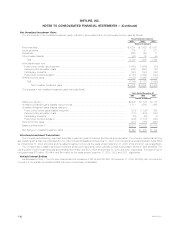

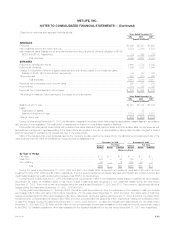

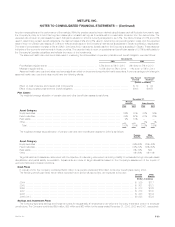

Approximately $5 million of net losses reported in accumulated other comprehensive income at December 31, 2003 are expected to be reclassified

during the year ending December 31, 2004 into net investment losses as the derivatives and underlying investments mature or expire according to their

original terms.

For the years ended December 31, 2003, 2002 and 2001, scheduled periodic settlement payments on derivative instruments recognized as net

investment gains and losses were immaterial. Net investment losses from changes in fair value of $18 million and $11 million and gains of $5 million

related to derivatives not qualifying as accounting hedges were recognized for the years ended December 31, 2003, 2002 and 2001, respectively.

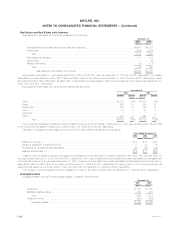

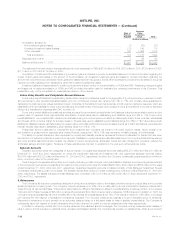

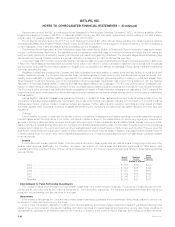

7. Debt

Debt consisted of the following:

December 31,

2003 2002

(Dollars in millions)

Senior notes, interest rates ranging from 3.91% to 7.25%, maturity dates ranging from 2005 to 2033 ****** $4,256 $2,539

Surplus notes, interest rates ranging from 7.00% to 7.88%, maturity dates ranging from 2005 to 2025 ***** 940 1,632

Fixed rate notes, interest rates ranging from 1.69% to 12.00%, maturity dates ranging from 2005 to 2009 ** 110 83

Capital lease obligations *********************************************************************** 74 21

Other notes with varying interest rates *********************************************************** 323 150

Total long-term debt ************************************************************************** 5,703 4,425

Total short-term debt ************************************************************************** 3,642 1,161

Total ******************************************************************************* $9,345 $5,586

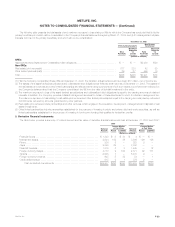

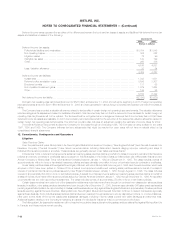

The Company maintains committed and unsecured credit facilities aggregating $2,478 million ($1,000 million expiring in 2004, $1,303 million

expiring in 2005 and $175 million expiring in 2006). If these facilities were drawn upon, they would bear interest at rates stated in the agreements. The

facilities are primarily used for general corporate purposes and as back-up lines of credit for the borrowers’ commercial paper program. At December 31,

2003, the Company had drawn approximately $49 million under the facilities expiring in 2005 at interest rates ranging from 4.08% to 5.48% and

approximately another $50 million under the facility expiring in 2006 at an interest rate of 1.69%. In April 2003, the Company replaced an expiring

$1 billion five-year credit facility with a $1 billion 364-day credit facility and the Holding Company was added as a borrower. In May 2003, the Company

replaced an expiring $140 million three-year credit facility, with a $175 million three-year credit facility which expires in 2006. At December 31, 2003, the

Company had approximately $828 million in letters of credit from various banks.

Payments of interest and principal on the surplus notes, subordinated to all other indebtedness, may be made only with the prior approval of the

insurance department of the state of domicile. On November 1, 2003, the Company redeemed the $300 million of 7.45% surplus notes outstanding

scheduled to mature on November 1, 2023 at a redemption price of $311 million.

The aggregate maturities of long-term debt for the Company are $134 million in 2004, $1,436 million in 2005, $662 million in 2006, $39 million in

2007, $44 million in 2008 and $3,388 million thereafter.

Short-term debt of the Company consisted of commercial paper with a weighted average interest rate of 1.1% and a weighted average maturity of

31 days at December 31, 2003. Short-term debt of the Company consisted of commercial paper with a weighted average interest rate of 1.5% and a

weighted average maturity of 74 days at December 31, 2002. The Company also has other collateralized borrowings with a weighted average coupon

rate of 5.07% and a weighted average maturity of 30 days at December 31, 2003. Such securities had a weighted average coupon rate of 5.83% and a

weighted average maturity of 34 days at December 31, 2002.

Interest expense related to the Company’s indebtedness included in other expenses was $420 million, $288 million and $252 million for the years

ended December 31, 2003, 2002 and 2001, respectively.

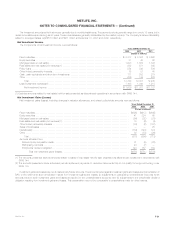

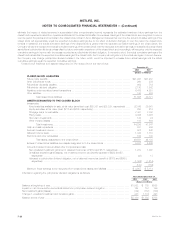

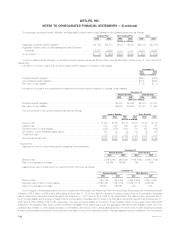

8. Shares Subject to Mandatory Redemption and Company-Obligated Mandatorily Redeemable Securities of Subsidiary Trusts

MetLife Capital Trust I. In connection with MetLife, Inc.’s, initial public offering in April 2000, the Holding Company and MetLife Capital Trust I

(the ‘‘Trust’’) issued equity security units (the ‘‘units’’). Each unit originally consisted of (i) a contract to purchase, for $50, shares of the Holding Company’s

common stock (the ‘‘purchase contracts’’) on May 15, 2003; and (ii) a capital security of the Trust, with a stated liquidation amount of $50.

In accordance with the terms of the units, the Trust was dissolved on February 5, 2003, and $1,006 million aggregate principal amount of

8.00% debentures of the Holding Company (the ‘‘MetLife debentures’’), the sole assets of the Trust, were distributed to the owners of the Trust’s capital

securities in exchange for their capital securities. The MetLife debentures were remarketed on behalf of the debenture owners on February 12, 2003 and

the interest rate on the MetLife debentures was reset as of February 15, 2003 to 3.911% per annum for a yield to maturity of 2.876%. As a result of the

remarketing, the debenture owners received $21 million ($0.03 per diluted common share) in excess of the carrying value of the capital securities. This

excess was recorded by the Company as a charge to additional paid-in capital and, for the purpose of calculating earnings per share, is subtracted from

net income to arrive at net income available to common shareholders.

On May 15, 2003, the purchase contracts associated with the units were settled. In exchange for $1,006 million, the Company issued 2.97 shares

of MetLife, Inc. common stock per purchase contract, or approximately 59.8 million shares of treasury stock. The excess of the Company’s cost of the

treasury stock ($1,662 million) over the contract price of the stock issued to the purchase contract holders ($1,006 million) was $656 million, which was

recorded as a direct reduction to retained earnings.

Interest expense on the capital securities is included in other expenses and was $10 million, $81 million and $81 million for the years ended

December 31, 2003, 2002 and 2001, respectively.

GenAmerica Capital I. In June 1997, GenAmerica Corporation (‘‘GenAmerica’’) issued $125 million of 8.525% capital securities through a wholly-

owned subsidiary trust, GenAmerica Capital I. GenAmerica has fully and unconditionally guaranteed, on a subordinated basis, the obligation of the trust

under the capital securities and is obligated to mandatorily redeem the securities on June 30, 2027. GenAmerica may prepay the securities any time after

June 30, 2007. Capital securities outstanding were $119 million, net of unamortized discounts of $6 million, at both December 31, 2003 and 2002.

MetLife, Inc.

F-30