MetLife 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Effective January 1, 2003, the Company elected to apply the fair value method of accounting for stock options granted by the Company

subsequent to December 31, 2002. As permitted under SFAS 148, options granted prior to January 1, 2003 will continue to be accounted for under

APB 25. Had compensation expense for grants awarded prior to January 1, 2003 been determined based on fair value at the date of grant in

accordance with SFAS 123, Accounting for Stock-Based Compensation (‘‘SFAS 123’’), the Company’s earnings and earnings per share amounts would

have been reduced to the following pro-forma amounts:

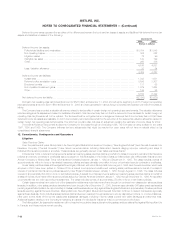

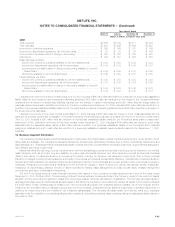

Years Ended December 31,

2003 2002 2001

(Dollars in millions,

except per share data)

Net Income******************************************************************************* $2,217 $1,605 $ 473

Charge for conversion of company-obligated mandatorily redeemable securities of a subsidiary trust(1) ** (21) — —

Net income available to common shareholders ************************************************* $2,196 $1,605 $ 473

Add: Stock-based employee compensation expense included in reported net income, net of related tax

effects********************************************************************************* $13 $ 1 $1

Deduct: Total Stock-based employee compensation determined under fair value based method for all

awards, net of related tax effects ********************************************************** (42) (33) (20)

Pro forma net income available to common shareholders(2)(3) ************************************ $2,167 $1,573 $ 454

Basic earnings per share

As reported ****************************************************************************** $ 2.98 $ 2.28 $0.64

Pro forma(2)(3) **************************************************************************** $ 2.94 $ 2.23 $0.61

Diluted earnings per share

As reported ****************************************************************************** $ 2.94 $ 2.20 $0.62

Pro forma(2)(3) **************************************************************************** $ 2.90 $ 2.15 $0.59

(1) See Note 8 for a discussion of this charge included in the calculation of net income available to common shareholders.

(2) The pro forma earnings disclosures are not necessarily representative of the effects on net income and earnings per share in future years.

(3) Includes the Company’s ownership share of stock compensation costs related to the Reinsurance Group of America, Incorporated incentive stock

plan and the stock compensation costs related to the incentive stock plans at SSRM Holdings, Inc. determined in accordance with SFAS 123.

For the years ended December 31, 2003, 2002 and 2001, stock-based compensation expense related to the Company’s Stock Incentive Plan and

Directors Stock Plan was $20 million, $2.1 million and $1.3 million, respectively, including stock-based compensation for non-employees of $550 thou-

sand, $2.1 million and $1.3 million, respectively.

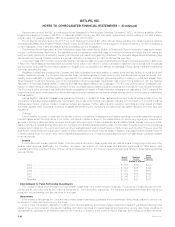

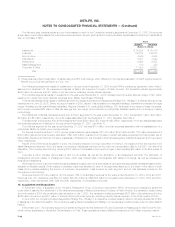

Statutory Equity and Income

Applicable insurance department regulations require that the insurance subsidiaries prepare statutory financial statements in accordance with

statutory accounting practices prescribed or permitted by the insurance department of the state of domicile. Statutory accounting practices primarily differ

from GAAP by charging policy acquisition costs to expense as incurred, establishing future policy benefit liabilities using different actuarial assumptions,

reporting surplus notes as surplus instead of debt and valuing securities on a different basis.

As of December 31, 2001, New York Statutory Accounting Practices did not provide for deferred income taxes. The Department has adopted a

modification to its regulations, effective December 31, 2002, with respect to the admissibility of deferred taxes by New York insurers, subject to certain

limitations.

Statutory net income of Metropolitan Life, as filed with the Department, was $2,169 million, $1,455 million and $2,782 million for the years ended

December 31, 2003, 2002 and 2001, respectively; statutory capital and surplus, as filed, was $7,978 million and $6,986 million at December 31, 2003

and 2002, respectively.

Statutory net income of MIAC, which is domiciled in Delaware, as filed with the Insurance Department of Delaware, was $341 million, $34 million and

$26 million for the years ended December 31, 2003, 2002 and 2001, respectively; statutory capital and surplus, as filed, was $1,051 million and

$1,037 million at December 31, 2003 and 2002, respectively.

Statutory net income of Metropolitan Property and Casualty, which is domiciled in Rhode Island, as filed with the Insurance Department of Rhode

Island, was $214 million, $173 million and $61 million for the years ended December 31, 2003, 2002 and 2001, respectively; statutory capital and

surplus, as filed, was $1,996 million and $1,964 million at December 31, 2003 and 2002, respectively.

The National Association of Insurance Commissioners (‘‘NAIC’’) adopted the Codification of Statutory Accounting Principles (the ‘‘Codification’’),

which is intended to standardize regulatory accounting and reporting to state insurance departments, and became effective January 1, 2001. However,

statutory accounting principles continue to be established by individual state laws and permitted practices. The Department required adoption of the

Codification, with certain modifications, for the preparation of statutory financial statements effective January 1, 2001. Further modifications by state

insurance departments may impact the effect of the Codification on the statutory capital and surplus of Metropolitan Life and the Holding Company’s

other insurance subsidiaries.

MetLife, Inc.

F-42