MetLife 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

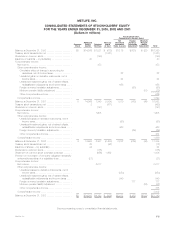

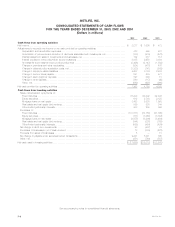

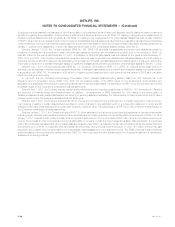

METLIFE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

(Dollars in millions)

2003 2002 2001

Cash flows from operating activities

Net income************************************************************************************ $ 2,217 $ 1,605 $ 473

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization expenses******************************************************** 478 498 481

Amortization of premiums and accretion of discounts associated with investments, net***************** (180) (519) (575)

(Gains) losses from sales of investments and businesses, net ************************************* 152 317 713

Interest credited to other policyholder account balances ****************************************** 3,035 2,950 3,084

Universal life and investment-type product policy fees ******************************************** (2,496) (2,147) (1,889)

Change in premiums and other receivables ***************************************************** (334) (473) 476

Change in deferred policy acquisition costs, net ************************************************* (1,332) (741) (563)

Change in insurance-related liabilities ********************************************************** 4,687 3,104 2,508

Change in income taxes payable ************************************************************* 241 479 477

Change in bank customer deposits *********************************************************** 897 209 81

Change in other liabilities ******************************************************************** 560 (117) (40)

Other, net ********************************************************************************* (562) (997) (968)

Net cash provided by operating activities *********************************************************** 7,363 4,168 4,258

Cash flows from investing activities

Sales, maturities and repayments of:

Fixed maturities **************************************************************************** 76,200 64,602 52,426

Equity securities**************************************************************************** 612 2,703 2,125

Mortgage loans on real estate **************************************************************** 3,483 2,638 1,993

Real estate and real estate joint ventures ******************************************************* 889 835 344

Other limited partnership interests ************************************************************* 308 209 396

Purchases of:

Fixed maturities **************************************************************************** (101,577) (85,155) (51,865)

Equity securities**************************************************************************** (187) (1,260) (3,354)

Mortgage loans on real estate **************************************************************** (4,975) (3,206) (3,494)

Real estate and real estate joint ventures ******************************************************* (344) (208) (769)

Other limited partnership interests ************************************************************* (588) (456) (424)

Net change in short-term investments *********************************************************** 98 (477) 74

Purchases of businesses, net of cash received *************************************************** 18 (879) (276)

Proceeds from sales of businesses ************************************************************* 5—81

Net change in payable under securities loaned transactions ***************************************** 9,221 5,201 360

Other, net *********************************************************************************** (851) (760) (587)

Net cash used in investing activities *************************************************************** $ (17,688) $(16,213) $ (2,970)

See accompanying notes to consolidated financial statements.

MetLife, Inc.

F-6