MetLife 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc. Annual Report 2003

Table of contents

-

Page 1

MetLife, Inc. Annual Report 2003 -

Page 2

... distribution channels. At MetLife Auto & Home, the 13th largest provider of personal lines property and casualty insurance in the U.S. by written premium, record net income of $157 million was achieved in 2003 and Auto & Home's combined ratio was 99.7% at year end. MetLife International... -

Page 3

..., in 2003, stock ownership guidelines were instituted for every officer. Everyone from the vice president level to the CEO will be required to achieve certain equity ownership requirements over the next few years. H A Solid Position for Continued Growth MetLife has a long, proud history and we... -

Page 4

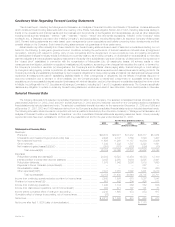

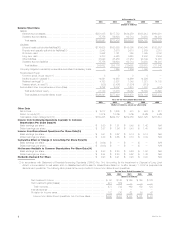

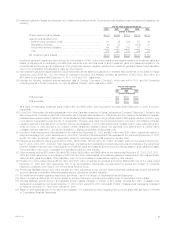

... investment-type product policy fees 2,496 Net investment income(1 11,636 Other revenues 1,342 Net investment gains (losses)(1)(2)(3)(7 358) Total revenues(4)(6 Expenses: Policyholder beneï¬ts and claims(2)(7 Interest credited to policyholder account balances Policyholder dividends Payments... -

Page 5

... health policyholder liabilities(10 Property and casualty policyholder liabilities(10 Short-term debt Long-term debt Other liabilities Separate account liabilities Total liabilities Company-obligated mandatorily redeemable securities of subsidiary trusts ** Stockholders' Equity: Common stock... -

Page 6

..., 2000 and 1999, respectively. Prior to its demutualization, Metropolitan Life was subject to surplus tax imposed on mutual life insurance companies under Section 809 of the Internal Revenue Code. Policyholder liabilities include future policy beneï¬ts and other policyholder funds. Life and health... -

Page 7

...its sale of Conning Corporation (''Conning''), an afï¬liate acquired in the acquisition of GenAmerica Financial Corporation (''GenAmerica'') in 2000. Conning specialized in asset management for insurance company investment portfolios and investment research. Summary of Critical Accounting Estimates... -

Page 8

...by minor short-term market ï¬,uctuations, but that it does change when large interim deviations have occurred. Future Policy Beneï¬ts The Company establishes liabilities for amounts payable under insurance policies, including traditional life insurance, annuities and disability insurance. Generally... -

Page 9

... and institutional customers. The Company offers life insurance, annuities, automobile and homeowners insurance and mutual funds to individuals, as well as group insurance, reinsurance, and retirement and savings products and services to corporations and other institutions. The MetLife companies... -

Page 10

... than credit-related losses. Premiums, fees and other revenues increased 9% over the prior year primarily as a result of growth in the annuities, retirement and savings and variable and universal life product lines. This increase stems in part from policy fee income earned on annuity deposits, which... -

Page 11

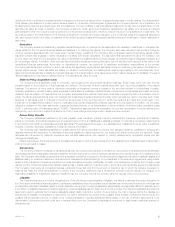

... in accounting principle. Institutional The following table presents consolidated ï¬nancial information for the Institutional segment for the years indicated: Year Ended December 31, 2003 2002 % Change (Dollars in millions) Revenues Premiums Universal life and investment-type product policy fees... -

Page 12

..., such as traditional, universal and variable life insurance and variable and ï¬xed annuities. In addition, Individual sales representatives distribute disability insurance and long-term care insurance products offered through the Institutional segment, investment products, such as mutual funds, as... -

Page 13

... expenses at New England Financial. Although revenues are essentially ï¬,at year over year, policy fees from variable life and annuity and investment-type products grew 15% year over year. In addition, there is a slight increase in premiums related to other traditional life products. These increases... -

Page 14

... with the year ended December 31, 2002-International International provides life insurance, accident and health insurance, annuities and savings and retirement products to both individuals and groups, and auto and homeowners coverage to individuals. The Company focuses on emerging markets in the... -

Page 15

... (''State Street Research''), provides a broad variety of asset management products and services to MetLife, third-party institutions and individuals. State Street Research offers investment management services in all major investment disciplines through multiple channels of distribution in both the... -

Page 16

... due to sales growth in its group life, dental, disability and long-term care businesses, a sale of a signiï¬cant retirement and savings contract in the second quarter of 2002, as well as new sales throughout 2002 in this segment's structured settlements and traditional annuity products. The June... -

Page 17

... in response to poor equity market performance. These increases are partially offset by lower policy fees from annuity and investment-type products generally resulting from poor equity market performance despite growth in annuity deposits. A $106 million increase in International is largely due to... -

Page 18

... the Company's asbestos-related liability, expenses to cover costs associated with the resolution of federal government investigations of General American's former Medicare business and a reduction of a previously established liability related to the Company's sales practices class action settlement... -

Page 19

... life, dental, disability and long-term care businesses. Retirement and savings premiums increased by $461 million primarily due to the sale of a signiï¬cant contract in the second quarter of 2002, as well as new sales throughout 2002 from structured settlements and traditional annuity products... -

Page 20

... agreement to increase the amount of insurance ceded from 50% to 100%. This amendment was effective January 1, 2002. The Company also believes the decline is the result of a continued shift in policyholders' preference from traditional policies to annuity and investment-type products. These... -

Page 21

... of traditional life insurance business. This increase is partially offset by the approval by the Company's Board of Directors in the fourth quarter of 2002 of a reduction in the dividend scale to reï¬,ect the impact of the current low interest rate environment on the asset portfolios supporting... -

Page 22

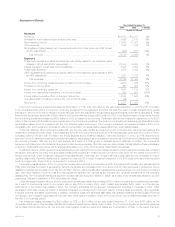

...) Revenues Premiums Universal life and investment-type product policy fees Net investment income Other revenues Net investment gains (losses Total revenues Expenses Policyholder beneï¬ts and claims Interest credited to policyholder account balances Policyholder dividends Other expenses... -

Page 23

... management for life products with guarantees associated with the sale of a block of policies to Banco Santander in May 2001. The remainder of the variance is attributable to minor ï¬,uctuations in several countries. Policyholder dividends remained essentially unchanged at $35 million for the year... -

Page 24

... the Company's asbestos-related liability, expenses to cover costs associated with the resolution of federal government investigations of General American's former Medicare business and a reduction of a previously established liability related to the Company's sales practices class action settlement... -

Page 25

... whether the ï¬nancial condition of a stock life insurance company would support the payment of such dividends to its stockholders. The New York Insurance Department (the ''Department'') has established informal guidelines for such determinations. The guidelines, among other things, focus... -

Page 26

..., 2003, neither the Holding Company, Metropolitan Life nor MetLife Funding had drawn against these credit facilities. Liquidity Uses The primary uses of liquidity of the Holding Company include cash dividends on common stock, service on debt, capital contributions to subsidiaries, payment of general... -

Page 27

... provisions limiting withdrawal rights on many of its products, including general account institutional pension products (generally group annuities, including guaranteed interest contracts and certain deposit fund liabilities) sold to employee beneï¬t plan sponsors. The Company's principal cash in... -

Page 28

... not to make future payments required by the terms of a non-recourse loan obligation. The book value of this loan was $15 million at December 31, 2003. The Company's exposure under the terms of the applicable loan agreement is limited solely to its investment in certain securities held by an af... -

Page 29

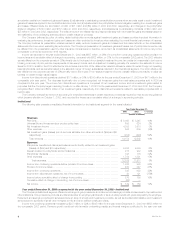

... life, dental, disability and long-term care businesses, as well as higher sales in retirement and savings' structured settlement products. The acquisition of John Hancock's group business also contributed to sales growth in the 2003 period. In addition, growth in MetLife Bank's customer deposits... -

Page 30

... the Company to change previously reported information. In July 2003, the Accounting Standards Executive Committee of the American Institute of Certiï¬ed Public Accountants issued Statement of Position 03-1, Accounting and Reporting by Insurance Enterprises for Certain Nontraditional Long-Duration... -

Page 31

... of credited interest and dividend rates for policies that permit such adjustments. The following table summarizes the Company's cash and invested assets at: December 31, 2003 Carrying Value 2002 % of Carrying Total Value (Dollars in millions) % of Total Fixed maturities available-for-sale, at... -

Page 32

... and $11,380 million for the years ended December 31, 2003, 2002 and 2001, respectively. The annualized yields on general account cash and invested assets, including net investment income from discontinued operations and scheduled periodic settlement payments on derivative instruments that do not... -

Page 33

... 91.4% of total ï¬xed maturities in the general account at December 31, 2003 and 2002, respectively. The following table shows the amortized cost and estimated fair value of ï¬xed maturities, by contractual maturity dates (excluding scheduled sinking funds) at: December 31, 2003 December 31, 2002... -

Page 34

... a greater economic value under the new terms rather than through liquidation or disposition. The terms of the restructuring may involve some or all of the following characteristics: a reduction in the interest rate, an extension of the maturity date, an exchange of debt for equity or a partial... -

Page 35

...0.0 100.0% Fixed Maturity Impairment. The Company classiï¬es all of its ï¬xed maturities as available-for-sale and marks them to market through other comprehensive income. All securities with gross unrealized losses at the consolidated balance sheet date are subjected to the Company's process for... -

Page 36

... remained below amortized cost by 20% or more for six months or greater. The security is in the U.S. corporate sector, and the estimated fair value and gross unrealized loss at December 31, 2003 was $14 million and $11 million, respectively. The Company analyzed this ï¬xed maturity security as of... -

Page 37

... issuer. Credit card and home equity loan securitizations, each accounting for about 29% of the total holdings, constitute the largest exposures in the Company's asset-backed securities portfolio. Asset-backed securities generally have limited sensitivity to changes in interest rates. Approximately... -

Page 38

... 1.5 100.0% Commercial Mortgage Loans. The Company diversiï¬es its commercial mortgage loans by both geographic region and property type, and manages these investments through a network of regional ofï¬ces overseen by its investment department. The following table presents the distribution across... -

Page 39

... groups of loans with similar characteristics based on property types and loan to value risk factors. The Company records adjustments to its loan loss allowance as investment losses. The following table presents the amortized cost and valuation allowance for commercial mortgage loans distributed by... -

Page 40

... in its portfolio mostly during the fourth quarter of 2002. This sales program did not represent any fundamental change in the Company's investment strategy. Once the Company identiï¬es a property that is expected to be sold within one year and commences a ï¬rm plan for marketing the property, in... -

Page 41

... Held-for Sale. The carrying value of the property as of December 31, 2003 is approximately $700 million. Equity Securities and Other Limited Partnership Interests The Company's carrying value of equity securities, which primarily consist of investments in common and preferred stocks and mutual fund... -

Page 42

... loss related to the Company's equity securities at December 31, 2003 was $6 million. Such securities are concentrated by security type in common stock (36%) and preferred stock (63%); and are concentrated by industry in ï¬nancial (57%) and domestic broad market mutual funds (7%) (calculated... -

Page 43

... purpose of investing in public and private debt and equity securities, as well as limited partnerships established for the purpose of investing in low-income housing that qualiï¬es for federal tax credits. Securities Lending The Company participates in a securities lending program whereby blocks... -

Page 44

... risk management at MetLife. The GAPM boards' duties include setting broad asset/liability management policy and strategy, reviewing and approving target portfolios, establishing investment guidelines and limits, and providing oversight of the portfolio management process. The portfolio managers and... -

Page 45

...Company used market rates at December 31, 2003 to re-price its invested assets and other ï¬nancial instruments. The sensitivity analysis separately calculated each of MetLife's market risk exposures (interest rate, equity price and foreign currency exchange rate) related to its non-trading invested... -

Page 46

... STATEMENTS Independent Auditors' Report Financial Statements as of December 31, 2003 and 2002 and for the years ended December 31, 2003, 2002 and 2001: Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Stockholders' Equity Consolidated Statements of Cash... -

Page 47

...' Report The Board of Directors and Shareholders of MetLife, Inc.: We have audited the accompanying consolidated balance sheets of MetLife, Inc. and subsidiaries (the ''Company'') as of December 31, 2003 and 2002, and the related consolidated statements of income, stockholders' equity, and cash... -

Page 48

... 167,752 Equity securities, at fair value (cost: $1,222 and $1,556, respectively 1,598 Mortgage loans on real estate 26,249 Policy loans 8,749 Real estate and real estate joint ventures held-for-investment 4,714 Real estate held-for-sale 89 Other limited partnership interests 2,477 Short-term... -

Page 49

... THE YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001 (Dollars in millions, except per share data) 2003 2002 2001 REVENUES Premiums Universal life and investment-type product policy fees Net investment income Other revenues Net investment gains (losses) (net of amounts allocable from other accounts... -

Page 50

...Issuance of shares - by subsidiary Dividends on common stock Settlement of common stock purchase contracts ******* Premium on conversion of company-obligated mandatorily redeemable securities of a subsidiary trust Comprehensive income: Net income Other comprehensive income: Unrealized losses on... -

Page 51

... losses from sales of investments and businesses, net Interest credited to other policyholder account balances Universal life and investment-type product policy fees Change in premiums and other receivables Change in deferred policy acquisition costs, net Change in insurance-related liabilities... -

Page 52

... FOR THE YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001 (Dollars in millions) 2003 2002 2001 Cash ï¬,ows from ï¬nancing activities Policyholder account balances: Deposits Withdrawals Net change in short-term debt Long-term debt issued Long-term debt repaid Treasury stock acquired Settlement of... -

Page 53

... of individual and institutional customers. The Company offers life insurance, annuities, automobile and homeowners insurance and mutual funds to individuals, as well as group insurance, reinsurance and retirement and savings products and services to corporations and other institutions. Basis of... -

Page 54

... consolidated ï¬nancial statements and liquidity. Signiï¬cant Accounting Policies Investments The Company's ï¬xed maturity and equity securities are classiï¬ed as available-for-sale and are reported at their estimated fair value. Unrealized investment gains and losses on securities are recorded... -

Page 55

... TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) temporary. These adjustments are recorded as investment losses. Investment gains and losses on sales of securities are determined on a speciï¬c identiï¬cation basis. All security transactions are recorded on a trade date basis. Mortgage loans on... -

Page 56

... in its fair value and all scheduled periodic settlement receipts and payments are reported in net investment gains or losses. The Company formally documents all relationships between hedging instruments and hedged items, as well as its risk management objective and strategy for undertaking various... -

Page 57

... for participating traditional life, universal life and investment-type products. Generally, DAC is amortized in proportion to the present value of estimated gross margins or proï¬ts from investment, mortality, expense margins and surrender charges. Interest rates are based on rates in effect... -

Page 58

... for annuities, the amount of expected future policy beneï¬t payments. Premiums related to non-medical health contracts are recognized on a pro rata basis over the applicable contract term. Deposits related to universal life and investment-type products are credited to policyholder account balances... -

Page 59

... to their policy values in the form of policy credits aggregating $408 million, as provided in the plan. In addition, Metropolitan Life's Canadian branch made cash payments of $327 million in the second quarter of 2000 to holders of certain policies transferred to Clarica Life Insurance Company in... -

Page 60

METLIFE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) reclassiï¬ed $1,678 million of separate account assets to general account investments and $1,678 million of separate account liabilities to future policy beneï¬ts and policyholder account balances. The net cumulative effect of ... -

Page 61

... transition, the amortized cost of ï¬xed maturities decreased and other invested assets increased by $22 million, representing the fair value of certain interest rate swaps that were accounted for prior to SFAS 133 using fair value-type settlement accounting. During the year ended December 31, 2001... -

Page 62

... FINANCIAL STATEMENTS - (Continued) 2. Investments Fixed Maturities and Equity Securities Fixed maturities and equity securities at December 31, 2003 were as follows: Cost or Amortized Cost Gross Unrealized Gain Loss (Dollars in millions) Estimated Fair Value Fixed Maturities: Bonds: U.S. corporate... -

Page 63

... 30,381 500 $30,881 $252 102 79 26 60 22 28 15 83 667 76 $743 At December 31, 2003, the Company had gross unrealized losses of $6 million from equity securities that had been in an unrealized loss position for less than twelve months. The amount of unrealized losses from equity securities that had... -

Page 64

... TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Assets on Deposit and Held in Trust The Company had investment assets on deposit with regulatory agencies with a fair market value of $1,353 million and $975 million at December 31, 2003 and 2002, respectively. Company securities held in trust to... -

Page 65

... 28%, 17% and 16% of the Company's real estate holdings were located in New York, California and Illinois, respectively. Changes in real estate and real estate joint ventures held-for-sale valuation allowance were as follows: Years Ended December 31, 2003 2002 2001 (Dollars in millions) Balance at... -

Page 66

...follows: Years Ended December 31, 2003 2002 2001 (Dollars in millions) Fixed maturities Equity securities Mortgage loans on real estate Real estate and real estate joint ventures(1 Policy loans Other limited partnership interests Cash, cash equivalents and short-term investments Other Total... -

Page 67

...2003 and 2002 and the related investment income for the years ended December 31, 2003, 2002 and 2001 were insigniï¬cant. The Company also invests in structured notes and similar type instruments, which generally provide equity-based returns on debt securities. The carrying value of such investments... -

Page 68

...investing in public and private debt and equity securities, as well as limited partnerships established for the purpose of investing in low-income housing that qualiï¬es for federal tax credits. 3. Derivative Financial Instruments The table below provides a summary of notional amount and fair value... -

Page 69

... that qualify as accounting hedges under SFAS No. 133, as amended, for the years ended December 31, 2003, 2002 and 2001, respectively. During the years ended December 31, 2003 and 2002, the Company recognized $191 million and $30 million, respectively, in net investment losses related to qualifying... -

Page 70

... investment income and net investment loss, respectively, as the derivatives and underlying investments mature or expire according to their original terms. For the years ended December 31, 2003, 2002 and 2001, the Company recognized as net investment gains, the scheduled periodic settlement payments... -

Page 71

... and interest. Interest rates used in establishing such liabilities range from 3% to 11%. Policyholder account balances for universal life and investment-type contracts are equal to the policy account values, which consist of an accumulation of gross premium payments plus credited interest, ranging... -

Page 72

... individual and group life claims in excess of $2 million per policy, as well as excess property and casualty losses, among others. See Note 12 for information regarding certain excess of loss reinsurance agreements providing coverage for risks associated primarily with sales practices claims. The... -

Page 73

... maturities available-for-sale, at fair value (amortized cost: $30,381 and $28,339, respectively) **** Equity securities, at fair value (cost: $217 and $236, respectively Mortgage loans on real estate Policy loans Short-term investments Other invested assets Total investments Cash and cash... -

Page 74

... settlement of interest rate caps and interest rate, foreign currency and credit default swaps that qualify as accounting hedges under SFAS 133, as amended. During the year ended December 31, 2003, the closed block recognized $1 million in net investment losses related to qualifying fair value... -

Page 75

... years ended December 31, 2003, 2002 and 2001, respectively. 8. Shares Subject to Mandatory Redemption and Company-Obligated Mandatorily Redeemable Securities of Subsidiary Trusts MetLife Capital Trust I. In connection with MetLife, Inc.'s, initial public offering in April 2000, the Holding Company... -

Page 76

... shares of RGA stock at an exercise price of $50. The fair market value of the warrant on the issuance date was $14.87 and is detachable from the preferred security. RGA fully and unconditionally guarantees, on a subordinated basis, the obligations of the Trust under the preferred securities. The... -

Page 77

... actions against New England Mutual, with which Metropolitan Life merged in 1996, and General American, which was acquired in 2000, have been settled. In October 2000, a federal court approved a settlement resolving sales practices claims on behalf of a class of owners of permanent life insurance... -

Page 78

... or inquiries relating to Metropolitan Life's, New England Mutual's or General American's sales of individual life insurance policies or annuities. Over the past several years, these and a number of investigations by other regulatory authorities were resolved for monetary payments and certain... -

Page 79

... the plan. These actions name as defendants some or all of Metropolitan Life, the Holding Company, the individual directors, the New York Superintendent of Insurance (the ''Superintendent'') and the underwriters for MetLife, Inc.'s initial public offering, Goldman Sachs & Company and Credit Suisse... -

Page 80

... of the cost of the sales practices settlement in connection with the demutualization of Metropolitan Life breached the terms of the settlement. Plaintiffs sought compensatory and punitive damages, as well as attorneys' fees and costs. In October 2003, the court granted defendants' motion to... -

Page 81

... the 2000 demutualization. In August 2003, an appellate court afï¬rmed the dismissal of fraud claims in this action. MetLife is vigorously defending the case. Regulatory bodies have contacted the Company and have requested information relating to market timing and late trading of mutual funds and... -

Page 82

... pension plans covering eligible employees and sales representatives of the Company. Retirement beneï¬ts are based upon years of credited service and ï¬nal average or career average earnings history. The Company also provides certain postemployment beneï¬ts and certain postretirement health care... -

Page 83

...ï¬ts 2003 2002 Discount rate Expected rate of return on plan assets Rate of compensation increase 4%-9.5% 3.5%-10% 3%-8% 4%-9.5% 4%-10 % 2%-8% 6.5%-6.75% 3.79%-8.5 % N/A 6.5%-7.40% 5.2%-9% N/A For the largest of the plans sponsored by the Company (the Metropolitan Life Retirement Plan for... -

Page 84

... used in determining net periodic pension costs, and the expected rates of return on pension plan assets of 3.5% and 10% are attributable to the Company's international subsidiaries in Taiwan and Mexico, respectively. The rates of compensation increase of 3% and 2% in 2003 and 2002, respectively, is... -

Page 85

.... The Department has established informal guidelines for such determinations. The guidelines, among other things, focus on the insurer's overall ï¬nancial condition and proï¬tability under statutory accounting practices. For the year ended December 31, 2003, Metropolitan Life paid to MetLife, Inc... -

Page 86

...for the duration of the plan. The Directors Stock Plan has a maximum limit of 500,000 share awards. All options granted have an exercise price equal to the fair market value price of the Company's common stock on the date of grant, and an option's maximum term is ten years. Certain options under the... -

Page 87

... future policy beneï¬t liabilities using different actuarial assumptions, reporting surplus notes as surplus instead of debt and valuing securities on a different basis. As of December 31, 2001, New York Statutory Accounting Practices did not provide for deferred income taxes. The Department has... -

Page 88

... 45 (69) 27 704 (60) (18) $ 626 Years Ended December 31, 2003 2002 2001 (Dollars in millions) Compensation 2,685 Commissions 2,474 Interest and debt issue costs 478 Amortization of policy acquisition costs (excludes amounts directly related to net investment gains (losses)) of $(31), $5 and $25... -

Page 89

METLIFE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) For the Years Ended December 31, 2003 2002 2001 (Dollars in millions, except share and per share data) Income from discontinued operations available to common shareholders *** Basic earnings per share Diluted earnings per share... -

Page 90

... health insurance, such as short and long-term disability, long-term care, and dental insurance, and other insurance products and services. Individual offers a wide variety of individual insurance and investment products, including life insurance, annuities and mutual funds. Auto & Home provides... -

Page 91

METLIFE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) At or for the Year Ended December 31, 2003 Institutional Individual Auto & Home International Reinsurance (Dollars in millions) Asset Management Corporate & Other Total Premiums Universal life and investment-type product policy... -

Page 92

... for the Year Ended December 31, 2001 Institutional Individual Auto & Home Asset Corporate International Reinsurance Management & Other (Dollars in millions) Total Premiums 7,288 $4,563 $2,755 $846 $1,762 $ - $ (2) $17,212 Universal life and investment-type product policy fees ********* 592 1,260... -

Page 93

...GAAP equity included in MetLife, Inc.'s 2002 Annual Report on Form 10-K. The Reinsurance segment's results of operations for the year ended December 31, 2003 include RGA's coinsurance agreement under which it assumed the traditional U.S. life reinsurance business of Allianz Life Insurance Company of... -

Page 94

...: Fixed maturities Equity securities Mortgage loans on real estate Policy loans Short-term investments Cash and cash equivalents Mortgage loan commitments 679 Commitments to fund partnership investments 1,380 Liabilities: Policyholder account balances Short-term debt Long-term debt Shares... -

Page 95

... of policyholder account balances is estimated by discounting expected future cash ï¬,ows based upon interest rates currently being offered for similar contracts with maturities consistent with those remaining for the agreements being valued. Short-term and Long-term Debt, Payables Under Securities... -

Page 96

...(1) Retired Chairman and Chief Executive Ofï¬cer, New York Stock Exchange, Inc. Member, Audit Committee, Governance Committee and Executive Committee HUGH B. PRICE President, U.S. Insurance and Financial Services businesses LELAND C. LAUNER, JR. Executive Vice President and Chief Investment Of... -

Page 97

....com Corporate Headquarters MetLife, Inc. One Madison Avenue New York, NY 10010 212-578-2211 Internet Address www.metlife.com Form 10-K and Other Information MetLife, Inc. will provide to shareholders without charge, upon written or oral request, a copy of MetLife, Inc.'s annual report on Form 10...