Kraft 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

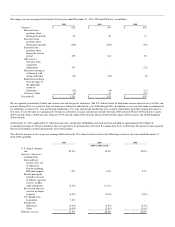

Nordic and Baltic snacks operation and several operations in Spain and the tax benefit from impairment charges taken in 2008. In addition, the 2008 tax rate

benefited from foreign earnings taxed below the U.S. federal statutory tax rate and from the expected tax benefit of 2008 restructuring expenses. These

benefits were only partially offset by state tax expense and certain foreign costs.

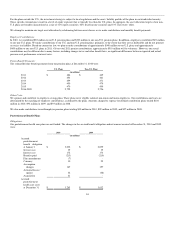

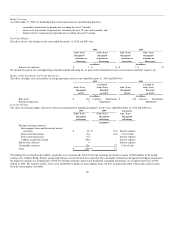

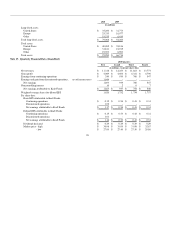

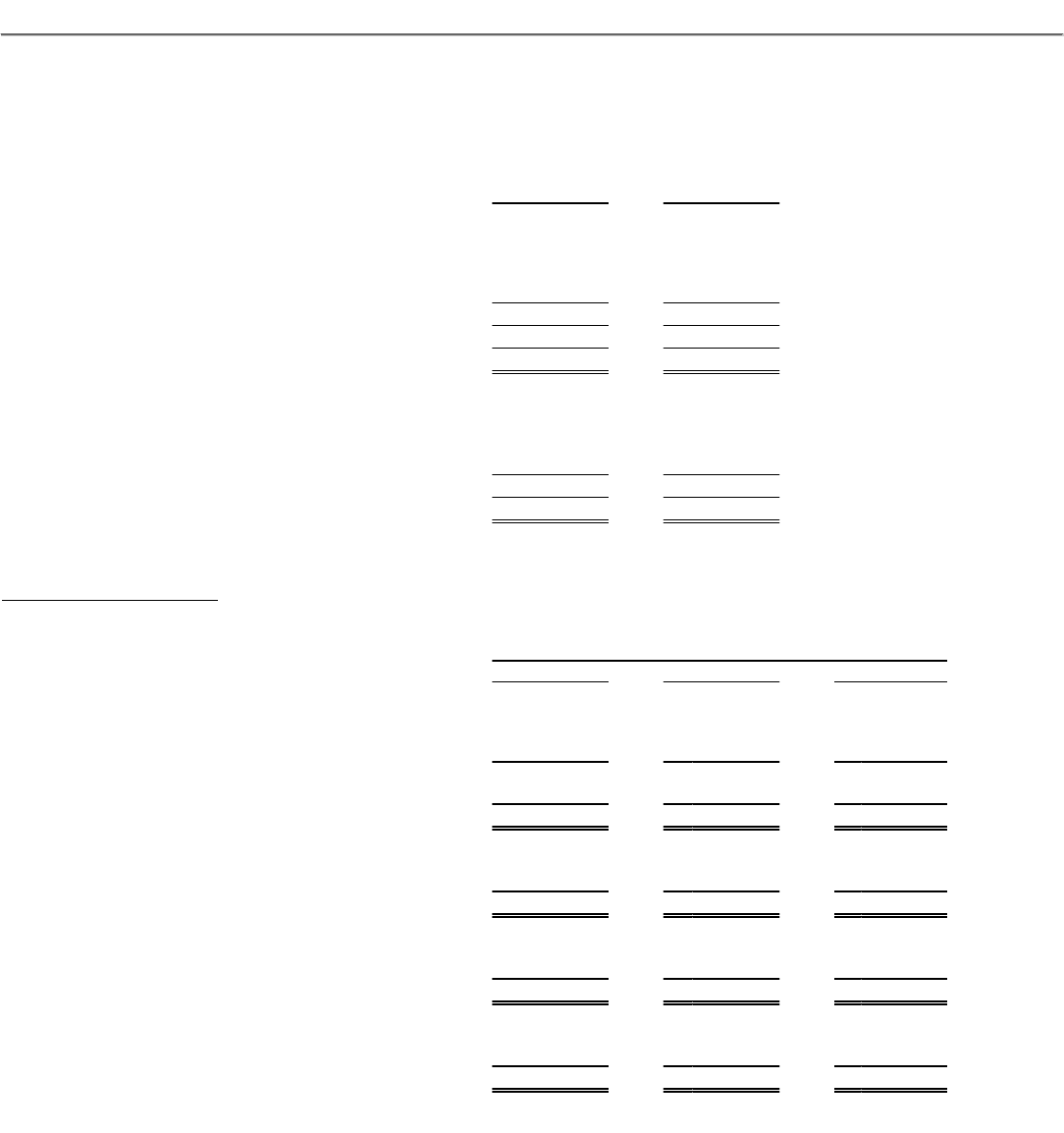

The tax effects of temporary differences that gave rise to deferred income tax assets and liabilities consisted of the following at December 31, 2010 and 2009:

2010 2009

(in millions)

Deferred income tax assets:

Accrued postretirement and postemployment benefits $ 1,103 $ 1,472

Accrued pension costs 458 456

Other 2,064 1,997

Total deferred income tax assets 3,625 3,925

Valuation allowance (400) (97)

Net deferred income tax assets $ 3,225 $ 3,828

Deferred income tax liabilities:

Trade names $ (7,606) $ (4,431)

Property, plant and equipment (1,845) (2,029)

Other (611) (1,055)

Total deferred income tax liabilities (10,062) (7,515)

Net deferred income tax liabilities $ (6,837) $ (3,687)

The majority of the increase in valuation allowances on deferred tax assets was a result of our Cadbury acquisition. Our significant allowances reside within

our operating subsidiaries in Ireland, Brazil, China, U.S., Nigeria and Japan.

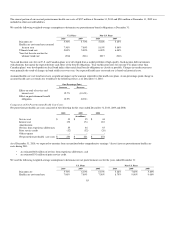

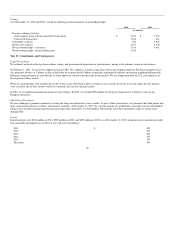

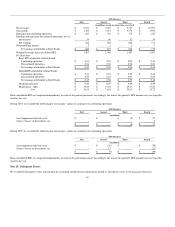

Note 15. Earnings Per Share:

Basic and diluted EPS from continuing and discontinued operations were calculated using the following:

For the Years Ended December 31,

2010 2009 2008

(in millions, except per share data; 2009 & 2008 revised)

Earnings from continuing operations $ 2,495 $ 2,810 $ 1,678

Earnings and gain from discontinued operations, net of

income taxes 1,644 218 1,215

Net earnings 4,139 3,028 2,893

Noncontrolling interest 25 7 9

Net earnings attributable to Kraft Foods $ 4,114 $ 3,021 $ 2,884

Weighted-average shares for basic EPS 1,715 1,478 1,505

Plus incremental shares from assumed conversions of stock

options and long-term incentive plan shares 5 8 10

Weighted-average shares for diluted EPS 1,720 1,486 1,515

Basic earnings per share attributable to Kraft Foods:

Continuing operations $ 1.44 $ 1.90 $ 1.11

Discontinued operations 0.96 0.14 0.81

Net earnings attributable to Kraft Foods $ 2.40 $ 2.04 $ 1.92

Diluted earnings per share attributable to Kraft Foods:

Continuing operations $ 1.44 $ 1.89 $ 1.10

Discontinued operations 0.95 0.14 0.80

Net earnings attributable to Kraft Foods $ 2.39 $ 2.03 $ 1.90

93