Kraft 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

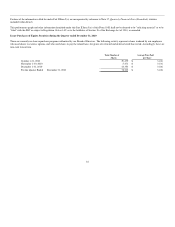

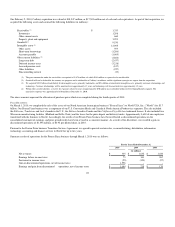

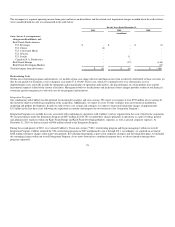

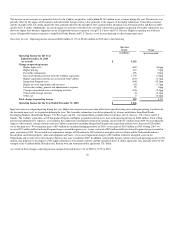

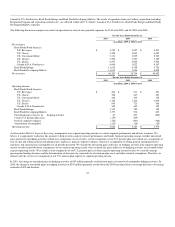

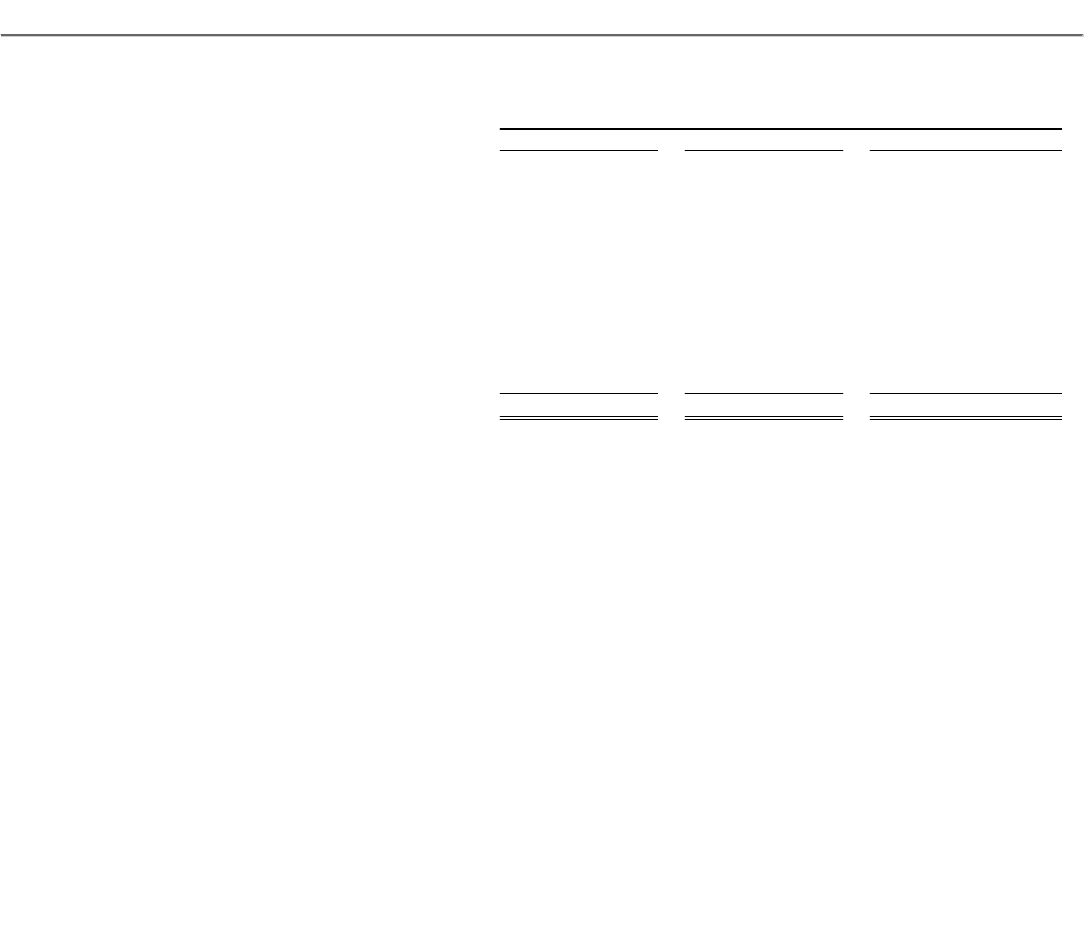

The net impacts to segment operating income from gains and losses on divestitures and the related asset impairment charges recorded when these divestitures

were considered held-for-sale are summarized in the table below.

For the Years Ended December 31,

2010 2009 2008

(in millions)

Gains / (losses) & asset impairment

charges on divestitures, net:

Kraft Foods North America:

U.S. Beverages $ - $ - $ (1)

U.S. Cheese (6) - -

U.S. Convenient Meals - - -

U.S. Grocery - - -

U.S. Snacks - 11 -

Canada & N.A. Foodservice - - -

Kraft Foods Europe - (17) (146)

Kraft Foods Developing Markets - - (13)

Total net impact from divestitures $ (6) $ (6) $ (160)

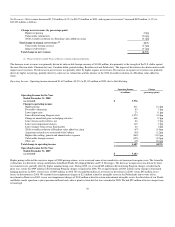

Restructuring Costs

Within our restructuring programs and initiatives, we include certain costs along with exit and disposal costs that are directly attributable to those activities yet

they do not qualify for treatment as exit or disposal costs under U.S. GAAP. These costs, which we commonly refer to as other project costs or

implementation costs, generally include the integration and reorganization of operations and facilities, the discontinuance of certain product lines and the

incremental expenses related to the closure of facilities. Management believes the disclosure and inclusion of these charges provides readers of our financial

statements greater transparency to the total costs of our programs and initiatives.

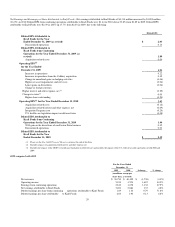

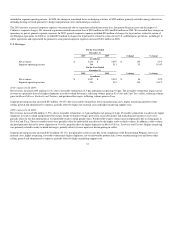

Integration Program:

Our combination with Cadbury has the potential for meaningful synergies and costs savings. We expect to recognize at least $750 million of cost savings by

the end of the third year following completion of the acquisition. Additionally, we expect to create revenue synergies from investments in distribution,

marketing and product development. In order to achieve these cost savings and synergies, we expect to incur total integration charges of approximately

$1.5 billion in the first three years following the acquisition to combine and integrate the two businesses (the "Integration Program").

Integration Program costs include the costs associated with combining our operations with Cadbury's and are separate from the costs related to the acquisition.

We incurred charges under the Integration Program of $657 million in 2010. We recorded these charges primarily in operations as a part of selling, general

and administrative expenses within our Kraft Foods Europe and Kraft Foods Developing Markets segments, as well as general corporate expenses. At

December 31, 2010, we had an accrual of $406 million related to the Integration Program.

During the second quarter of 2010, we evaluated Cadbury's Vision into Action ("VIA") restructuring program and began managing it within our overall

Integration Program. Cadbury initiated the VIA restructuring program in 2007 and planned to run it through 2011. Accordingly, we acquired an accrual of

$228 million relating to charges taken in previous periods. In evaluating the program as part of our corporate strategies and our integration plans, we included

the remaining charges within our overall Integration Program. As we move forward on a combined company basis, we do not intend to manage these

programs separately.

25