Kraft 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

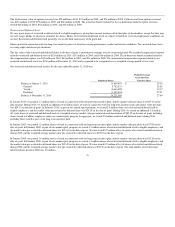

In addition to the above, some of our international subsidiaries maintain primarily uncommitted credit lines to meet short-term working capital needs.

Collectively, these credit lines amounted to $2.4 billion at December 31, 2010. Borrowings on these lines amounted to $267 million at December 31, 2010

and $191 million at December 31, 2009.

Cadbury maintained a three-year, £450 million senior unsecured revolving credit facility that we terminated in 2010.

As part of our Cadbury acquisition, on November 9, 2009, we entered into an agreement for a 364-day senior unsecured bridge facility (the "Cadbury Bridge

Facility"). During the first quarter of 2010, we borrowed £807 million under the Cadbury Bridge Facility, and later repaid it ($1,205 million at the time of

repayment) with proceeds from the divestiture of our Frozen Pizza business. Upon repayment, the Cadbury Bridge Facility was terminated.

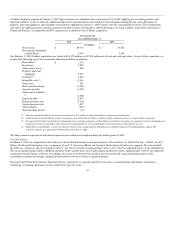

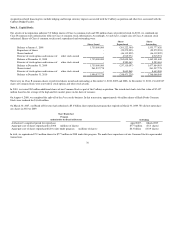

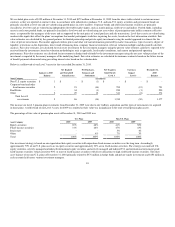

Long-Term Debt:

On February 8, 2010, we issued $9.5 billion of senior unsecured notes at a weighted-average effective rate of 5.364% and used the net proceeds ($9,379

million) to finance the Cadbury acquisition and for general corporate purposes. The general terms of the $9.5 billion notes are:

• $3.75 billion total principal notes due February 10, 2020 at a fixed, annual interest rate of 5.375%. Interest is payable semiannually beginning

August 10, 2010.

• $3.00 billion total principal notes due February 9, 2040 at a fixed, annual interest rate of 6.500%. Interest is payable semiannually beginning

August 9, 2010.

• $1.75 billion total principal notes due February 9, 2016 at a fixed, annual interest rate of 4.125%. Interest is payable semiannually beginning

August 9, 2010.

• $1.00 billion total principal notes due May 8, 2013 at a fixed, annual interest rate of 2.625%. Interest is payable semiannually beginning

November 8, 2010.

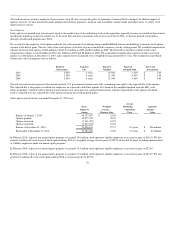

In addition, these notes include covenants that restrict our ability to incur debt secured by liens above a certain threshold. We also must offer to purchase these

notes at a price equal to 101% of the aggregate principal amount, plus accrued and unpaid interest to the date of repurchase, if both of the following occur:

(i) a "change of control" triggering event, and

(ii) a downgrade of these notes below an investment grade rating by each of Moody's Investors Service, Inc., Standard & Poor's Ratings Services and

Fitch, Inc. within a specified period.

We expect to continue to comply with our long-term debt covenants.

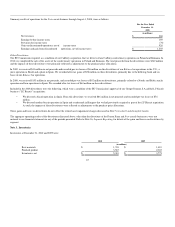

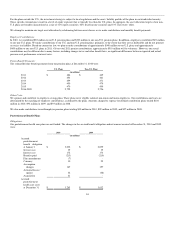

The fair value of the long-term debt we acquired as part of our Cadbury acquisition was $2,437 million at February 2, 2010. The acquired debt has the

following terms (including U.S. dollar par amounts):

• £77 million (approximately $123 million) total principal notes due December 20, 2010 at a fixed, annual interest rate of 4.875%.

• C$150 million (approximately $140 million) Canadian bank loan agreement expiring August 30, 2012 at a variable interest rate. The interest rate

at December 31, 2010 was 1.573%.

• $1.00 billion total principal notes due October 1, 2013 at a fixed, annual interest rate of 5.125%.

• £300 million (approximately $478 million) total principal notes due December 11, 2014 at a fixed, annual interest rate of 5.375%.

• £350 million (approximately $558 million) total principal notes due July 18, 2018 at a fixed, annual interest rate of 7.250%.

74