Kraft 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

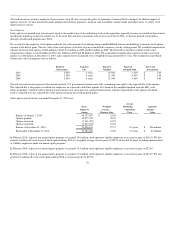

Each of our reporting units passed the first step of our 2010 annual impairment review with an estimated fair value greater than 105% of its carrying value.

Looking past 2010, there are uncertainties within the five identified reporting units that could potentially require further analysis in the future in order for us to

determine if a goodwill impairment exists within any of the individual reporting units. Significant uncertainties are:

• Across Kraft Foods North America, and specifically within our U.S. Grain Snacks reporting unit, we experienced significant input cost inflation

over the past year. In 2010 the contribution from pricing trailed input cost inflation. Consequently, in 2011 we have announced price increases on

selective portions of the portfolio, while also implementing sizing changes on other portions of the portfolio. If input costs continue to rise, as we

expect, additional price increases will be required. We expect to take needed pricing actions in the midst of persistent consumer weakness;

however, if we are unable to, it would decrease profitability and adversely affect the estimated fair value of our U.S. Grain Snacks reporting unit.

• Our U.S. Salty Snacks business grew in 2010, after experiencing two years of volume declines. Revenues and operating income grew more

substantially as we increased pricing and implemented cost saving measures. Further volume, revenue or operating income declines would

adversely affect the estimated fair value of U.S. Salty Snacks reporting unit. However, as noted, we also experienced significant input cost

inflation over the past year within our U.S. Salty Snacks business. If input costs continue to rise, as we expect, additional price increases will be

required. We expect to take needed pricing actions in the midst of persistent consumer weakness; however, if we are unable to, it would decrease

profitability and adversely affect the estimated fair value of our U.S. Salty Snacks reporting unit.

• Our U.S. Confections, Asia Pacific and Central and Eastern Europe, Middle East and Africa businesses compose a significant portion of our 2010

Cadbury acquisition. As our Cadbury acquisition was only eight months prior to our annual review of goodwill on October 1, 2010, we did not

expect a significant amount of excess estimated fair value over book value to be realized in such a short period. We expect to integrate our

combined businesses in these reporting units over the next two years; however, if we are unable to, it would adversely affect the estimated fair

values of these reporting units.

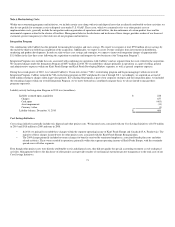

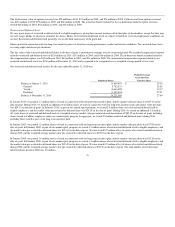

During the fourth quarter of 2009, we completed the annual review of goodwill and non-amortizable intangible assets and recorded a $12 million charge for

the impairment of intangible assets in the Netherlands. In addition, during 2009, we recorded a $9 million asset impairment charge to write off an investment

in Norway. We recorded the aggregate charges within asset impairment and exit costs.

During the fourth quarter of 2008, we completed the annual review of goodwill and non-amortizable intangible assets and recorded a $44 million charge for

the impairment of intangible assets in the Netherlands, France and Puerto Rico. During our 2008 impairment review, we determined that our Europe Biscuits

reporting unit was the most sensitive to near-term changes in our discounted cash flow assumptions, as it contains a significant portion of the goodwill

recorded upon our 2007 acquisition of LU Biscuit. In addition, in December 2008, we reached a preliminary agreement to divest a juice operation in Brazil

and reached an agreement to sell a cheese plant in Australia. In anticipation of divesting the juice operation in Brazil, we recorded an asset impairment charge

of $13 million in the fourth quarter of 2008. The charge primarily included the write-off of associated intangible assets of $8 million and property, plant and

equipment of $4 million. In anticipation of selling the cheese plant in Australia, we recorded an asset impairment charge of $28 million to property, plant and

equipment in the fourth quarter of 2008. Additionally, in 2008, we divested a Nordic and Baltic snacks operation and incurred an asset impairment charge of

$55 million in connection with the divestiture. This charge primarily included the write-off of associated goodwill of $34 million and property, plant and

equipment of $16 million. We recorded the aggregate charges within asset impairment and exit costs.

70