Kraft 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

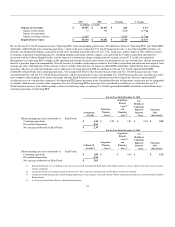

We perform our annual impairment review of goodwill and non-amortizable intangible assets as of October 1 each year. The basis of our valuation

methodology for estimating the fair value of our 21 reporting units is a 20-year projection of discounted cash flows that is based on our annual strategic

planning process. Estimating the fair value of individual reporting units requires us to make assumptions and estimates regarding our future plans, industry

and economic conditions. For reporting units within our Kraft Foods North America and Kraft Foods Europe geographic units, we used a market-participant,

weighted-average cost of capital of 7.5% to discount the projected cash flows of those operations. For reporting units within our Kraft Foods Developing

Markets geographic unit, we used a risk-rated discount rate of 10.5%.

Insurance and Self-Insurance:

We use a combination of insurance and self-insurance for a number of risks, including workers' compensation, general liability, automobile liability, product

liability and our obligation for employee healthcare benefits. Liabilities associated with the risks are estimated by considering historical claims experience and

other actuarial assumptions.

Revenue Recognition:

We recognize revenues when title and risk of loss pass to customers, which generally occurs upon shipment or delivery of goods. Revenues are recorded net

of consumer incentives and trade promotions and include all shipping and handling charges billed to customers. Kraft Foods' shipping and handling costs are

classified as part of cost of sales. A provision for product returns and allowances for bad debts are also recorded as reductions to revenues within the same

period that the revenue is recognized.

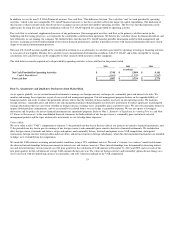

Selling, general and administrative expenses:

Marketing - We promote our products with advertising, consumer incentives and trade promotions. These programs include, but are not limited to, discounts,

coupons, rebates, in-store display incentives and volume-based incentives. We expense advertising costs either in the period the advertising first takes place or

as incurred. Consumer incentive and trade promotion activities are recorded as a reduction to revenues based on amounts estimated as being due to customers

and consumers at the end of a period. We base these estimates principally on historical utilization and redemption rates. For interim reporting purposes,

advertising and consumer incentive expenses are charged to operations as a percentage of volume, based on estimated volume and related expense for the full

year. We do not defer costs on our year-end consolidated balance sheet and all marketing costs are recorded as an expense in the year incurred. Advertising

expense was $2,269 million in 2010, $1,581 million in 2009, and $1,598 million in 2008.

Research - We expense costs as incurred for product research and development. Research and development expense was $583 million in 2010, $466 million

in 2009, and $487 million in 2008.

Environmental Costs:

We are subject to laws and regulations relating to the protection of the environment. We accrue for environmental remediation obligations on an undiscounted

basis when amounts are probable and can be reasonably estimated. The accruals are adjusted as new information develops or circumstances change.

Recoveries of environmental remediation costs from third parties are recorded as assets when recovery of those costs is deemed probable. At December 31,

2010, our subsidiaries were involved in 74 active actions in the U.S. under Superfund legislation (and other similar actions and legislation) related to current

operations and certain former or divested operations for which we retain liability.

Outside the U.S., we are subject to applicable multi-national, national and local environmental laws and regulations in the countries in which we do business.

Outside the U.S., we have specific programs across our business units designed to meet applicable environmental compliance requirements.

As of December 31, 2010, we had accrued an insignificant amount for environmental remediation. Based on information currently available, we believe that

the ultimate resolution of existing environmental remediation actions and our compliance in general with environmental laws and regulations will not have a

material effect on our financial results. However, we cannot quantify with certainty the potential impact of future compliance efforts and environmental

remediation actions.

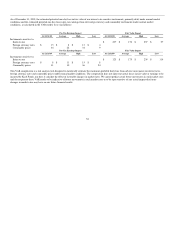

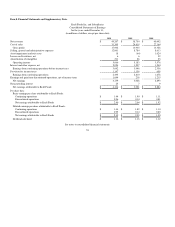

Employee Benefit Plans:

We provide a range of benefits to our employees and retired employees. These include pension benefits, postretirement health care benefits and

postemployment benefits, consisting primarily of severance. We provide

61