Kraft 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

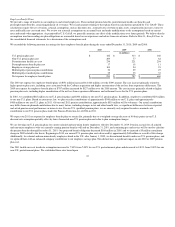

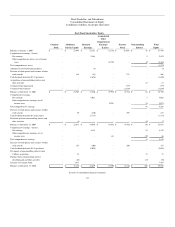

Dividends:

We paid dividends of $2,175 million in 2010, $1,712 million in 2009, and $1,663 million in 2008. The increase of 27.0% in 2010 reflects an increase in shares

outstanding due to the Cadbury acquisition and the $224 million payment of a ten pence per share dividend that Cadbury declared and accrued on the Cadbury

shares that were outstanding at the time of the acquisition. The 2.9% increase in 2009 reflects a higher dividend rate, partially offset by fewer shares

outstanding resulting from the split-off of the Post cereals business and share repurchases. The present annualized dividend rate is $1.16 per common share.

The declaration of dividends is subject to the discretion of our Board of Directors and depends on various factors, including our net earnings, financial

condition, cash requirements, future prospects and other factors that our Board of Directors deems relevant to its analysis and decision making.

2011 Outlook

Our outlook for 2011 reflects confidence in continuing our strong business momentum in a challenging environment of weak consumer and category growth

as well as significant input cost inflation.

The company expects to deliver organic net revenue growth of at least 5 percent, or approximately 4 percent excluding the impact of accounting calendar

changes, and Operating EPS growth of 11 to 13 percent.

New Accounting Guidance

See Note 1, Summary of Significant Accounting Policies, to the consolidated financial statements for a discussion of new accounting standards.

Contingencies

See Note 13, Commitments and Contingencies, to the consolidated financial statements.

Non-GAAP Financial Measures

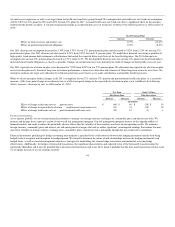

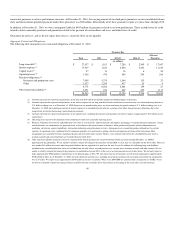

We use the non-U.S. GAAP financial measure "organic net revenues" and corresponding growth ratios. The difference between "organic net revenues" and

"net revenues," which is the most comparable U.S. GAAP financial measure, is that organic net revenues excludes the impact of acquisitions, divestitures and

currency. Management uses organic net revenues to budget, make operating and strategic decisions and evaluate our performance. We have disclosed this

measure so that you have the same financial data that management uses with the intention of assisting you in making comparisons to our historical operating

results and analyzing our underlying performance. Our management believes that organic net revenues better reflect the underlying growth from the ongoing

activities of our business and provide improved comparability of results because they exclude the impact of fluctuations in foreign currency exchange rates,

which are not under our control, and also exclude the one-time impacts of acquisitions and divestitures on net revenues. The limitation of this measure is that

it excludes items that have an impact on net revenues. The best way that this limitation can be addressed is by using organic net revenues in combination with

our U.S. GAAP reported net revenues. Our management believes that the presentation of this non-U.S. GAAP financial measure, when considered together

with our U.S. GAAP financial measures and the reconciliations to the corresponding U.S. GAAP financial measures, provides you with a more complete

understanding of the factors and trends affecting Kraft Foods than could be obtained absent these disclosures. Because organic net revenues calculations may

vary among other companies, the organic net revenues figures presented in the Consolidated Results of Operations section may not be comparable to similarly

titled measures used by other companies. Our use of organic net revenues is not meant to be considered in isolation or as a substitute for any U.S. GAAP

financial measure. You should carefully evaluate the following tables reconciling U.S. GAAP reported net revenues to organic net revenues.

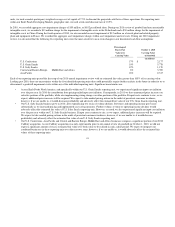

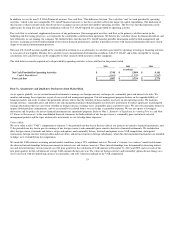

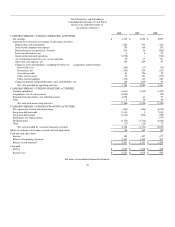

2010 2009 $ Change % Change

(in millions; 2009 revised)

Organic net revenues $ 40,075 $ 38,645 $ 1,430 3.7%

Impact of divestitures 21 109 (88) (0.3)pp

Impact of acquisitions 9,143 - 9,143 23.7pp

Impact of integration (1) - (1) -

Impact of foreign currency (31) - (31) (0.1)pp

Reported net revenues $ 49,207 $ 38,754 $ 10,453 27.0%

51