Kraft 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

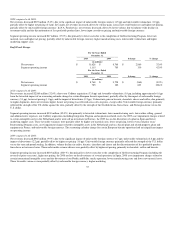

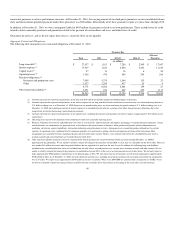

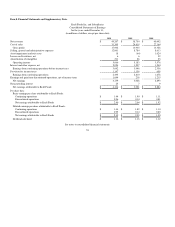

Net Cash Provided by / (Used in) Financing Activities:

Net cash provided by financing activities was $4.2 billion in 2010, $3.1 billion used in 2009 and $2.1 billion used in 2008. The net cash provided by financing

activities in 2010 primarily related to proceeds from our long-term debt issuance of $9.4 billion, partially offset by $2.2 billion in dividends paid, $2.1 billion

in long-term debt repayments, primarily related to our repurchase of $1.5 billion in notes through our tender offer, and $864 million in net repayments of

short-term borrowings. The net cash used in financing activities in 2009 primarily related to $1.7 billion in dividend payments, $950 million in repayments of

long-term debt and $344 million in net commercial paper repayments. Additionally, other cash used in financing activities in 2009 included $69 million in

costs related to our bridge facility agreement dated November 9, 2009 (the "Cadbury Bridge Facility"). The net cash used in financing activities in 2008

primarily related to $5.9 billion in payments made on the bridge facility used to fund our LU Biscuit acquisition, $1.7 billion in dividend payments, $777

million in Common Stock share repurchases and $795 million in repayments of long-term debt securities, primarily related to debt that matured on October 1,

2008, partially offset by $6.9 billion in proceeds from our long-term debt offerings.

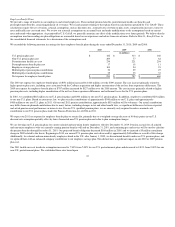

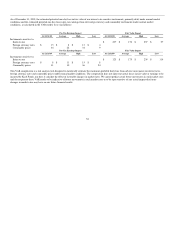

In November 2011, $1.1 billion of our long-term debt matures. We expect to fund the repayment by re-financing all or a portion of it with long-term debt or

short-term borrowings, and any remaining amounts will be funded by cash from operations.

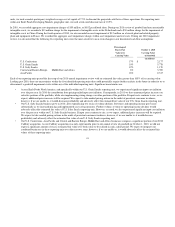

Borrowing Arrangements:

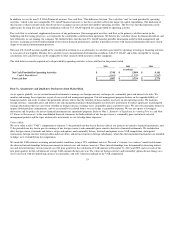

We maintain a revolving credit facility that we have historically used for general corporate purposes, including for working capital purposes, and to support

our commercial paper issuances. Our $4.5 billion three-year senior unsecured revolving credit facility expires in November 2012. No amounts have been

drawn on the facility.

The revolving credit facility agreement includes a covenant that we maintain a minimum total shareholders' equity, excluding accumulated other

comprehensive earnings / (losses), of at least $28.6 billion. This threshold was increased by $5.6 billion to $28.6 billion due to the equity we issued as part of

our Cadbury acquisition. At December 31, 2010, our total shareholders' equity, excluding accumulated other comprehensive earnings / (losses), was $39.7

billion. We expect to continue to meet this covenant. The revolving credit agreement also contains customary representations, covenants and events of default.

However, the revolving credit facility has no other financial covenants, credit rating triggers or provisions that could require us to post collateral as security.

In addition to the above, some of our international subsidiaries maintain primarily uncommitted credit lines to meet short-term working capital needs.

Collectively, these credit lines amounted to $2.4 billion at December 31, 2010. Borrowings on these lines amounted to $267 million at December 31, 2010

and $191 million at December 31, 2009.

Cadbury maintained a three-year, £450 million senior unsecured revolving credit facility that we terminated in 2010.

As part of our Cadbury acquisition, on November 9, 2009, we entered into the Cadbury Bridge Facility. During the first quarter of 2010, we borrowed

£807 million under the Cadbury Bridge Facility, and later repaid it ($1,205 million at the time of repayment) with proceeds from the divestiture of our Frozen

Pizza business. Upon repayment, the Cadbury Bridge Facility was terminated.

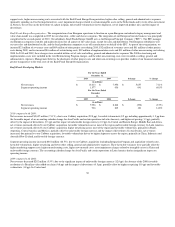

Long-term Debt:

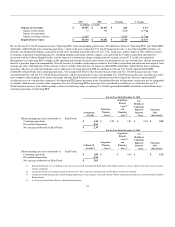

Our total debt was $28.7 billion at December 31, 2010 and $19.0 billion at December 31, 2009. Our debt-to-capitalization ratio was 0.44 at December 31,

2010 and 0.42 at December 31, 2009. At December 31, 2010, the weighted-average term of our outstanding long-term debt was 9.9 years.

On December 29, 2010, we repurchased $900 million principal amount of our 5.625% notes due 2011 and $600 million principal amount of our 6.25% notes

due 2012, which were validly tendered pursuant to the cash tender offers we initiated in November 2010. We paid $1,596 million aggregate consideration,

including accrued and unpaid interest, for the accepted notes in December 2010.

On December 20, 2010, we repaid £77 million (approximately $119 million) of our long-term debt and on August 11, 2010, we repaid $500 million of our

long-term debt. We funded these repayments with cash from operations and short-term borrowings.

47