Kraft 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

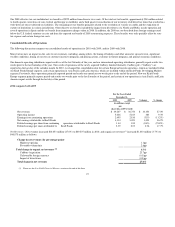

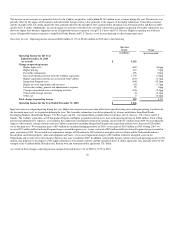

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussions should be read in conjunction with the other sections of this Annual Report on Form 10-K, including the consolidated financial

statements and related notes contained in Item 8.

Description of the Company

We market biscuits, confectionery, beverages, cheese, grocery products and convenient meals in approximately 170 countries.

Executive Summary

The following executive summary is intended to provide significant highlights of the discussion and analysis that follows.

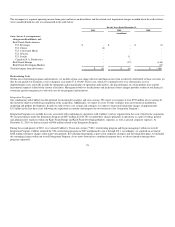

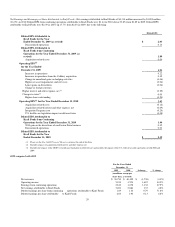

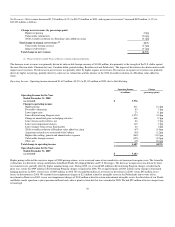

• Net revenues in 2010 increased 27.0% to $49.2 billion. Net revenues in 2009 decreased 4.3% to $38.8 billion.

• Diluted EPS attributable to Kraft Foods increased 17.7% to $2.39 in 2010 and increased 6.8% to $2.03 in 2009. Diluted EPS attributable to Kraft

Foods from continuing operations decreased 23.8% to $1.44 in 2010 and increased 71.8% to $1.89 in 2009.

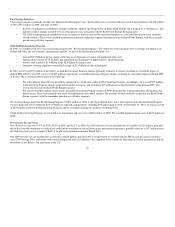

• On February 2, 2010, we had received acceptances to our offer of 71.73% of the outstanding ordinary shares of Cadbury. From February 2, 2010

through June 1, 2010, we acquired the remaining 28.27% of Cadbury Shares. In acquiring Cadbury, we issued 262 million shares of our Common

Stock and paid $10.9 billion in cash.

• On February 8, 2010, we issued $9.5 billion of senior unsecured notes at a weighted-average effective rate of 5.364% and primarily used the net

proceeds ($9,379 million) to finance the Cadbury acquisition.

• On March 1, 2010, we completed the sale of the assets of our North American frozen pizza business to Nestlé USA, Inc. for $3.7 billion.

Accordingly, the results of our Frozen Pizza business have been reflected as discontinued operations on the consolidated statement of earnings,

and prior period results have been revised in a consistent manner.

• On December 29, 2010, we repurchased $1.5 billion of our notes due in 2011 and 2012. We paid $1,596 million aggregate consideration,

including accrued and unpaid interest, for the accepted notes.

• On November 30, 2009, we entered into a revolving credit agreement for a $4.5 billion three-year senior unsecured revolving credit facility. The

agreement replaced our former revolving credit agreement, which was terminated upon the signing of the new agreement.

• Our $5.0 billion share repurchase authority expired on March 30, 2009. Prior to the expiration, we repurchased 130.9 million shares for $4.3

billion under the program. We did not repurchase any shares in 2010 or 2009.

• In 2008, we completed our $2.9 billion, five-year Restructuring Program. We reversed previously accrued Restructuring Program charges of $37

million in 2010 and $85 million in 2009, and we recorded charges of $989 million during 2008.

• On August 4, 2008, we completed the split-off of the Post cereals business. Accordingly, the Post cereals business prior period results were

reflected as discontinued operations on the consolidated statement of earnings.

20