Kraft 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Discussion and Analysis

Strategy

We are seeking to build a global Snacks powerhouse with an unrivaled portfolio of brands people love. Our future growth is centered on three strategies: To

delight global Snacks consumers; To unleash the Power of our Iconic Heritage Brands; and To Create a Performance-Driven, Values-Led Organization, which

we believe will allow us to deliver top-tier shareholder returns. We plan to drive sustained, profitable growth that will put us among the top performers of our

industry. Our strategic focus on global snacks, iconic heritage brands and our culture is intended to deliver robust top-line growth. Our ongoing overhead and

cost saving efforts are fueling significant additional investments in marketing and innovation. We believe that these savings and investments, along with our

emphasis on the importance of superior execution, will generate sustained growth. We believe we are well-positioned to deliver consistent financial results in

the top-tier of our peer group.

Items Affecting Comparability of Financial Results

Acquisitions and Divestitures

Cadbury Acquisition:

On January 19, 2010, we announced the terms of our final offer for each outstanding ordinary share of Cadbury Limited (formerly, Cadbury plc) ("Cadbury"),

including each ordinary share represented by an American Depositary Share ("Cadbury ADS"), and the Cadbury Board of Directors recommended that

Cadbury shareholders accept the terms of the final offer. On February 2, 2010, all of the conditions to the offer were satisfied or validly waived, the initial

offer period expired and a subsequent offer period immediately began. At that point, we had received acceptances of 71.73% of the outstanding

Cadbury ordinary shares, including those represented by Cadbury ADSs ("Cadbury Shares"). As of June 1, 2010, we owned 100% of all outstanding Cadbury

Shares. We believe the combination of Kraft Foods and Cadbury will create a global snacks powerhouse and an unrivaled portfolio of brands people love.

Under the terms of our final offer and the subsequent offer, we agreed to pay Cadbury shareholders 500 pence in cash and 0.1874 shares of Kraft Foods

Common Stock per Cadbury ordinary share validly tendered and 2,000 pence in cash and 0.7496 shares of Kraft Foods Common Stock per Cadbury ADS

validly tendered. This valued Cadbury at $18.5 billion, or approximately £11.6 billion (based on the average price of $28.36 for a share of Kraft Foods

Common Stock on February 2, 2010 and an exchange rate of $1.595 per £1.00).

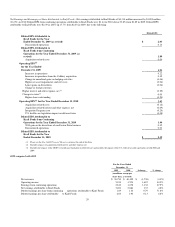

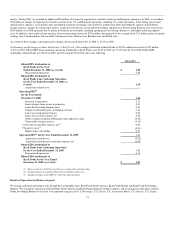

On February 2, 2010, we acquired 71.73% of Cadbury Shares for $13.1 billion and the value attributed to noncontrolling interests was $5.4 billion. From

February 2, 2010 through June 1, 2010, we acquired the remaining 28.27% of Cadbury Shares for $5.4 billion. We had a $38 million gain on noncontrolling

interest acquired and recorded it within additional paid in capital.

As part of our Cadbury acquisition, we incurred and expensed transaction related fees of $218 million in 2010 and $40 million in 2009. We recorded these

expenses within selling, general and administrative expenses. We also incurred acquisition financing fees of $96 million in 2010. We recorded these expenses

within interest and other expense, net.

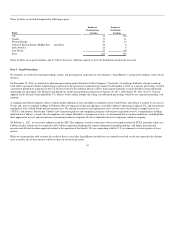

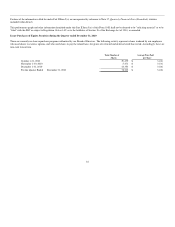

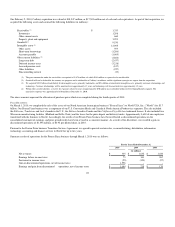

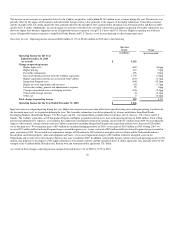

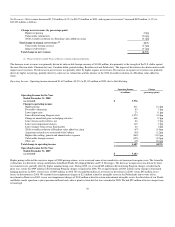

Cadbury contributed net revenues of $9,143 million and net earnings of $530 million from February 2, 2010 through December 31, 2010. The following

unaudited pro forma summary presents Kraft Foods' consolidated information as if Cadbury had been acquired on January 1, 2009. These amounts were

calculated after conversion to U.S. GAAP, applying our accounting policies, and adjusting Cadbury's results to reflect the additional depreciation and

amortization that would have been charged assuming the fair value adjustments to property, plant and equipment, and intangible assets had been applied from

January 1, 2009, together with the consequential tax effects. These adjustments also reflect the additional interest expense incurred on the debt to finance the

purchase, and the divestitures of certain Cadbury confectionery operations in Poland and Romania, as required by the EU Commission as a condition of our

Cadbury acquisition.

Pro forma for the

Years Ended December 31,

2010 2009

(in millions)

Net revenues $ 49,770 $ 47,852

Net earnings attributable to Kraft Foods 3,938 2,586

21