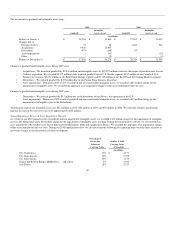

Kraft 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

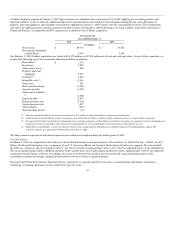

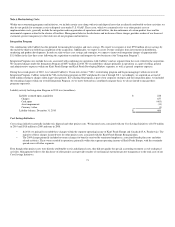

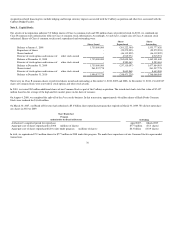

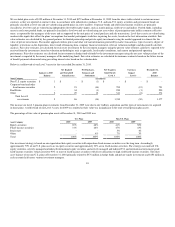

At December 31, 2010 and 2009, our long-term debt consisted of (interest rates were as of December 31, 2010):

December 31,

2010

December 31,

2009

(in millions)

Notes, 2.63% to 7.55% (average effective rate 5.86%), due through 2040 $ 22,872 $ 14,395

Euro notes, 5.75% to 6.25% (average effective rate 5.98%), due through 2015 3,808 4,072

Sterling notes, 5.38% to 7.25% (average effective rate 4.94%), due through 2018 1,091 -

Other foreign currency obligations 158 5

Capital leases and other 45 65

Total 27,974 18,537

Less current portion of long-term debt (1,115) (513)

Long-term debt $ 26,859 $ 18,024

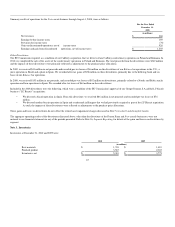

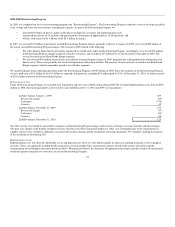

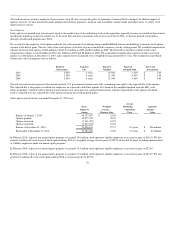

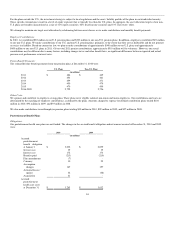

As of December 31, 2010, aggregate maturities of long-term debt were (in millions):

2011 $ 1,115

2012 3,738

2013 3,557

2014 972

2015 1,541

Thereafter 17,062

On December 29, 2010 we repurchased $900 million principal amount of our 5.625% notes due 2011 and $600 million principal amount of our 6.25% notes

due 2012, which were validly tendered pursuant to the cash tender offers we initiated in November 2010. We paid $1,596 million aggregate consideration,

including accrued and unpaid interest, for the accepted notes in December 2010.

On December 20, 2010, we repaid £77 million (approximately $119 million) of our long-term debt and on August 11, 2010, we repaid $500 million of our

long-term debt. We funded these repayments with cash from operations and short-term borrowings.

On September 3, 2009, we redeemed our November 2011, 7% $200 million debenture at par value. Upon redemption, we recorded a loss of $14 million

within interest and other expense, net which represented the write-off of the remaining discount. On November 12, 2009, we repaid $750 million in notes.

This repayment was primarily financed from commercial paper issuances.

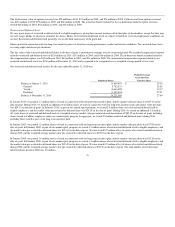

Fair Value:

The aggregate fair value of our total debt, based on quoted prices in active markets for identical liabilities, was $31,459 million at December 31, 2010 as

compared with the carrying value of $28,724 million. The aggregate fair value of our total debt, based on quoted prices in active markets for identical

liabilities, at December 31, 2009, was $20,222 million as compared with the carrying value of $18,990 million.

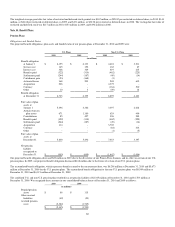

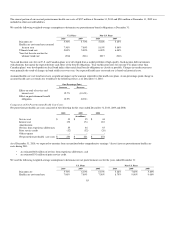

Interest and Other Expense:

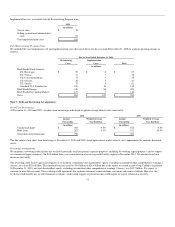

Interest and other expense was:

For the Years Ended December 31,

2010 2009 2008

(in millions)

Interest and other expense, net:

Interest expense, debt $ 1,790 $ 1,260 $ 1,272

Acquisition-related financing fees $ 251 $ - $ -

Other income, net (17) (23) (32)

Total interest and other expense, net $ 2,024 $ 1,237 $ 1,240

75