Kraft 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Employee Benefit Plans:

We provide a range of benefits to our employees and retired employees. These include pension benefits, postretirement health care benefits and

postemployment benefits, consisting primarily of severance. We record amounts relating to these plans based on calculations specified by U.S. GAAP. These

calculations require the use of various actuarial assumptions, such as discount rates, assumed rates of return on plan assets, compensation increases, turnover

rates and health care cost trend rates. We review our actuarial assumptions on an annual basis and make modifications to the assumptions based on current

rates and trends when appropriate. As permitted by U.S. GAAP, we generally amortize any effect of the modifications over future periods. We believe that the

assumptions used in recording our plan obligations are reasonable based on our experience and advice from our actuaries. Refer to Note 11, Benefit Plans, to

the consolidated financial statements for a discussion of the assumptions used.

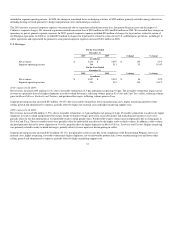

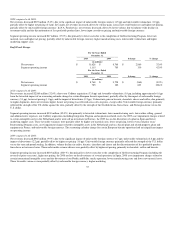

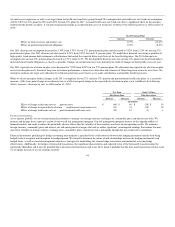

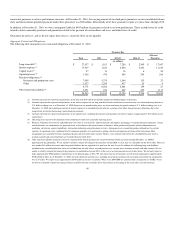

We recorded the following amounts in earnings for these employee benefit plans during the years ended December 31, 2010, 2009 and 2008:

2010 2009 2008

(in millions)

U.S. pension plan cost $ 322 $ 313 $ 160

Non-U.S. pension plan cost 209 77 82

Postretirement health care cost 234 221 254

Postemployment benefit plan cost 17 18 11

Employee savings plan cost 104 94 93

Multiemployer pension plan contributions 30 29 27

Multiemployer medical plan contributions 35 35 33

Net expense for employee benefit plans $ 951 $ 787 $ 660

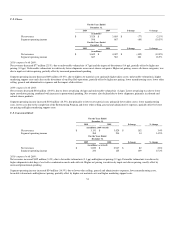

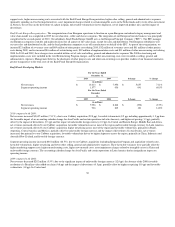

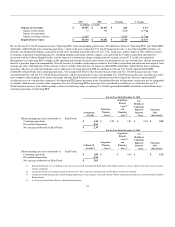

The 2010 net expense for employee benefit plans of $951 million increased by $164 million over the 2009 amount. The cost increase primarily related to

higher pension plan costs, including costs associated with the Cadbury acquisition and higher amortization of the net loss from experience differences. The

2009 net expense for employee benefit plans of $787 million increased by $127 million over the 2008 amount. The cost increase primarily related to higher

pension plan costs, including higher amortization of the net loss from experience differences and settlement losses for the U.S. pension plans.

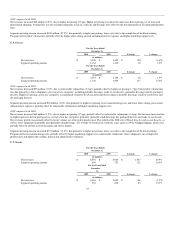

In 2010, we contributed $85 million to our U.S. pension plans and $303 million to our non-U.S. pension plans. In addition, employees contributed $23 million

to our non-U.S. plans. Based on current tax law, we plan to make contributions of approximately $540 million to our U.S. plans and approximately

$400 million to our non-U.S. plans in 2011. Of our total 2011 pension contributions, approximately $510 million will be voluntary. Our actual contributions

may differ from our planned contributions due to many factors, including changes in tax and other benefit laws, or significant differences between expected

and actual pension asset performance or interest rates. For our U.S. qualified pension plans, we are currently only required to make a nominal cash

contribution to our U.S. pension plans under the Pension Protection Act of 2006 in 2011.

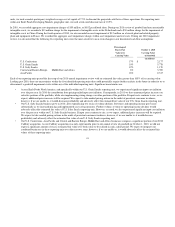

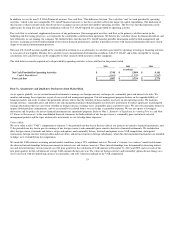

We expect our 2011 net expense for employee benefit plans to remain flat, primarily due to a weighted-average decrease of 40 basis points in our U.S.

discount rate assumption partially offset by lower forecasted non-U.S. pension plan costs due to plan assumption changes.

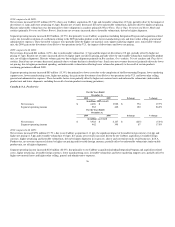

We are freezing our U.S. pension plans for current salaried and non-union hourly employees effective December 31, 2019. Pension accruals for all salaried

and non-union employees who are currently earning pension benefits will end on December 31, 2019, and continuing pay and service will be used to calculate

the pension benefits through December 31, 2019. Our projected benefit obligation decreased $168 million in 2009, and we incurred a $5 million curtailment

charge in 2009 related to the freeze. Beginning in 2010, our annual U.S. pension plan costs decreased by approximately $40 million as a result of this change.

Additionally, for salaried and non-union hourly employees hired in the U.S. after January 1, 2009, we discontinued benefits under our U.S. pension plans, and

we replaced them with an enhanced company contribution to our employee savings plan. This did not have a significant impact on our 2010 or 2009 pension

plan cost.

Our 2011 health care cost trend rate assumption increased to 7.50% from 7.00% for our U.S. postretirement plans and decreased to 8.83% from 9.00% for our

non-U.S. postretirement plans. We established these rates based upon

43