Kraft 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Forward-looking Statements

This report contains a number of forward-looking statements. Words, and variations of words, such as "expect," "goals," "plans," "believe," "continue,"

"may," "will," and similar expressions are intended to identify our forward-looking statements, including but not limited to those related to our strategy, in

particular, our unrivaled brand portfolio, top-tier shareholder returns and financial results, substained profitable growth, robust top-line growth, overhead and

cost savings, Post Cereals split-off; new food law regulations; our workforce and authorities; our properties; our combination with Cadbury, including

expected receivables, intangible assets, synergies, cost savings and integration charges; our long-term strategy; with regard to our Restructuring Program, our

expected cash payments for charges and cumulative annualized savings; the Venezuelan currency devaluation; asset impairments; our legal proceedings,

including environmental remedial actions; our pension plans and other employee benefit plans, including expected contributions, obligations and costs;

commodity costs; our liquidity, effects of guarantees on our liquidity and funding sources; future acquisitions and divestitures; our capital expenditures and

funding; our revolving credit facility and long-term debt covenants; our plan to file an automatic shelf registration statement; our aggregate contractual

obligations; our 2012 Outlook, including the challenging operating environment and consumer weakness, our strong business momentum, organic net revenue

growth and Operating EPS; and our risk management program, including the use of financial instruments for hedging activities.

These forward-looking statements are subject to a number of risks and uncertainties, and the cautionary statements contained in the "Risk Factors" found in

this Annual Report on Form 10-K identify important factors that could cause actual results to differ materially from those in our forward-looking statements.

Such factors include, but are not limited to, continued volatility of, and sharp increase in, commodity and other input costs, pricing actions, increased

competition, our ability to differentiate our products from retailer brands, increased costs of sales, our indebtedness and our ability to pay our indebtedness,

unexpected safety or manufacturing issues, regulatory or legal restrictions, actions or delays, unanticipated expenses such as litigation or legal settlement

expenses, a shift in our product mix to lower margin offerings, risks from operating internationally, continued consumer weakness, weakness in economic

conditions, our failure to successfully integrate the Cadbury business, performance in developing markets and tax law changes. We disclaim and do not

undertake any obligation to update or revise any forward-looking statement in this report.

PART I

Item 1. Business.

General

Kraft Foods is the world's second largest food company with revenues of $49.2 billion and earnings from continuing operations before income taxes of $3.6

billion in 2010. Kraft Foods was incorporated in 2000 in the Commonwealth of Virginia. We have approximately 127,000 employees worldwide, and we

manufacture and market packaged food products, including biscuits, confectionery, beverages, cheese, convenient meals and various packaged grocery

products. We sell our products to consumers in approximately 170 countries. At December 31, 2010, we had operations in more than 75 countries and made

our products at 223 manufacturing and processing facilities worldwide. At December 31, 2010, we had net assets of $35.9 billion and gross assets of $95.3

billion. We are a member of the Dow Jones Industrial Average, Standard & Poor's 500, the Dow Jones Sustainability Index and the Ethibel Sustainability

Index.

At December 31, 2010, our portfolio included eleven brands with annual revenues exceeding $1 billion each: Oreo, Nabisco and LU biscuits; Milka and

Cadbury chocolates; Trident gum; Jacobs and Maxwell House coffees; Philadelphia cream cheeses; Kraft cheeses, dinners and dressings; and Oscar Mayer

meats. Our portfolio included approximately 70 brands which each generate annual revenues of more than $100 million.

Because Kraft Foods Inc. is a holding company, our principal source of funds is from our subsidiaries. Our wholly owned subsidiaries currently are not

limited by long-term debt or other agreements in their ability to pay cash dividends or make other distributions with respect to their common stock.

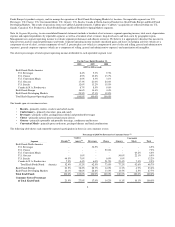

Reportable Segments

We manage and report operating results through three geographic units: Kraft Foods North America, Kraft Foods Europe and Kraft Foods Developing

Markets. We manage the operations of Kraft Foods North America and Kraft

1