Kraft 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

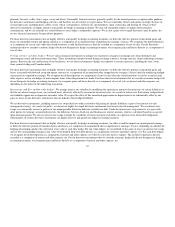

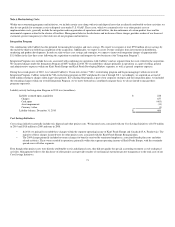

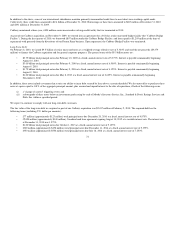

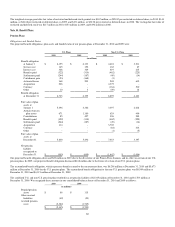

Implementation costs associated with the Restructuring Program were:

2008

(in millions)

Cost of sales $ 38

Selling, general and administrative

costs 67

Total implementation costs $ 105

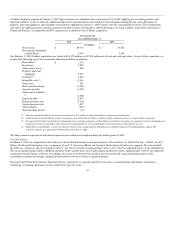

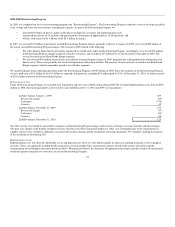

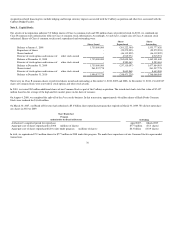

Total Restructuring Program Costs:

We included the asset impairment, exit and implementation costs discussed above, for the year ended December 31, 2008 in segment operating income as

follows:

For the Year Ended December 31, 2008

Restructuring

Costs

Implementation

Costs Total

(in millions)

Kraft Foods North America:

U.S. Beverages $ 59 $ 8 $ 67

U.S. Cheese 31 7 38

U.S. Convenient Meals 31 7 38

U.S. Grocery 36 5 41

U.S. Snacks 72 9 81

Canada & N.A. Foodservice 100 10 110

Kraft Foods Europe 418 56 474

Kraft Foods Developing Markets 137 3 140

Total $ 884 $ 105 $ 989

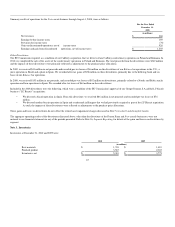

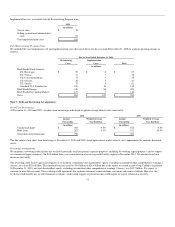

Note 7. Debt and Borrowing Arrangements:

Short-Term Borrowings:

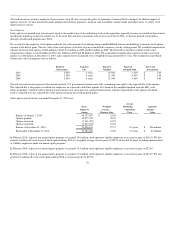

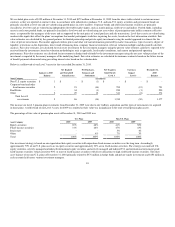

At December 31, 2010 and 2009, our short-term borrowings and related weighted-average interest rates consisted of:

2010 2009

Amount

Outstanding

Weighted-Average

Year-End Rate

Amount

Outstanding

Weighted-Average

Year-End Rate

(in millions) (in millions)

Commercial paper $ 483 0.5% $ 262 0.5%

Bank loans 267 6.3% 191 10.5%

Total short-term borrowings $ 750 $ 453

The fair values of our short-term borrowings at December 31, 2010 and 2009, based upon current market interest rates, approximate the amounts disclosed

above.

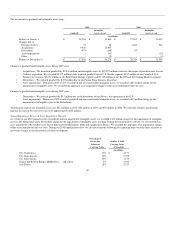

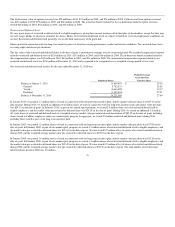

Borrowing Arrangements:

We maintain a revolving credit facility that we have historically used for general corporate purposes, including for working capital purposes, and to support

our commercial paper issuances. Our $4.5 billion three-year senior unsecured revolving credit facility expires in November 2012. No amounts have been

drawn on the facility.

The revolving credit facility agreement requires us to maintain a minimum total shareholders' equity, excluding accumulated other comprehensive earnings /

(losses), of at least $28.6 billion. This threshold was increased by $5.6 billion to $28.6 billion due to the equity we issued as part of our Cadbury acquisition.

At December 31, 2010, our total shareholders' equity, excluding accumulated other comprehensive earnings / (losses), was $39.7 billion. We expect to

continue to meet this covenant. The revolving credit agreement also contains customary representations, covenants and events of default. However, the

revolving credit facility has no other financial covenants, credit rating triggers or provisions that could require us to post collateral as security.

73