Kraft 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

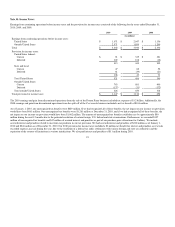

Note 14. Income Taxes:

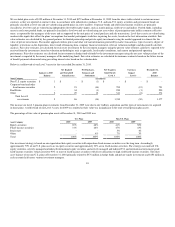

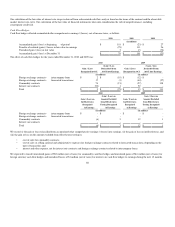

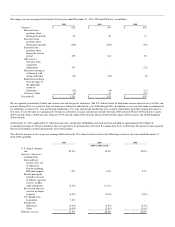

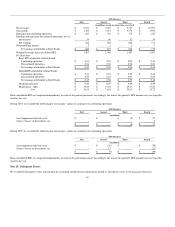

Earnings from continuing operations before income taxes and the provision for income taxes consisted of the following for the years ended December 31,

2010, 2009, and 2008:

2010 2009 2008

(in millions)

Earnings from continuing operations before income taxes:

United States $ 1,071 $ 2,047 $ 1,136

Outside United States 2,571 1,899 1,200

Total $ 3,642 $ 3,946 $ 2,336

Provision for income taxes:

United States federal:

Current $ 91 $ 335 $ 321

Deferred 322 108 (12)

413 443 309

State and local:

Current 47 82 52

Deferred 61 (39) (21)

108 43 31

Total United States 521 486 340

Outside United States:

Current 763 681 490

Deferred (137) (31) (172)

Total outside United States 626 650 318

Total provision for income taxes $ 1,147 $ 1,136 $ 658

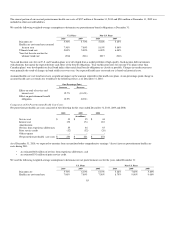

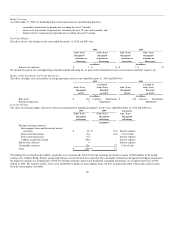

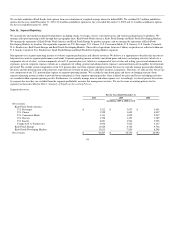

The 2010 earnings and gain from discontinued operations from the sale of the Frozen Pizza business included tax expense of $1.2 billion. Additionally, the

2008 earnings and gain from discontinued operations from the split-off of the Post cereals business included a net tax benefit of $104 million.

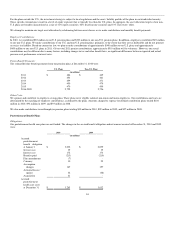

As of January 1, 2010, our unrecognized tax benefits were $829 million. If we had recognized all of these benefits, the net impact on our income tax provision

would have been $661 million. Our unrecognized tax benefits were $1,281 million at December 31, 2010, and if we had recognized all of these benefits, the

net impact on our income tax provision would have been $1,062 million. The amount of unrecognized tax benefits could decrease by approximately $50

million during the next 12 months due to the potential resolution of certain foreign, U.S. federal and state examinations. Furthermore, we recorded $357

million of unrecognized tax benefits and $47 million of accrued interest and penalties as part of our purchase price allocations for Cadbury. We include

accrued interest and penalties related to uncertain tax positions in our tax provision. We had accrued interest and penalties of $210 million as of January 1,

2010 and $246 million as of December 31, 2010. Our 2010 provision for income taxes included a $3 million net benefit for interest and penalties as reversals

exceeded expense accruals during the year, due to the resolution of a federal tax audit, settlements with various foreign and state tax authorities and the

expiration of the statutes of limitations in various jurisdictions. We also paid interest and penalties of $11 million during 2010.

91