Kraft 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

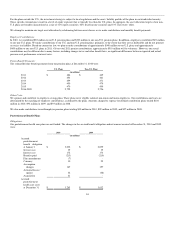

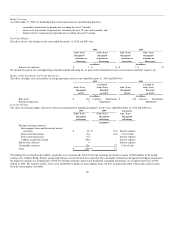

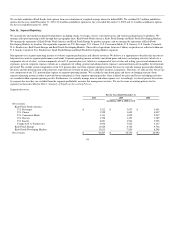

Note 12. Financial Instruments:

Fair Value of Derivative Instruments:

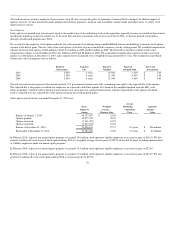

The fair values of derivative instruments recorded in the consolidated balance sheet as of December 31, 2010 and 2009 were:

December 31, 2010 December 31, 2009

Asset

Derivatives

Liability

Derivatives

Asset

Derivatives

Liability

Derivatives

(in millions)

Derivatives designated

as

hedging instruments:

Foreign exchange contracts $ 24 $ 115 $ 8 $ 158

Commodity contracts 74 5 25 14

Interest rate contracts 58 13 153 -

$ 156 $ 133 $ 186 $ 172

Derivatives not

designated

as hedging instruments:

Foreign exchange contracts $ 21 $ 48 $ 2 $ -

Commodity contracts 202 114 71 62

Interest rate contracts 59 21 - -

$ 282 $ 183 $ 73 $ 62

Total fair value $ 438 $ 316 $ 259 $ 234

The majority of the increase in derivatives not designated as hedging instruments was a result of the Cadbury acquisition as we did not re-designate them

for hedge accounting. We include the fair value of our asset derivatives within other current assets and the fair value of our liability derivatives within other

current liabilities.

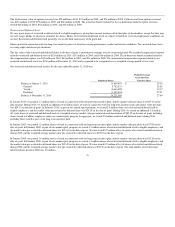

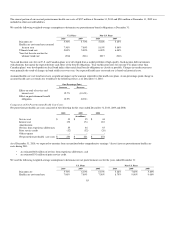

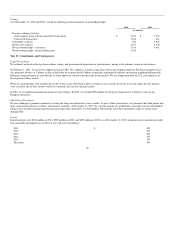

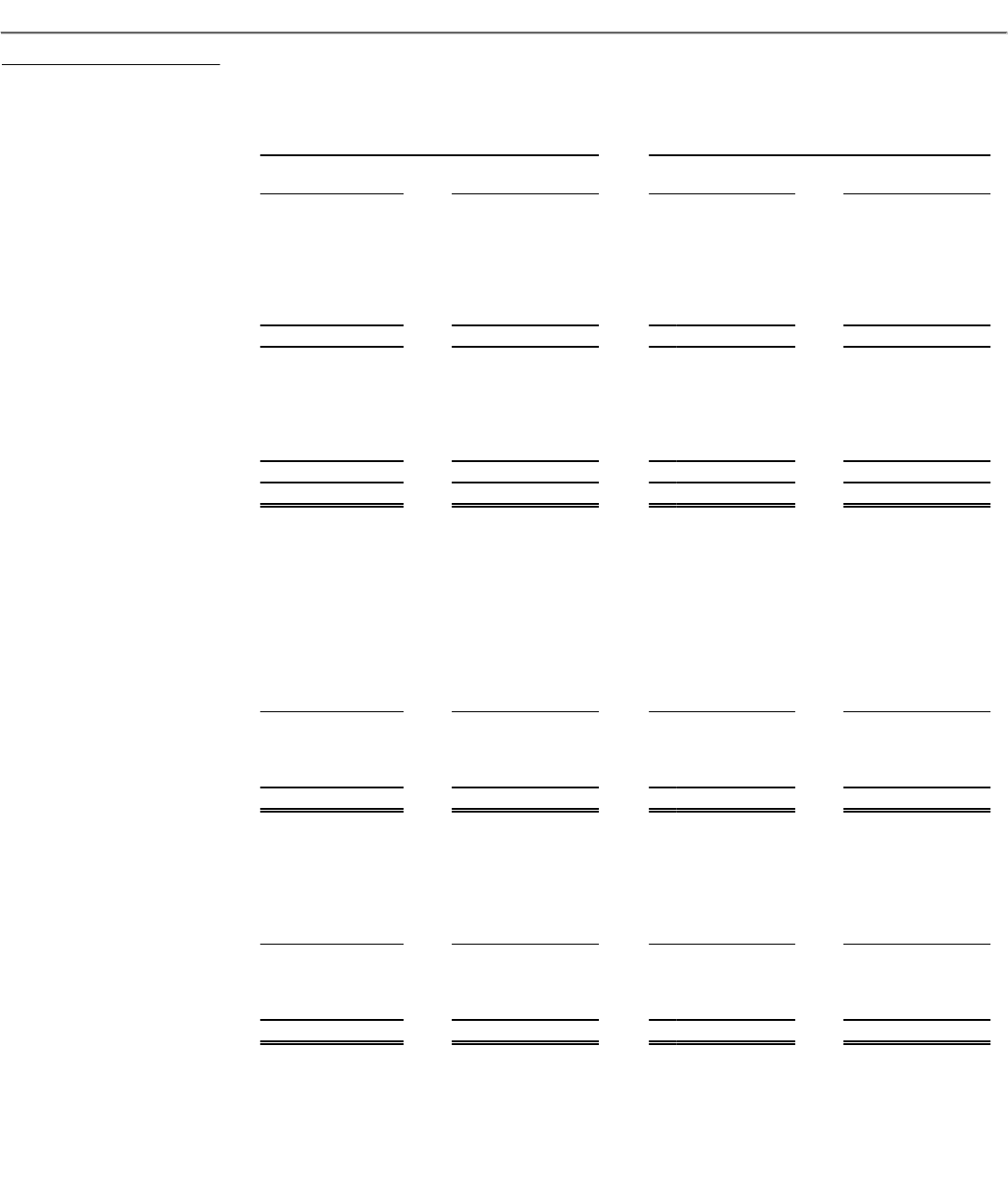

The fair values (asset / (liability)) of our derivative instruments at December 31, 2010 were determined using:

Total

Fair Value

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(in millions)

Foreign exchange contracts $ (118) $ - $ (118) $ -

Commodity contracts 157 129 28 -

Interest rate contracts 83 - 83 -

Total derivatives $ 122 $ 129 $ (7) $ -

The fair values (asset / (liability)) of our derivative instruments at December 31, 2009 were determined using:

Total

Fair Value

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(in millions)

Foreign exchange contracts $ (148) $ - $ (148) $ -

Commodity contracts 20 11 8 1

Interest rate contracts 153 - 153 -

Total derivatives $ 25 $ 11 $ 13 $ 1

Level 2 financial assets and liabilities consist of commodity forwards; foreign exchange forwards, currency swaps, and options; and interest rate swaps.

Commodity derivatives are valued using an income approach based on the observable market commodity index prices less the contract rate multiplied by the

notional amount. Foreign currency contracts are valued using an income approach based on observable market forward rates less the contract rate multiplied

by the notional amount.

87