Kraft 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

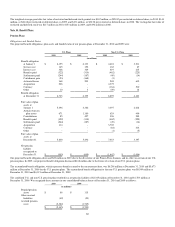

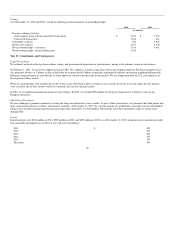

Volume:

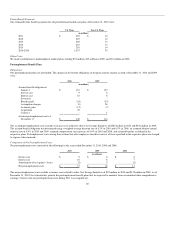

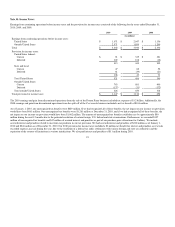

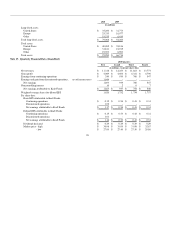

As of December 31, 2010 and 2009, we had the following notional amounts of outstanding hedges:

2010 2009

(in millions)

Foreign exchange contracts:

Intercompany loans and forecasted interest payments $ 2,183 $ 1,376

Forecasted transactions 1,946 631

Commodity contracts 630 1,832

Interest rate contracts 5,167 2,350

Net investment hedge - euro notes 3,814 4,081

Net investment hedge - pound sterling notes 1,015 -

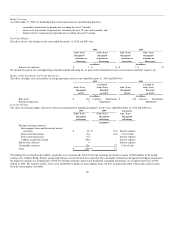

Note 13. Commitments and Contingencies:

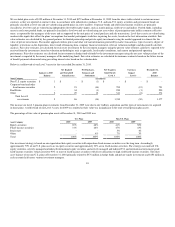

Legal Proceedings:

We routinely are involved in legal proceedings, claims, and governmental inspections or investigations, arising in the ordinary course of our business.

On February 1, 2011, we received a subpoena from the SEC. The subpoena, issued in connection with an investigation under the Foreign Corrupt Practices

Act, primarily relates to a Cadbury facility in India that we acquired in the Cadbury acquisition and primarily requests information regarding dealings with

Indian governmental agencies and officials to obtain approvals related to the operation of that facility. We are cooperating with the U.S. government in its

investigation of these matters.

While we cannot predict with certainty the results of this or any other legal matters in which we are currently involved, we do not expect that the ultimate

costs to resolve any of these matters will have a material effect on our financial results.

In 2010, we recorded an insignificant amount of legal charges. In 2009, we recorded $50 million of charges for legal matters related to certain of our

European operations.

Third-Party Guarantees:

We have third-party guarantees primarily covering the long-term obligations of our vendors. As part of those transactions, we guarantee that third parties will

make contractual payments or achieve performance measures. At December 31, 2010, the carrying amount of our third-party guarantees on our consolidated

balance sheet and the maximum potential payment under these guarantees was $26 million. Substantially all of these guarantees expire at various times

through 2018.

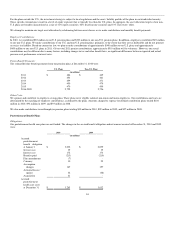

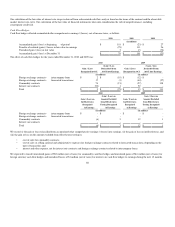

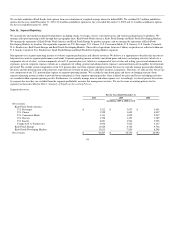

Leases:

Rental expenses were $514 million in 2010, $505 million in 2009, and $505 million in 2008. As of December 31, 2010, minimum rental commitments under

non-cancelable operating leases in effect at year-end were (in millions):

2011 $ 470

2012 324

2013 225

2014 169

2015 130

Thereafter 244

90