Kraft 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

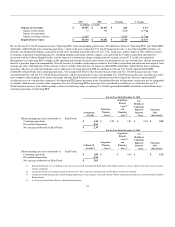

pension coverage for certain employees of our non-U.S. subsidiaries through separate plans. Local statutory requirements govern many of these plans. For

salaried and non-union hourly employees hired in the U.S. after January 1, 2009, we discontinued benefits under our U.S. pension plans, and we replaced

them with an enhanced company contribution to our employee savings plan. Additionally, we will be freezing the U.S. pension plans for current salaried and

non-union hourly employees effective December 31, 2019. Pension accruals for all salaried and non-union employees who are currently earning pension

benefits will end on December 31, 2019, and continuing pay and service will be used to calculate the pension benefits through December 31, 2019. Our

projected benefit obligation decreased $168 million in 2009, and we incurred a $5 million curtailment charge in 2009 related to the freeze. Our U.S.,

Canadian, and United Kingdom subsidiaries provide health care and other benefits to most retired employees. Local government plans generally cover health

care benefits for retirees outside the U.S., Canada, and United Kingdom. Our postemployment benefit plans cover most salaried and certain hourly employees.

The cost of these plans is charged to expense over the working life of the covered employees.

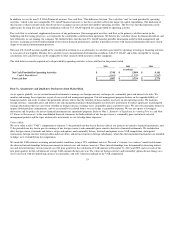

In September 2006, new guidance was issued surrounding employers' accounting for defined benefit pension and other postretirement plans. The new

guidance required us to measure plan assets and benefit obligations as of the balance sheet date beginning in 2008. We previously measured our non-U.S.

pension plans (other than certain Canadian and French pension plans) at September 30 of each year. On December 31, 2008, we recorded an after-tax decrease

of $8 million to retained earnings using the 15-month approach to proportionally allocate the transition adjustment required upon adoption of the measurement

provision of the new guidance.

Financial Instruments:

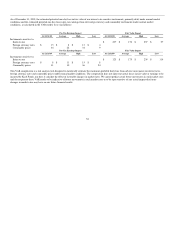

As we operate globally, we use certain financial instruments to manage our foreign currency exchange rate, commodity price and interest rate risks. We

monitor and manage these exposures as part of our overall risk management program. Our risk management program focuses on the unpredictability of

financial markets and seeks to reduce the potentially adverse effects that the volatility of these markets may have on our operating results. We maintain

foreign currency, commodity price and interest rate risk management strategies that seek to reduce significant, unanticipated earnings fluctuations that may

arise from volatility in foreign currency exchange rates, commodity prices and interest rates, principally through the use of derivative instruments.

Financial instruments qualifying for hedge accounting must maintain a specified level of effectiveness between the hedging instrument and the item being

hedged, both at inception and throughout the hedged period. We formally document the nature of and relationships between the hedging instruments and

hedged items, as well as our risk management objectives, strategies for undertaking the various hedge transactions and method of assessing hedge

effectiveness. Additionally, for hedges of forecasted transactions, the significant characteristics and expected terms of the forecasted transaction must be

specifically identified, and it must be probable that each forecasted transaction will occur. If we deem it probable that the forecasted transaction will not occur,

we recognize the gain or loss in earnings currently.

By using derivatives to hedge exposures to changes in exchange rates, commodity prices and interest rates, we have exposure on these derivatives to credit

and market risk. We are exposed to credit risk that the counterparty might fail to fulfill its performance obligations under the terms of the derivative contract.

We minimize our credit risk by entering into transactions with high quality counterparties with investment grade credit ratings, limiting the amount of

exposure we have with each counterparty and monitoring the financial condition of our counterparties. We also maintain a policy of requiring that all

significant, non-exchange traded derivative contracts with a duration greater than one year be governed by an International Swaps and Derivatives Association

master agreement. Market risk is the risk that the value of the financial instrument might be adversely affected by a change in foreign currency exchange rates,

commodity prices or interest rates. We manage market risk by incorporating monitoring parameters within our risk management strategy that limit the types

of derivative instruments and derivative strategies we use, and the degree of market risk that may be undertaken by the use of derivative instruments.

We record derivative financial instruments at fair value in our consolidated balance sheets as either current assets or current liabilities. Cash flows from

hedging instruments are classified in the same manner as the affected hedged item in the consolidated statement of cash flows.

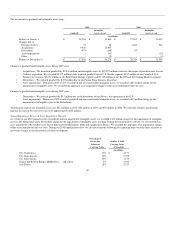

Commodity cash flow hedges - We are exposed to price risk related to forecasted purchases of certain commodities that we primarily use as raw materials.

Accordingly, we use commodity forward contracts as cash flow hedges,

62