Kraft 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

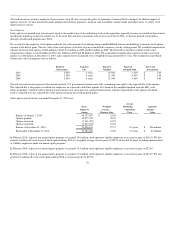

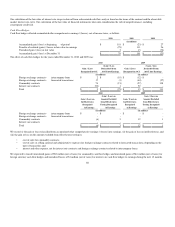

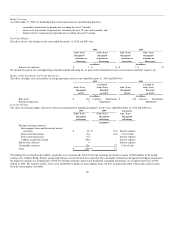

As of December 31, 2010, for the combined U.S. and non-U.S. pension plans, we expected to amortize from accumulated other comprehensive earnings /

(losses) into net periodic pension cost during 2011:

• an estimated $318 million of net loss from experience differences; and

• an estimated $7 million of prior service cost.

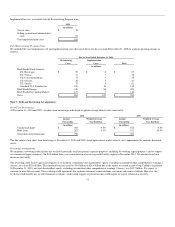

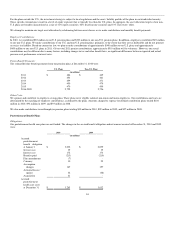

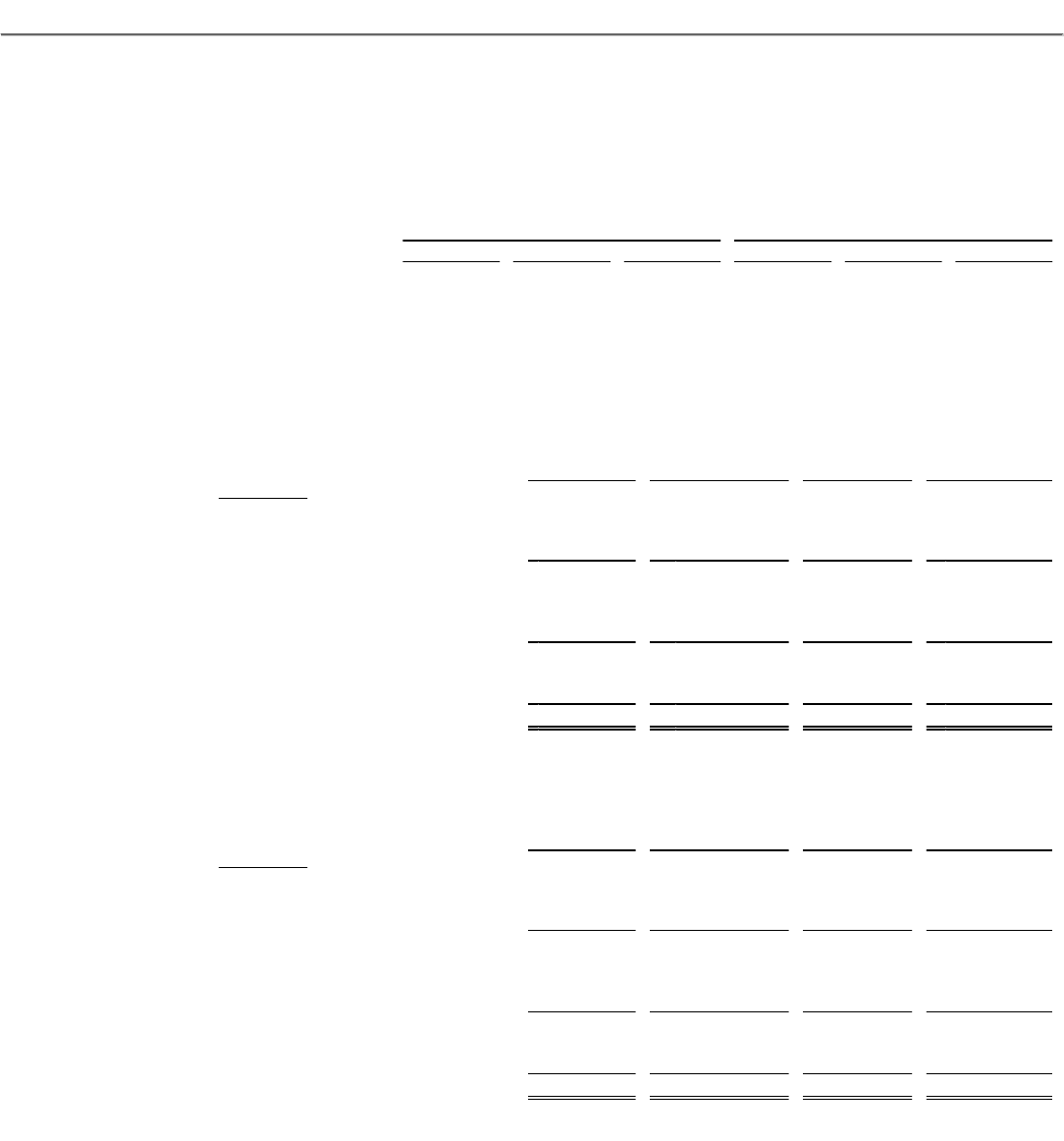

We used the following weighted-average assumptions to determine our net pension cost for the years ended December 31:

U.S. Plans Non-U.S. Plans

2010 2009 2008 2010 2009 2008

Discount rate 5.85% 6.10% 6.30% 5.21% 6.41% 5.44%

Expected rate of return on plan assets 7.99% 8.00% 8.00% 6.68% 7.25% 7.43%

Rate of compensation increase 3.98% 4.00% 4.00% 3.59% 3.09% 3.13%

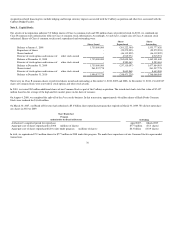

Plan Assets:

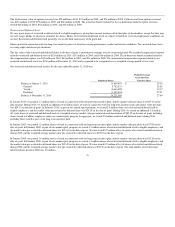

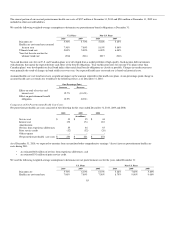

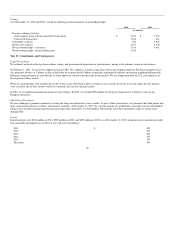

The fair value of pension plan assets at December 31, 2010 was determined using:

Asset Category

Total

Fair Value

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(in millions)

U.S. equity securities $ 280 $ 276 $ 4 $ -

Non-U.S. equity securities 1,915 1,912 3 -

Pooled funds - equity securities 4,971 281 4,690 -

Total equity securities 7,166 2,469 4,697 -

Government bonds 1,405 731 674 -

Pooled funds - fixed income securities 1,893 52 1,841 -

Corporate bonds and other fixed income securities 1,749 5 993 751

Total fixed income securities 5,047 788 3,508 751

Real estate 343 86 7 250

Other 542 155 11 376

Total $ 13,098 $ 3,498 $ 8,223 $ 1,377

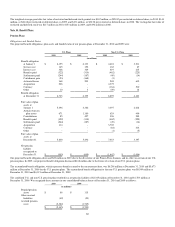

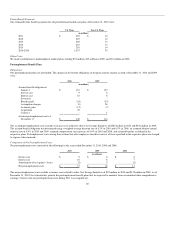

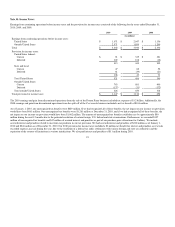

The fair value of pension plan assets at December 31, 2009 was determined using:

Asset Category

Total

Fair Value

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(in millions)

U.S. equity securities $ 289 $ 289 $ - $ -

Non-U.S. equity securities 1,991 1,988 2 1

Pooled funds - equity securities 3,014 - 3,014 -

Total equity securities 5,294 2,277 3,016 1

Government bonds 1,037 931 106 -

Pooled funds - fixed income securities 945 - 945 -

Corporate bonds and other fixed income securities 988 54 932 2

Total fixed income securities 2,970 985 1,983 2

Real estate 131 22 109 -

Other 326 322 2 2

Total $ 8,721 $ 3,606 $ 5,110 $ 5

82