Kraft 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

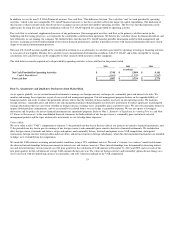

rules, which principally means all transactions are recorded in U.S. dollars. On January 8, 2010, the Venezuelan government devalued its currency and

established a preferential exchange rate for imports of food, medicine and other essential items. Accordingly, we were required to revalue our net assets in

Venezuela. In July 2010, the Venezuelan government eliminated the secondary (or parallel) market exchange rate and replaced it with the government-

regulated Transaction System for Foreign Currency Denominate Securities ("SITME") rate. Accordingly, we were required to revalue those of our net assets

in Venezuela that we maintained at the parallel rate. Then on December 30, 2010, the Venezuelan government eliminated the preferential exchange rate.

Although the elimination of the preferential exchange rate did not immediately cause us to revalue our net assets in Venezuela, it will have further impacts to

our operating results in future periods. Venezuela now has two exchange rates: the official rate and the SITME rate. We used both the official rate and the

SITME rate to translate our Venezuelan operations into U.S. dollars, based on the nature of the operations of each individual subsidiary.

During 2010, we recorded approximately $115 million of unfavorable foreign currency impacts relating to highly inflationary accounting in Venezuela. This

included a one-time impact to translate cash of $34 million that we previously carried at the secondary rate. Upon the change to highly inflationary accounting

in January, we were required to translate those U.S. dollars on hand using the official rate.

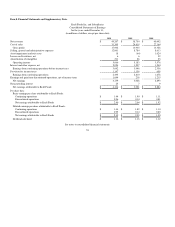

Cash and Cash Equivalents:

Cash equivalents include demand deposits with banks and all highly liquid investments with original maturities of three months or less.

Inventories:

Inventories are stated at the lower of cost or market. We value all our inventories using the average cost method. We also record inventory allowances for

overstocked and obsolete inventories due to ingredient and packaging changes.

Long-Lived Assets:

Property, plant and equipment are stated at historical cost and depreciated by the straight-line method over the estimated useful lives of the assets. Machinery

and equipment are depreciated over periods ranging from 3 to 20 years and buildings and building improvements over periods up to 40 years.

We review long-lived assets, including amortizable intangible assets, for impairment when conditions exist that indicate the carrying amount of the assets may

not be fully recoverable. We perform undiscounted operating cash flow analyses to determine if an impairment exists. When testing for impairment of assets

held for use, we group assets and liabilities at the lowest level for which cash flows are separately identifiable. If an impairment is determined to exist, the loss

is calculated based on estimated fair value. Impairment losses on assets to be disposed of, if any, are based on the estimated proceeds to be received, less costs

of disposal.

Software Costs:

We capitalize certain computer software and software development costs incurred in connection with developing or obtaining computer software for internal

use. Capitalized software costs are included in property, plant and equipment and amortized on a straight-line basis over the estimated useful lives of the

software, which do not exceed seven years.

Goodwill and Intangible Assets:

We test goodwill and non-amortizable intangible assets at least annually for impairment. We have recognized goodwill in our reporting units, which are

generally one level below our operating segments. We use a two step process to test goodwill at the reporting unit level. The first step involves a comparison

of the estimated fair value of each reporting unit with its carrying value. Fair value is estimated using discounted cash flows of the reporting unit based on

planned growth rates, and estimates of discount rates and residual values. If the carrying value exceeds the fair value, we must proceed with the second step of

the process. The second step measures the difference between the carrying value and implied fair value of goodwill. To test non-amortizable intangible assets

for impairment, we compare the fair value of the intangible asset with its carrying value. Fair value of non-amortizable intangible assets is determined using

our planned growth rates, and estimates of discount rates and royalty rates. If the carrying value exceeds fair value, the intangible asset is considered impaired

and is reduced to fair value. Definite-lived intangible assets are amortized over their estimated useful lives.

60