Kraft 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

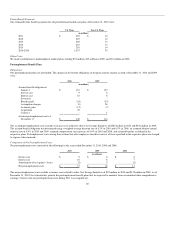

For the plans outside the U.S., the investment strategy is subject to local regulations and the asset / liability profiles of the plans in each individual country.

These specific circumstances result in a level of equity exposure that is typically less than the U.S. plans. In aggregate, the asset allocation targets of our non-

U.S. plans are broadly characterized as a mix of 41% equity securities, 46% fixed-income securities and 13% real estate / other.

We attempt to maintain our target asset allocation by rebalancing between asset classes as we make contributions and monthly benefit payments.

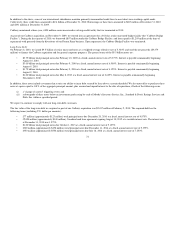

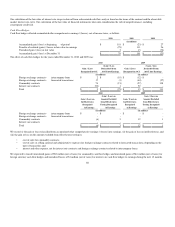

Employer Contributions:

In 2010, we contributed $85 million to our U.S. pension plans and $303 million to our non-U.S. pension plans. In addition, employees contributed $23 million

to our non-U.S. plans. We make contributions to our U.S. and non-U.S. pension plans, primarily, to the extent that they are tax deductible and do not generate

an excise tax liability. Based on current tax law, we plan to make contributions of approximately $540 million to our U.S. plans and approximately

$400 million to our non-U.S. plans in 2011. Of our total 2011 pension contributions, approximately $510 million will be voluntary. However, our actual

contributions may be different due to many factors, including changes in tax and other benefit laws, or significant differences between expected and actual

pension asset performance or interest rates.

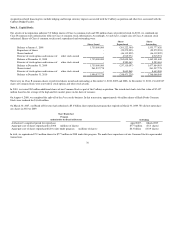

Future Benefit Payments:

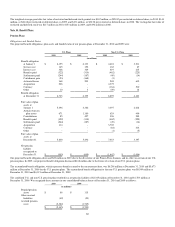

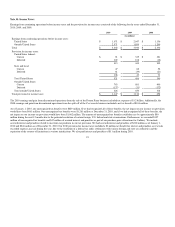

The estimated future benefit payments from our pension plans at December 31, 2010 were:

U.S. Plans Non-U.S. Plans

(in millions)

2011 $ 484 $ 449

2012 454 461

2013 459 471

2014 450 479

2015 470 499

2016-2020 2,722 2,726

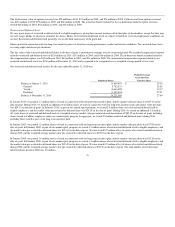

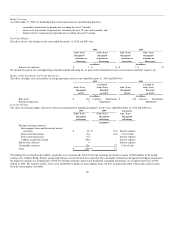

Other Costs:

We sponsor and contribute to employee savings plans. These plans cover eligible salaried, non-union and union employees. Our contributions and costs are

determined by the matching of employee contributions, as defined by the plans. Amounts charged to expense for defined contribution plans totaled $104

million in 2010, $94 million in 2009, and $93 million in 2008.

We also made contributions to multiemployer pension plans totaling $30 million in 2010, $29 million in 2009, and $27 million in 2008.

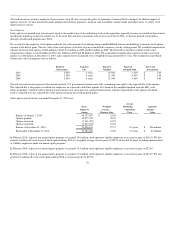

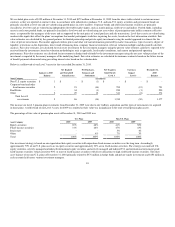

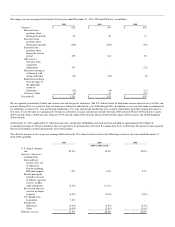

Postretirement Benefit Plans

Obligations:

Our postretirement health care plans are not funded. The changes in the accrued benefit obligation and net amount accrued at December 31, 2010 and 2009

were:

2010 2009

(in millions)

Accrued

postretirement

benefit obligation

at January 1 $ 3,032 $ 2,899

Service cost 39 35

Interest cost 172 174

Benefits paid (213) (210)

Plan amendments (7) -

Currency 10 25

Assumption

changes 147 157

Actuarial losses /

(gains) 42 (48)

Acquisition 41 -

Accrued

postretirement

health care costs

at December 31 $ 3,263 $ 3,032

84