Kraft 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

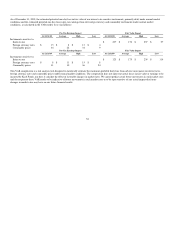

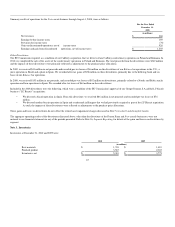

Hedges of net investments in foreign operations - We have numerous investments in our foreign subsidiaries. The net assets of these subsidiaries are exposed

to volatility in foreign currency exchange rates. We use foreign-currency-denominated debt to hedge our net investment in foreign operations against adverse

movements in exchange rates. We designated our euro and pound sterling denominated borrowings as a net investment hedge of a portion of our overall

European operations. The gains and losses on our net investment in these designated European operations are economically offset by losses and gains on our

euro and pound sterling denominated borrowings. The change in the debt's fair value is recorded in the currency translation adjustment component of

accumulated other comprehensive earnings / (losses).

Guarantees:

Authoritative guidance related to guarantor's accounting and disclosure requirements for guarantees requires us to disclose certain guarantees and to recognize

a liability for the fair value of the obligation of qualifying guarantee activities. See Note 13, Commitments and Contingencies for a further discussion of

guarantees.

Income Taxes:

We recognize tax benefits in our financial statements when our uncertain tax positions are more likely than not to be sustained upon audit. The amount we

recognize is measured as the largest amount of benefit that is greater than 50 percent likely of being realized upon ultimate settlement.

We recognize deferred tax assets for deductible temporary differences, operating loss carryforwards and tax credit carryforwards. Deferred tax assets are

reduced by a valuation allowance if it is more likely than not that some portion, or all, of the deferred tax assets will not be realized.

New Accounting Pronouncements:

In June 2009, new guidance was issued on the consolidation of variable interest entities. We adopted the guidance effective January 1, 2010. This guidance

increases the likelihood of an enterprise being classified as a variable interest entity. The adoption of this guidance did not have a material impact on our

financial results.

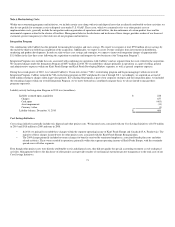

Note 2. Acquisitions and Divestitures:

Cadbury Acquisition:

On January 19, 2010, we announced the terms of our final offer for each outstanding ordinary share of Cadbury, including each ordinary share represented by

an American Depositary Share ("Cadbury ADS"), and the Cadbury Board of Directors recommended that Cadbury shareholders accept the terms of the final

offer. On February 2, 2010, all of the conditions to the offer were satisfied or validly waived, the initial offer period expired and a subsequent offer period

immediately began. At that point, we had received acceptances of 71.73% of the outstanding Cadbury ordinary shares, including those represented by

Cadbury ADSs ("Cadbury Shares"). As of June 1, 2010, we owned 100% of all outstanding Cadbury Shares. We believe the combination of Kraft Foods and

Cadbury will create a global snacks powerhouse and an unrivaled portfolio of brands people love.

Under the terms of our final offer and the subsequent offer, we agreed to pay Cadbury shareholders 500 pence in cash and 0.1874 shares of Kraft Foods

Common Stock per Cadbury ordinary share validly tendered and 2,000 pence in cash and 0.7496 shares of Kraft Foods Common Stock per Cadbury ADS

validly tendered. This valued Cadbury at $18.5 billion, or approximately £11.6 billion (based on the average price of $28.36 for a share of Kraft Foods

Common Stock on February 2, 2010 and an exchange rate of $1.595 per £1.00).

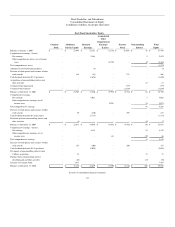

On February 2, 2010, we acquired 71.73% of Cadbury Shares for $13.1 billion and the value attributed to noncontrolling interests was $5.4 billion. From

February 2, 2010 through June 1, 2010, we acquired the remaining 28.27% of Cadbury Shares for $5.4 billion. We had a $38 million gain on noncontrolling

interest acquired and recorded it within additional paid in capital.

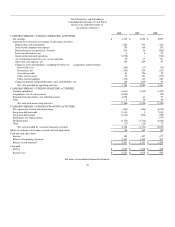

As part of our Cadbury acquisition, we incurred and expensed transaction related fees of $218 million in 2010 and $40 million in 2009. We recorded these

expenses within selling, general and administrative expenses. We also incurred acquisition financing fees of $96 million in 2010. We recorded these expenses

within interest and other expense, net.

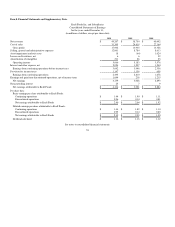

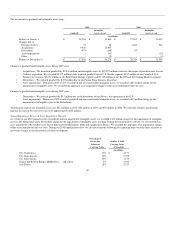

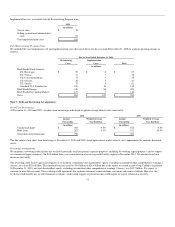

Cadbury contributed net revenues of $9,143 million and net earnings of $530 million from February 2, 2010 through December 31, 2010. The following

unaudited pro forma summary presents Kraft Foods' consolidated information as

64