Kraft 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

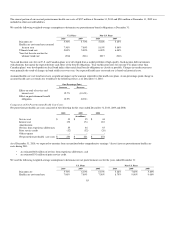

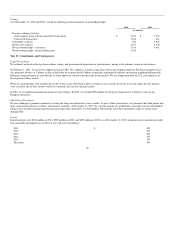

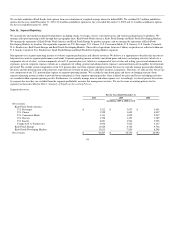

Hedge Coverage:

As of December 31, 2010, we had hedged forecasted transactions for the following durations:

• commodity transactions for periods not exceeding the next 17 months;

• interest rate transactions for periods not exceeding the next 32 years and 4 months; and

• foreign currency transactions for periods not exceeding the next 13 months.

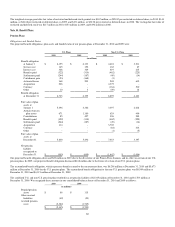

Fair Value Hedges:

The effect of fair value hedges for the years ended December 31, 2010 and 2009 was:

2010 2009

Gain / (Loss)

Recognized

in Income on

Derivatives

Gain / (Loss)

Recognized

in Income on

Borrowings

Gain / (Loss)

Recognized

in Income on

Derivatives

Gain / (Loss)

Recognized

in Income on

Borrowings

(in millions) (in millions)

Interest rate contracts $ 1 $ (1) $ 7 $ (7)

We include the gain or loss on hedged long-term debt and the offsetting loss or gain on the related interest rate swap in interest and other expense, net.

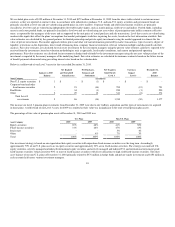

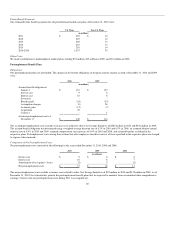

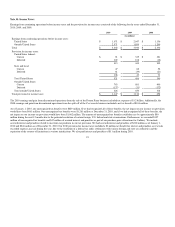

Hedges of Net Investments in Foreign Operations:

The effect of hedges of net investments in foreign operations for the years ended December 31, 2010 and 2009 was:

2010 2009

Gain / (Loss)

Recognized

in OCI

Location of

Gain / (Loss)

Recorded

in AOCI

Gain / (Loss)

Recognized

in OCI

Location of

Gain / (Loss)

Recorded

in AOCI

(in millions) (in millions)

Euro notes $ 170 Currency Translation $ (65) Currency Translation

Pound sterling notes 7 Adjustment - Adjustment

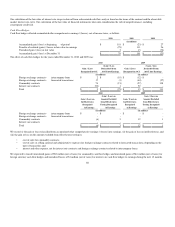

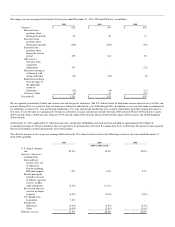

Economic Hedges:

The effect of economic hedges, derivatives that are not designated as hedging instruments, for the years ended December 31, 2010 and 2009 was:

2010 2009 Location of

Gain / (Loss)

Recognized

in Earnings

Gain / (Loss)

Recognized

in Earnings

Gain / (Loss)

Recognized

in Earnings

(in millions)

Foreign exchange contracts:

Intercompany loans and forecasted interest

payments $ 28 $ (10) Interest expense

Forecasted transactions (11) (10) Cost of sales

Forecasted transactions (17) - Interest expense

Cadbury acquisition related (395) - Interest expense

Interest rate contracts 4 - Interest expense

Commodity contracts 126 37 Cost of sales

Total $ (265) $ 17

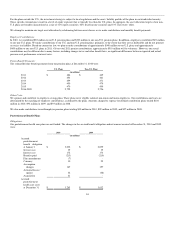

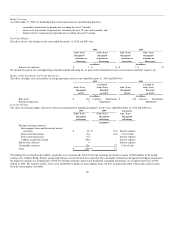

The hedging losses related to the Cadbury acquisition were economically offset by foreign exchange movement net gains of $240 million on the pound

sterling cash, Cadbury Bridge Facility and payable balances associated with the acquisition. For commodity contracts not designated as hedging instruments,

the impact to earnings was insignificant in 2008. For foreign exchange contracts not designated as hedging instruments, we recognized net losses of $50

million in 2008. The majority of these losses were attributable to hedges of intercompany loans and were economically offset with foreign currency gains

from the intercompany receivable.

89