Kraft 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

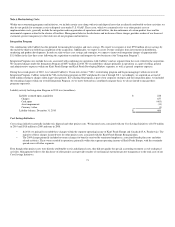

Acquisition-related financing fees include hedging and foreign currency impacts associated with the Cadbury acquisition and other fees associated with the

Cadbury Bridge Facility.

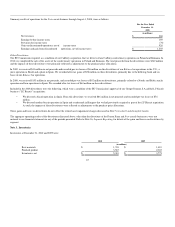

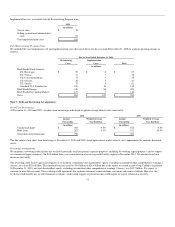

Note 8. Capital Stock:

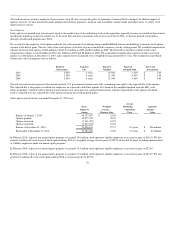

Our articles of incorporation authorize 5.0 billion shares of Class A common stock and 500 million shares of preferred stock. In 2010, we combined our

Class B common stock authorization with our Class A common stock authorization. Accordingly, we only have a single class of Class A common stock

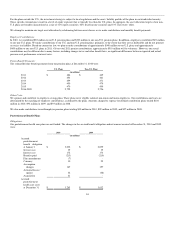

authorized. Shares of Class A common stock issued, repurchased and outstanding were:

Shares Issued

Shares

Repurchased

Shares

Outstanding

Balance at January 1, 2008 1,735,000,000 (201,222,380) 1,533,777,620

Repurchase of shares - (25,272,255) (25,272,255)

Shares tendered - (46,119,899) (46,119,899)

Exercise of stock options and issuance of other stock awards - 6,915,974 6,915,974

Balance at December 31, 2008 1,735,000,000 (265,698,560) 1,469,301,440

Exercise of stock options and issuance of other stock awards - 8,583,463 8,583,463

Balance at December 31, 2009 1,735,000,000 (257,115,097) 1,477,884,903

Shares issued 261,537,778 - 261,537,778

Exercise of stock options and issuance of other stock awards - 8,643,868 8,643,868

Balance at December 31, 2010 1,996,537,778 (248,471,229) 1,748,066,549

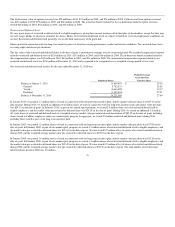

There were no Class B common shares or preferred shares issued and outstanding at December 31, 2010, 2009 and 2008. At December 31, 2010, 136,402,967

shares of Common Stock were reserved for stock options and other stock awards.

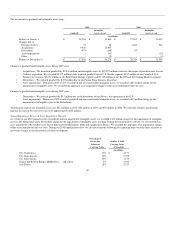

In 2010, we issued 262 million additional shares of our Common Stock as part of the Cadbury acquisition. The issued stock had a total fair value of $7,457

million based on the average of the high and low market prices on the dates of issuance.

On August 4, 2008, we completed the split-off of the Post cereals business. In this transaction, approximately 46 million shares of Kraft Foods Common

Stock were tendered for $1,644 million.

On March 30, 2007, our Board of Directors had authorized a $5.0 billion share repurchase program that expired on March 30, 2009. We did not repurchase

any shares in 2010 or 2009.

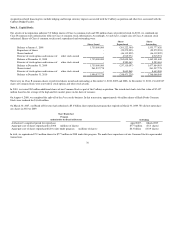

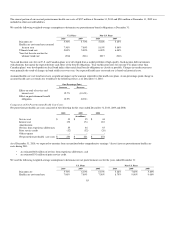

Share Repurchase

Program

Authorized by the Board of Directors $5.0 billion

Authorized / completed period for repurchase April 2007 - March 2009

Aggregate cost of shares repurchased in 2008 (millions of shares) $777 million (25.3 shares)

Aggregate cost of shares repurchased life-to-date under program (millions of shares) $4.3 billion (130.9 shares)

In total, we repurchased 25.3 million shares for $777 million in 2008 under this program. We made these repurchases of our Common Stock in open market

transactions.

76