Kraft 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

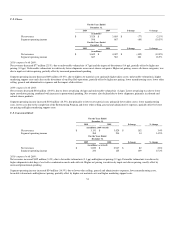

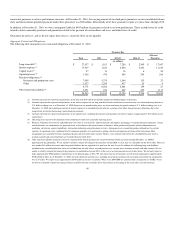

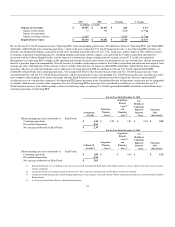

our most recent experience as well as our expectation for health care trend rates going forward. We anticipate that our health care cost trend rate assumption

will be 5.00% for U.S. plans by 2016 and 6.00% for non-U.S. plans by 2017. Assumed health care cost trend rates have a significant effect on the amounts

reported for the health care plans. A one-percentage-point change in assumed health care cost trend rates would have the following effects as of December 31,

2010:

One-Percentage-Point

Increase Decrease

Effect on total of service and interest cost 12.7% (10.4%)

Effect on postretirement benefit obligation 10.5% (8.8%)

Our 2011 discount rate assumption decreased to 5.30% from 5.70% for our U.S. postretirement plans and decreased to 5.02% from 5.25% for our non-U.S.

postretirement plans. Our 2011 discount rate decreased to 5.53% from 5.93% for our U.S. pension plans. We model these discount rates using a portfolio of

high quality, fixed-income debt instruments with durations that match the expected future cash flows of the benefit obligations. Our 2011 discount rate

assumption for our non-U.S. pension plans decreased to 5.11% from 5.21%. We developed the discount rates for our non-U.S. plans from local bond indices

that match local benefit obligations as closely as possible. Changes in our discount rates were primarily the result of changes in bond yields year-over-year.

Our 2011 expected rate of return on plan assets decreased to 7.95% from 8.00% for our U.S. pension plans. We determine our expected rate of return on plan

assets from the plan assets' historical long-term investment performance, current asset allocation and estimates of future long-term returns by asset class. We

attempt to maintain our target asset allocation by rebalancing between asset classes as we make contributions and monthly benefit payments.

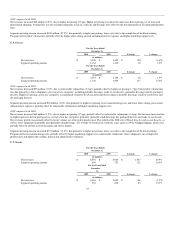

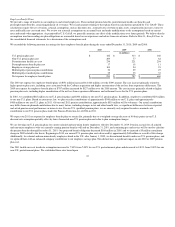

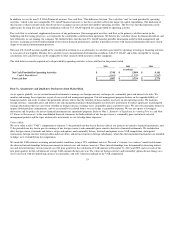

While we do not anticipate further changes in the 2011 assumptions for our U.S. and non-U.S. pension and postretirement health care plans, as a sensitivity

measure, a fifty-basis point change in our discount rate or a fifty-basis point change in the expected rate of return on plan assets would have the following

effects, increase / (decrease) in cost, as of December 31, 2010:

U.S. Plans Non-U.S. Plans

Fifty-Basis-Point Fifty-Basis-Point

Increase Decrease Increase Decrease

(in millions)

Effect of change in discount rate on pension costs $ (64) $ 66 $ (38) $ 36

Effect of change in expected rate of return on plan assets on pension costs (31) 31 (38) 38

Effect of change in discount rate on postretirement health care costs (12) 12 (1) 1

Financial Instruments:

As we operate globally, we use certain financial instruments to manage our foreign currency exchange rate, commodity price and interest rate risks. We

monitor and manage these exposures as part of our overall risk management program. Our risk management program focuses on the unpredictability of

financial markets and seeks to reduce the potentially adverse effects that the volatility of these markets may have on our operating results. We maintain

foreign currency, commodity price and interest rate risk management strategies that seek to reduce significant, unanticipated earnings fluctuations that may

arise from volatility in foreign currency exchange rates, commodity prices and interest rates, principally through the use of derivative instruments.

Financial instruments qualifying for hedge accounting must maintain a specified level of effectiveness between the hedging instrument and the item being

hedged, both at inception and throughout the hedged period. We formally document the nature of and relationships between the hedging instruments and

hedged items, as well as our risk management objectives, strategies for undertaking the various hedge transactions and method of assessing hedge

effectiveness. Additionally, for hedges of forecasted transactions, the significant characteristics and expected terms of the forecasted transaction must be

specifically identified, and it must be probable that each forecasted transaction will occur. If we deem it probable that the forecasted transaction will not occur,

we recognize the gain or loss in earnings currently.

44