Kraft 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

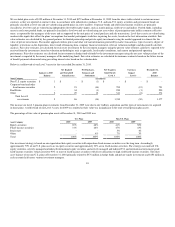

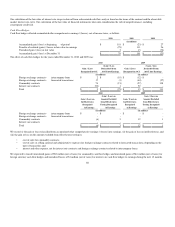

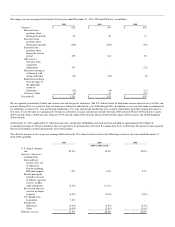

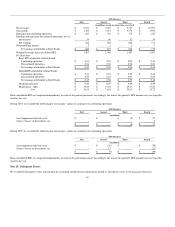

The changes in our unrecognized tax benefits for the years ended December 31, 2010, 2009 and 2008 were (in millions):

2010 2009 2008

January 1 $ 829 $ 807 $ 850

Increases from

positions taken

during prior periods 49 90 17

Decreases from

positions taken

during prior periods (146) (205) (90)

Increases from

positions taken

during the current

period 229 146 98

(Decreases) /

increases from

acquisition

adjustments 357 - (22)

Decreases relating to

settlements with

taxing authorities (19) (26) (8)

Reductions resulting

from the lapse of

the applicable

statute of

limitations (10) (14) (13)

Currency / other (8) 31 (25)

December 31 $ 1,281 $ 829 $ 807

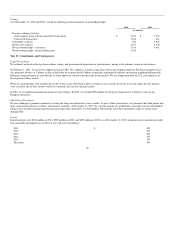

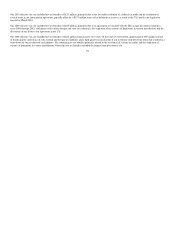

We are regularly examined by federal and various state and foreign tax authorities. The U.S. federal statute of limitations remains open for the year 2004 and

onward. During 2010, we reached a final resolution on a federal tax audit for the years 2000 through 2003. In addition, we are currently under examination by

tax authorities in various U.S. state and foreign jurisdictions. U.S. state and foreign jurisdictions have statutes of limitations generally ranging from three to

five years. Years still open to examination by foreign tax authorities in major jurisdictions include Australia (2008 onward), Brazil (2005 onward), Canada

(2003 onward), France (2006 onward), Germany (1999 onward), India (2003 onward), Russia (2004 onward), Spain (2002 onward), and United Kingdom

(2006 onward).

At December 31, 2010, applicable U.S. federal income taxes and foreign withholding taxes had not been provided on approximately $8.4 billion of

accumulated earnings of foreign subsidiaries that are expected to be permanently reinvested. It is impractical for us to determine the amount of unrecognized

deferred tax liabilities on these permanently reinvested earnings.

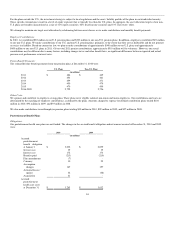

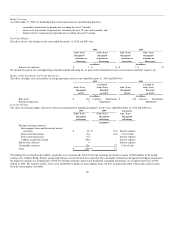

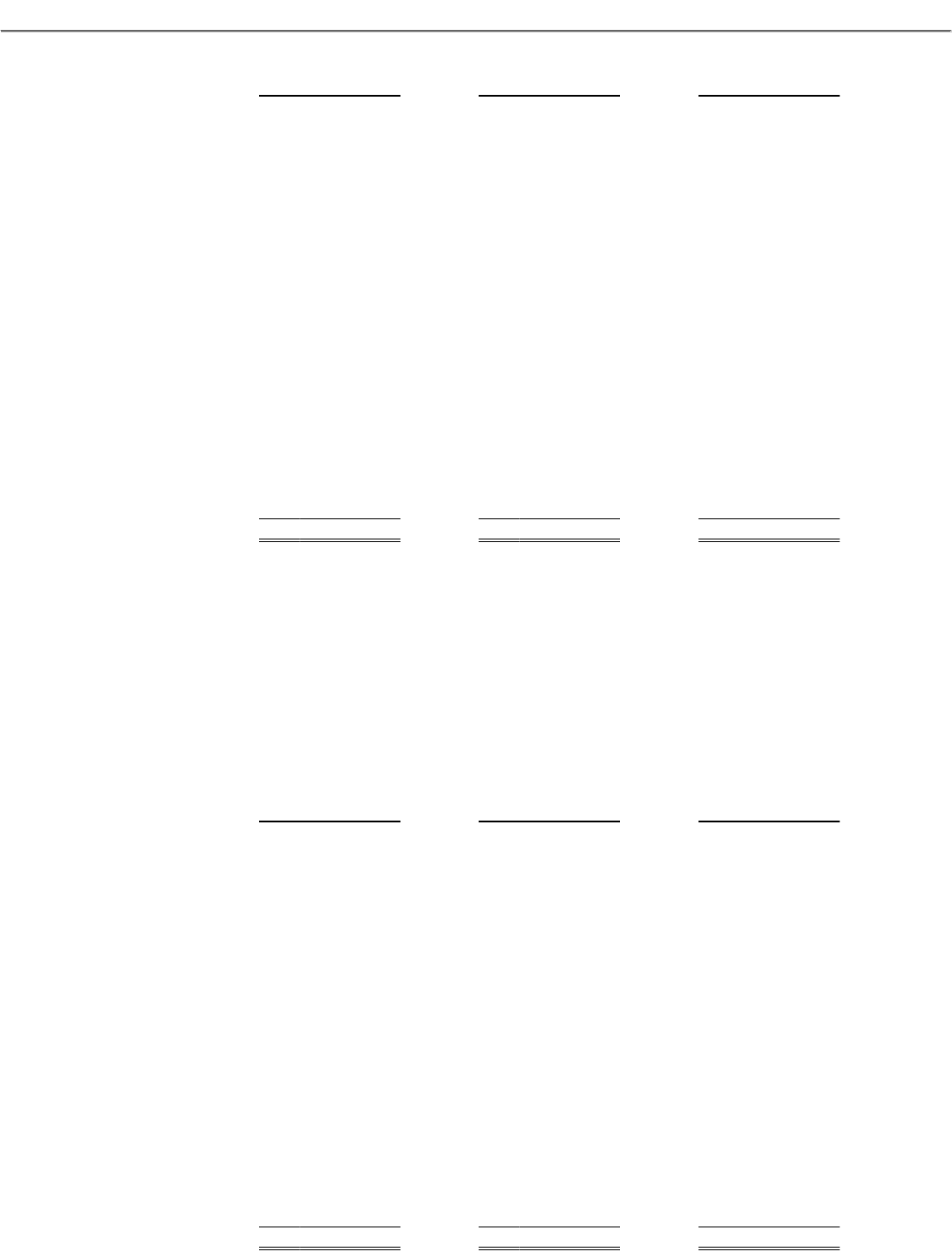

The effective income tax rate on pre-tax earnings differed from the U.S. federal statutory rate for the following reasons for the years ended December 31,

2010, 2009 and 2008:

2010 2009 2008

(2009 & 2008 revised)

U.S. federal statutory

rate 35.0% 35.0% 35.0%

Increase / (decrease)

resulting from:

State and local

income taxes, net

of federal tax

benefit excluding

IRS audit impacts 1.9% 1.9% 2.7%

Benefit principally

related to reversal

of federal and state

reserves on IRS

audit settlements (2.3%) (3.1%) -

Reversal of other tax

accruals no longer

required (0.5%) (0.4%) (1.8%)

U.S. Health Care

Legislation 3.8% - -

Foreign rate

differences (6.0%) (2.2%) (5.7%)

Other (0.4%) (2.4%) (2.0%)

Effective tax rate 31.5% 28.8% 28.2%