Kraft 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

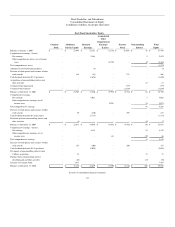

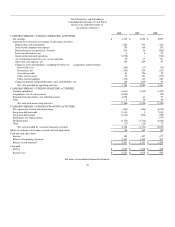

Equity and Dividends

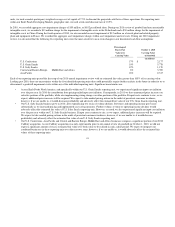

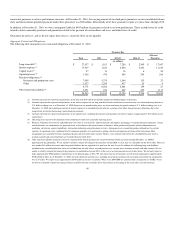

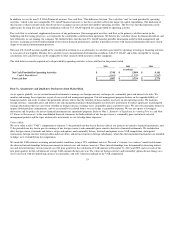

Stock Repurchases:

Our Board of Directors had authorized a $5.0 billion share repurchase program that expired on March 30, 2009. We did not repurchase any shares in 2010 or

2009.

Share Repurchase Program

Authorized by the Board of Directors $5.0 billion

Authorized / completed period for repurchase April 2007 - March 2009

Aggregate cost of shares repurchased in 2008 $777 million

(millions of shares) (25.3 shares)

Aggregate cost of shares repurchased life-to-date under program $4.3 billion

(millions of shares) (130.9 shares)

In total, we repurchased 25.3 million shares for $777 million in 2008 under these programs. We made these repurchases of our Common Stock in open market

transactions.

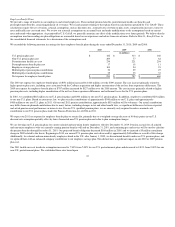

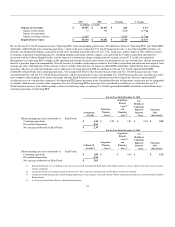

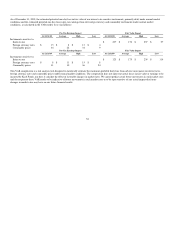

Stock Plans:

In January 2010, we granted 1.7 million shares of stock in connection with our long-term incentive plan, and the market value per share was $27.33 on the

date of grant. In February 2010, as part of our annual equity program, we issued 2.5 million shares of restricted and deferred stock to eligible employees, and

the market value per restricted or deferred share was $29.15 on the date of grant. Also, as a part of our annual equity program, we granted 15.0 million stock

options to eligible employees at an exercise price of $29.15.

During 2010, we granted an additional 0.6 million shares of stock in connection with our long-term incentive plan and the market value per share was $29.15

on the date of grant. We also issued 1.0 million off-cycle shares of restricted and deferred stock at a weighted-average market value per restricted or deferred

share of $29.57 on the date of grant, including shares issued to Cadbury employees under our annual equity program. Additionally, we issued 3.1 million off-

cycle shares of stock options at a weighted-average exercise price of $29.73 on the date of the grant, including options issued to Cadbury employees under our

annual equity program.

At December 31, 2010, the number of shares to be issued upon exercise of outstanding stock options, vesting of non-U.S. deferred shares and vesting of long-

term incentive plan shares was 62.2 million or 3.6% of total shares outstanding.

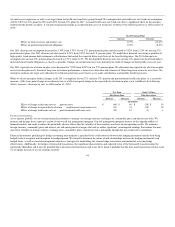

In January 2009, we granted 1.5 million shares of stock in connection with our long-term incentive plan. The market value per share was $27.00 on the date of

grant. In February 2009, as part of our annual equity program, we issued 4.1 million shares of restricted and deferred stock to eligible employees. The market

value per restricted or deferred share was $23.64 on the date of grant. Also, as part of our annual equity program, we granted 16.3 million stock options to

eligible employees at an exercise price of $23.64.

We also issued 0.2 million off-cycle shares of restricted and deferred stock during 2009. The weighted-average market value per restricted or deferred share

was $25.55 on the date of grant. In aggregate, we issued 5.8 million restricted and deferred shares during 2009.

In January 2008, we granted 1.4 million shares of stock in connection with our long-term incentive plan. The market value per share was $32.26 on the date of

grant. In February 2008, as part of our annual equity program, we issued 3.4 million shares of restricted and deferred stock to eligible employees. The market

value per restricted or deferred share was $29.49 on the date of grant. Also, as part of our annual equity program, we granted 13.5 million stock options to

eligible employees at an exercise price of $29.49.

In addition, we issued 0.2 million off-cycle shares of restricted and deferred stock during 2008. The weighted-average market value per restricted or deferred

share was $30.38 on the date of grant. In aggregate, we issued 5.0 million restricted and deferred shares during 2008. We also granted 0.1 million off-cycle

stock options during 2008 at an exercise price of $30.78. In aggregate, we granted 13.6 million stock options during 2008.

50