Kraft 2010 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

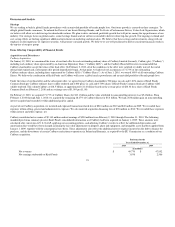

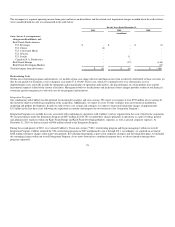

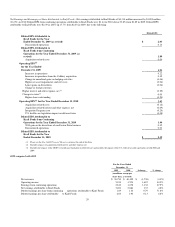

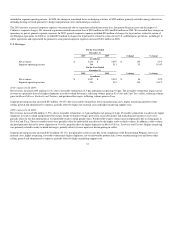

Cost Savings Initiatives:

Cost savings initiatives generally include exit, disposal and other project costs. We incurred costs associated with our Cost Savings Initiatives of $170 million

in 2010, $318 million in 2009, and none in 2008.

• In 2010, we primarily recorded these changes within the segment operating income of Kraft Foods Europe and Canada & N.A. Foodservice. The

majority of these charges incurred were for other project costs associated with the Kraft Foods Europe Reorganization.

• The 2009 charges primarily included severance charges for benefits received by terminated employees, associated benefit plan costs and other

related activities. These were recorded in operations, primarily within the segment operating income of Kraft Foods Europe, with the remainder

spread across all other segments.

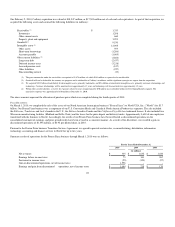

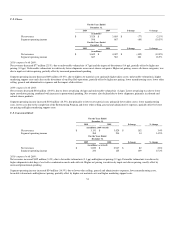

2004-2008 Restructuring Program:

In 2008, we completed our five-year restructuring program (the "Restructuring Program"). The objectives of this program were to leverage our global scale,

realign and lower our cost structure, and optimize capacity. As part of the Restructuring Program, we:

• incurred $2.9 billion in pre-tax charges reflecting asset disposals, severance and implementation costs;

• announced the closure of 35 facilities and announced the elimination of approximately 18,200 positions;

• will use cash to pay for $1.9 billion of the $2.9 billion in charges; and

• anticipate reaching cumulative annualized savings of $1.4 billion for the total program.

In 2010, we reversed $37 million of previously accrued Restructuring Program charges, primarily related to severance (resulting in a favorable impact to

diluted EPS of $0.01). In 2009, we reversed $85 million of previously accrued Restructuring Program charges (resulting in a favorable impact to diluted EPS

of $0.04). The reversals in 2009 related to the following:

• We sold a plant in Spain that we previously announced we would close under our Restructuring Program. Accordingly, we reversed $35 million

in Restructuring Program charges, primarily related to severance, and recorded a $17 million loss on the divestiture of the plant in 2009. The

reversal occurred in our Kraft Foods Europe segment.

• We also reversed $50 million of previously accrued Restructuring Program charges in 2009, primarily due to planned position eliminations that

did not occur. These were primarily the result of redeployment and natural attrition. The majority of these reversals occurred in our Kraft Foods

Europe segment, with the remainder spread across all other segments.

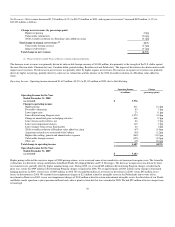

We incurred charges under the Restructuring Program of $989 million in 2008, or $0.45 per diluted share. Since the inception of the Restructuring Program,

we have paid cash of $1.8 billion of the $1.9 billion in expected cash payments, including $94 million paid in 2010. At December 31, 2010, we had an accrual

of $125 million related to the Restructuring Program, and we anticipate utilizing the majority of it during 2011.

Under the Restructuring Program, we recorded asset impairment and exit costs of $884 million in 2008. We recorded implementation costs of $105 million in

2008.

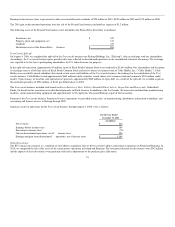

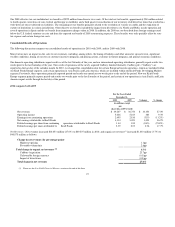

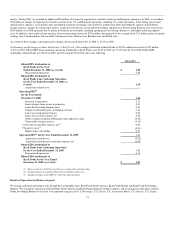

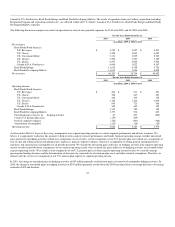

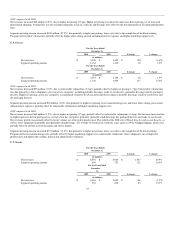

Provision for Income Taxes

Our effective tax rate was 31.5% in 2010, 28.8% in 2009, and 28.2% in 2008. Our 2010 effective tax rate included net tax benefits of $123 million, primarily

due to the favorable resolution of a federal tax audit and the resolution of several items in our international operations, partially offset by a $137 million write-

off of deferred tax assets as a result of the U.S. health care legislation enacted in March 2010.

Our 2009 effective tax rate included net tax benefits of $225 million, primarily due to an agreement we reached with the IRS on specific matters related to

years 2000 through 2003, settlements with various foreign and state tax authorities, the expiration of the statutes of limitations in various jurisdictions and the

divestiture of our Balance bar operations in the U.S.

26